Thailand Healthcare Infrastructure Market Outlook to 2029

By Market Structure, By Facility Type, By Region, By Patient Demographics, and By Government vs. Private Ownership

- Product Code: TDR0097

- Region: Asia

- Published on: December 2024

- Total Pages: 110

Report Summary

The report titled “Thailand Healthcare Infrastructure Market Outlook to 2029 - By Market Structure, By Facility Type, By Region, By Patient Demographics, and By Government vs. Private Ownership” provides a comprehensive analysis of the healthcare infrastructure market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of investment and capacity, market segmentation; trends and developments, regulatory landscape, healthcare provider profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the healthcare infrastructure market. The report concludes with future market projections based on investments, by market, facility types, region, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

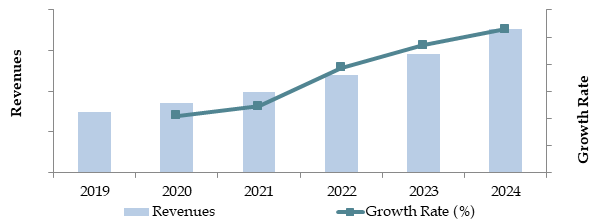

Thailand Healthcare Infrastructure Market Overview and Size

The Thailand healthcare infrastructure market reached a valuation of THB 400 Billion in 2023, driven by increasing government expenditure on healthcare, rising medical tourism, and an aging population. The market is characterized by major players such as Bangkok Dusit Medical Services (BDMS), Bumrungrad International Hospital, Samitivej Hospital, and Thonburi Healthcare Group, known for their extensive networks, high-quality services, and innovations in digital healthcare.

In 2023, Bumrungrad International Hospital partnered with leading telemedicine providers to enhance access for international patients, showcasing a growing trend towards digital integration. Key regions like Bangkok, Chiang Mai, and Phuket dominate due to their advanced infrastructure and significant