UAE Hot Beverages Market Outlook to 2029

By Product Type (Tea, Coffee and Other Hot Beverages), By Distribution Channel, By Price Point, By Region

- Product Code: TDR0094

- Region: Middle East

- Published on: December 2024

- Total Pages: 110

Report Summary

The report titled “UAE Hot Beverages Market Outlook to 2029 - By Product Type (Tea, Coffee and Other Hot Beverages), By Distribution Channel, By Price Point, By Region” provides a comprehensive analysis of the hot beverages market in the UAE. This report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape, including competition scenario, cross-comparison, opportunities and bottlenecks, and profiling of major players in the UAE Hot Beverages Market. The report concludes with future market projections based on revenue, segmented by market, product types, region, and insights into cause and effect relationships, alongside case studies highlighting key opportunities and cautions.

UAE Hot Beverages Market Overview and Size

The UAE hot beverages market reached a valuation of AED 3 Billion in 2023, driven by a growing demand for premium tea and coffee, the country’s expanding expatriate population, and an increasing trend towards on-the-go and health-oriented beverage options. Major players, including Nestlé, Unilever, Starbucks, and Lavazza, dominate the market with robust distribution networks, innovative product offerings, and customer-centric marketing strategies.

In 2023, Starbucks introduced a new range of plant-based hot beverages in response to rising demand for sustainable and health-focused choices. Dubai and Abu Dhabi are key markets due to their high population density, diverse consumer base, and well-established retail and hospitality sectors.

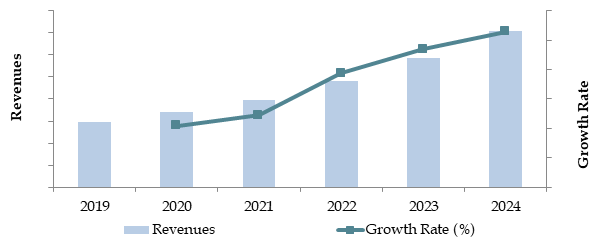

Market Size for UAE Hot Beverages Market by Revenues in USD Billion, 2018-2024

Factors Leading to the Growth of the UAE Hot Beverages Market:

Economic Factors: Despite global economic challenges, the UAE’s stable economic environment and increasing consumer spending have bolstered demand for premium hot beverages. In 2023, premium products accounted for approximately 40% of total hot beverage sales in the UAE, as consumers seek quality experiences and unique flavors, particularly in urban areas.

Growing Expatriate Population: With expatriates making up a significant portion of the population, there is a strong demand for diverse beverage options catering to different cultural preferences. This population, largely comprising young professionals, has fueled growth in the coffee segment, which is expected to see continued expansion as new coffee shops and specialty cafés open throughout the UAE.

Digitalization and E-commerce Growth: The increasing prevalence of online food and beverage retail platforms has transformed purchasing behavior in the UAE. In 2023, approximately 35% of hot beverage transactions were conducted through digital channels, reflecting a shift towards convenient, accessible, and quick shopping experiences.

Challenges Impacting the Growth of the UAE Hot Beverages Market

Quality and Authenticity Concerns: Concerns over the quality and authenticity of hot beverages, particularly premium coffee and tea, present a significant challenge in the UAE market. According to recent surveys, approximately 45% of consumers are cautious about purchasing premium hot beverages due to potential adulteration and lack of quality assurance. This issue has led to lower consumer trust, potentially deterring up to 20% of premium product buyers who seek verified sourcing and authenticity in their beverage choices.

Regulatory Compliance: Stringent regulations related to food safety, labeling, and sourcing affect many hot beverage producers, especially those importing products. In 2023, it was reported that around 18% of imported hot beverage products faced delays or additional costs due to compliance issues with UAE food safety standards. These regulatory requirements impose extra costs on distributors and importers, particularly those handling organic or niche products, thereby impacting market entry and pricing strategies.

High Competition and Market Saturation: The UAE hot beverages market is highly competitive, with a multitude of brands vying for market share. This saturation makes it challenging for new entrants and smaller brands to compete against established players. Data from 2023 indicates that roughly 40% of new brands struggled to secure retail space or online visibility, limiting their growth potential and market reach.

Regulations and Initiatives Governing the UAE Hot Beverages Market

Food Safety and Quality Regulations: The UAE government enforces stringent food safety and quality standards for all beverage products, including hot beverages, to ensure consumer safety. These regulations require regular quality checks on ingredients and adherence to labeling standards. In 2023, approximately 80% of hot beverage products complied with food safety standards on the first review, highlighting a strong level of industry compliance.

Import and Certification Requirements: The UAE government has specific import guidelines and certifications for hot beverages, particularly for organic and specialty products. Imported beverages must meet UAE standards regarding quality and ingredient transparency. In 2023, the number of approved hot beverage imports decreased by 6% due to stricter enforcement of certification and labeling requirements.

Sustainability Initiatives and Green Certifications: To promote environmental responsibility, the UAE government encourages sustainability initiatives, including certifications for eco-friendly packaging and sourcing. These initiatives incentivize companies to adopt sustainable practices, and in 2023, roughly 12% of hot beverage brands in the UAE market received green certifications. This percentage is expected to rise as more consumers prioritize environmentally friendly options.

UAE Hot Beverages Market Segmentation

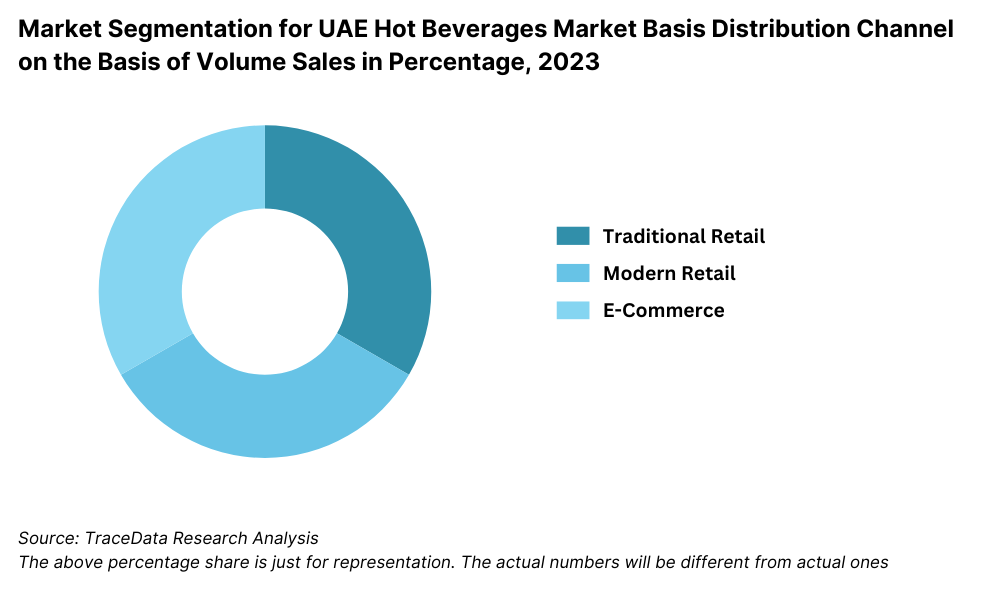

By Market Structure: The UAE hot beverages market is primarily led by organized retail channels, including supermarkets, hypermarkets, and branded coffee shops. Organized players dominate the market due to their wide reach, variety of offerings, and reliable quality standards, attracting a broad consumer base. Unorganized segments, such as local grocers and small cafés, hold a smaller but significant share, appealing to price-sensitive customers and those seeking niche or traditional beverages.

By Product Type: Coffee holds the largest share in the UAE hot beverages market, driven by a strong coffee culture, especially among expatriates and young professionals. Premium coffee brands and specialty blends are particularly popular in urban centers. Tea follows as a close second, with herbal, green, and specialty teas gaining traction due to a growing interest in health and wellness products.

By Consumer Preferences: Health-conscious consumers form a significant and growing segment, favoring organic and herbal teas, decaffeinated coffees, and low-sugar options. This trend is expected to expand as consumers increasingly prioritize wellness, influencing brands to innovate and cater to this demand.

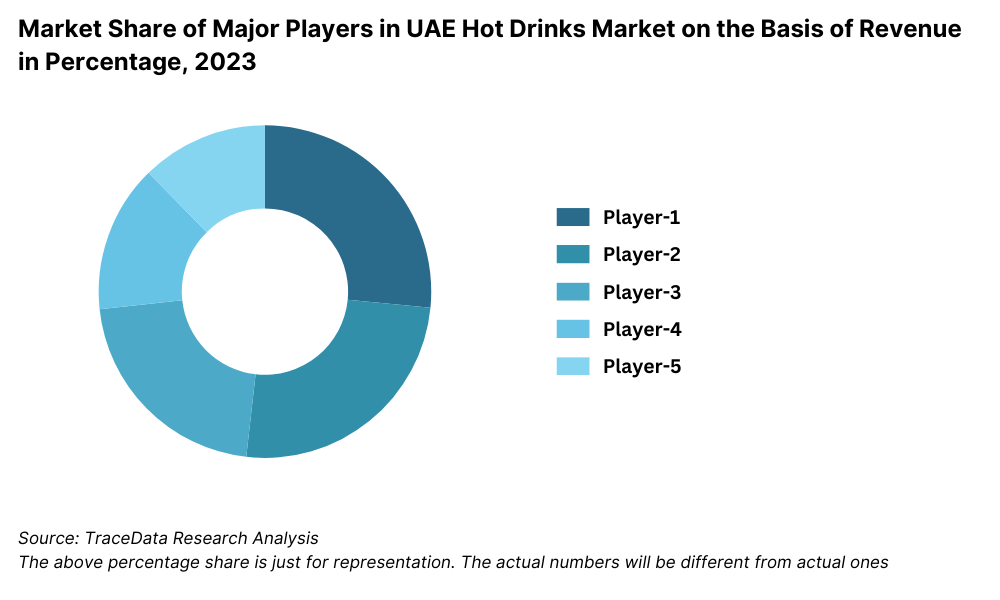

Competitive Landscape in UAE Hot Beverages Market

The UAE hot beverages market is relatively competitive, with several key players dominating the landscape. However, the entrance of new brands and expansion of digital retail platforms such as Amazon.ae, Carrefour UAE, Kibsons, Talabat, Spinneys, Choithrams, and smaller specialty stores has diversified the market, providing consumers with a wider range of options and services.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Alokozay Group (Alokozay Tea) | 2003 | Dubai, UAE |

Lipton (Unilever) | 1890 | Dubai, UAE |

Nescafé (Nestlé) | 1938 | Vevey, Switzerland |

Bru (Hindustan Unilever) | 1968 | Mumbai, India |

Emirati Coffee Co. | 2017 | Dubai, UAE |

RAW Coffee Company | 2007 | Dubai, UAE |

Seven Fortunes Coffee Roasters | 2015 | Dubai, UAE |

Coffee Planet | 2005 | Dubai, UAE |

Ahmad Tea | 1986 | London, United Kingdom |

Boon Coffee | 2013 | Dubai, UAE |

Recent Competitor Trends and Key Information:

Nestlé Middle East: Known for its Nescafé brand, Nestlé recorded a 15% increase in hot beverage sales in 2023, driven by demand for premium coffee varieties. Nestlé’s focus on sustainable sourcing and product innovation, such as plant-based and sugar-free options, has solidified its strong position in the market.

Starbucks: With a robust presence across major cities, Starbucks UAE saw a 12% rise in sales, with particular growth in the sales of its seasonal and specialty hot beverages. Starbucks has also expanded its digital presence by offering pre-order and delivery options, catering to a tech-savvy customer base.

Unilever: The company, known for its Lipton and PG Tips tea brands, reported a 10% sales increase in 2023. Unilever’s emphasis on health-oriented products, including herbal and green tea offerings, has gained traction among UAE consumers prioritizing wellness.

Lavazza: Focusing on premium Italian coffee, Lavazza experienced a 20% growth in sales, attributed to its partnerships with high-end hotels and cafés. Lavazza’s investment in organic and sustainable coffee options has attracted eco-conscious consumers in the UAE.

Kibsons: An online grocery platform specializing in fresh food and beverages, Kibsons saw a 25% increase in hot beverage sales in 2023, largely from its focus on organic and fair-trade teas and coffees. Its home delivery service has been particularly successful among busy urban residents looking for convenient, quality options.

What Lies Ahead for the UAE Hot Beverages Market?

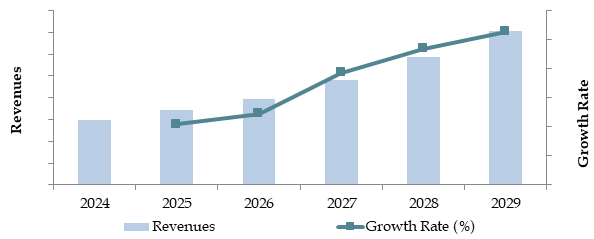

The UAE hot beverages market is anticipated to experience steady growth by 2029, with a healthy CAGR throughout the forecast period. This growth will likely be driven by a combination of rising consumer demand for premium products, increased health awareness, and an expanding focus on convenience and sustainability.

Shift Towards Health-Conscious Beverages: As UAE consumers become more health-conscious, demand for organic, herbal, and low-sugar hot beverages is expected to rise. This shift is supported by an increased awareness of wellness trends and government campaigns promoting healthier lifestyle choices. Herbal teas, green teas, and plant-based coffee alternatives are expected to see notable growth.

Expansion of Digital Retail Platforms: With the UAE’s strong digital infrastructure, online sales of hot beverages are projected to increase. E-commerce platforms are integrating features like subscription models and exclusive product lines, offering consumers convenience and variety. This trend will continue to shape the market, making high-quality hot beverages more accessible.

Growth of Premium and Specialty Coffee Segments: The UAE’s growing coffee culture is fueling demand for specialty coffee and premium tea blends, particularly among younger, urban consumers. Many brands are introducing exclusive or limited-edition products that appeal to this demographic, with a focus on single-origin, artisanal blends.

Focus on Sustainability and Eco-Friendly Packaging: Sustainability is becoming a priority in the UAE, with consumers increasingly favoring eco-friendly brands. More companies are expected to adopt sustainable practices, such as biodegradable packaging and ethically sourced ingredients, to appeal to environmentally conscious consumers. This focus on sustainability will likely influence market competition and brand loyalty.

Future Outlook and Projections for UAE Hot Drinks Market on the Basis of Revenues in USD Billion, 2024-2029

UAE Hot Beverages Market Segmentation

- By Product Type:

- Tea

- Coffee

- Other Hot Drinks

- Tea

- Black Tea

- Fruit/Herbal Tea

- Green Tea

- Instant Tea

- Other Tea

- Coffee

- Fresh Coffee

- Instant Coffee

- Other Hot Drinks

- Flavoured Powder Drinks

- Chocolate-based Flavoured Powder Drinks

- Malt-based Hot Drinks

- Non-Chocolate-based Flavoured Powder Drinks

- Other Plant-based Hot Drinks

- Flavoured Powder Drinks

- By Distribution Channel:

- Traditional Retail (Kirana Stores, Local Markets)

- Modern Retail (Supermarkets, Hypermarkets)

- E-commerce Platforms

- Cafés and Specialty Stores

- By Consumer Age Group:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Dubai

- Abu Dhabi

- Northern Emirates

- Western Region

- Eastern Region

Players Mentioned in the Report:

- Nestlé SA

- Jacobs Douwe Egberts

- Unilever

- Ajinomoto Group

- Massimo Zanetti Beverage Group

- New Concept ProductCo., Ltd.

- Suzuki Gourmet Coffee

- Heinz (Kraft Heinz Company)

Key Target Audience:

- Hot Beverage Manufacturers

- Specialty Coffee Shops and Tea Houses

- Online and Offline Retailers

- Food and Beverage Distributors

- Regulatory Bodies (e.g., UAE Ministry of Health and Prevention)

- Sustainability and Environmental Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in UAE Hot Beverages Market

4. Value Chain Analysis

4.1. Value Chain Process - Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for UAE Hot Beverages Market

4.3. Consumer Buying Decision Process

5. Market Structure

5.1. Market Overview and Genesis

5.2. Number of Quick Service Restaurants serving Hot Drinks in UAE, 2018-2024

5.3. Rural vs. Urban Consumption Ratio in UAE, 2018-2024

6. Market Attractiveness for UAE Hot Beverages Market

7. Supply-Demand Gap Analysis

8. Market Size for UAE Hot Beverages Market Basis

8.1. Revenues, 2018-2024

9. Market Breakdown for UAE Hot Beverages Market Basis

9.1. By Product Type (Tea, Coffee, Other Hot Drinks), 2023-2024P

9.1.1. By Tea (Black Tea, Herbal Tea, Green Tea, Instant Tea and other Tea), 2023

9.1.2. By Coffee (Fresh Coffee, Instant Coffee), 2023

9.1.3. By Other Hot Drinks (Flavoured Powder Drinks and Other Plant-based Hot Drinks), 2023

9.2. By Distribution Channel (Traditional Retail, Modern Retail, E-commerce), 2023-2024P

9.3. By Region (North, South, Central, East, West), 2023-2024P

9.4. By Price Category (Economy, Premium, Super-Premium), 2023-2024P

10. Demand Side Analysis for UAE Hot Beverages Market

10.1. Customer Landscape and Target Customer Cohort

10.2. Customer Journey and Decision-Making Process

10.3. Needs, Desires, and Pain Point Analysis

10.4. Market Gap Analysis Framework

10.5. By Consumer Age Group (18-24, 25-34, 35-54, 55+), 2023-2024P

11. Industry Analysis

11.1. Trends and Developments in UAE Hot Beverages Market

11.2. Growth Drivers for UAE Hot Beverages Market

11.3. SWOT Analysis for UAE Hot Beverages Market

11.4. Issues and Challenges in UAE Hot Beverages Market

11.5. Government Regulations Affecting UAE Hot Beverages Market

12. Opportunity Matrix for UAE Hot Beverages Market

12.1. Presented through Radar Chart Analysis

13. PEAK Matrix Analysis for UAE Hot Beverages Market

14. Competitor Analysis for UAE Hot Beverages Market

14.1. Market Share of Key Players in Hot Drinks Market, 2023

14.2. Market Share of Key Players in Tea Market, 2023

14.3. Market Share of Key Players in Coffee Market, 2023

14.4. Benchmarking Key Competitors across 15-20 Operational and Financial Indicators

14.5. Strength and Weakness Comparison

14.6. Operating Model Analysis Framework

14.7. Strategic Analysis Tools (Gartner Magic Quadrant, Bowman’s Strategic Clock)

15. Future Market Size for UAE Hot Beverages Market Basis

15.1. Revenues, 2025-2029

16. Market Breakdown for UAE Hot Beverages Market Basis

16.1. By Product Type (Tea, Coffee, Other Hot Drinks), 2025-2029

16.1.1. By Tea (Black Tea, Herbal Tea, Green Tea, Instant Tea and other Tea), 2025-2029

16.1.2. By Coffee (Fresh Coffee, Instant Coffee), 2025-2029

16.1.3. By Other Hot Drinks (Flavoured Powder Drinks and Other Plant-based Hot Drinks), 2025-2029

16.2. By Distribution Channel (Traditional Retail, Modern Retail, E-commerce), 2025-2029

16.3. By Region (North, South, Central, East, West), 2025-2029

16.4. By Price Category (Economy, Premium, Super-Premium), 2025-2029

17. Recommendation

17.1. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities for the UAE Hot Beverages Market. Based on this ecosystem, we will shortlist the leading 5-6 producers in the country based on their financial information, production capacity, and market presence.

Sourcing will be conducted through industry articles, various secondary sources, and proprietary databases to gather preliminary market data and collate insights at the industry level.

Step 2: Desk Research

Engage in comprehensive desk research by referencing multiple secondary and proprietary databases. This approach enables a thorough analysis of the market, aggregating insights on sales revenue, market player numbers, price levels, demand, and other market dynamics.

Supplement this research with detailed examinations of company-specific data using sources such as press releases, annual reports, financial statements, and similar documents to build a foundational understanding of both the market and the players within it.

Step 3: Primary Research

Conduct a series of in-depth interviews with C-level executives and other stakeholders from various companies in the UAE Hot Beverages Market and end-users. These interviews serve multiple purposes: to validate market hypotheses, confirm statistical data, and obtain valuable operational and financial insights from industry representatives.

To ensure robust validation, conduct disguised interviews by approaching each company as potential customers. This approach validates the operational and financial information shared by executives, corroborating it with secondary database information. These interactions also provide comprehensive insights into revenue streams, the value chain, processes, pricing, and other factors.

Step 4: Sanity Check

- Perform both bottom-to-top and top-to-bottom analyses, along with market size modeling exercises, to complete the sanity check process and verify the accuracy of the collected data and market projections.

FAQs

1. What is the potential for the UAE Hot Beverages Market?

The UAE hot beverages market is expected to see steady growth, with a market valuation of approximately AED 3 Billion in 2023. This growth is driven by a rising demand for premium coffee and tea products, increasing health consciousness among consumers, and a growing expatriate population that contributes to diverse beverage preferences. The market's potential is further enhanced by the expansion of digital retail platforms, which make premium and specialty beverages more accessible.

2. Who are the Key Players in the UAE Hot Beverages Market?

Key players in the UAE hot beverages market include Nestlé Middle East, Starbucks, Unilever, and Lavazza, each commanding a significant share due to their strong distribution networks, brand recognition, and variety of product offerings. Other notable players include local platforms like Kibsons and Carrefour UAE, which cater to the demand for quality beverages and convenient delivery options.

3. What are the Growth Drivers for the UAE Hot Beverages Market?

Key growth drivers include increasing consumer preference for premium and health-focused beverages, a robust coffee culture, and the rising popularity of eco-friendly and organic options. Additionally, the growth of digital retail channels, the expansion of specialty coffee shops, and innovative product offerings tailored to UAE consumer preferences are fueling market growth.

4. What are the Challenges in the UAE Hot Beverages Market?

The UAE Hot Beverages Market faces challenges such as regulatory compliance related to food safety and labeling standards, which can impact import approvals and product timelines. Additionally, issues related to the quality and authenticity of premium beverages, competition among numerous brands, and the high cost of eco-friendly packaging can pose barriers for market entry and expansion.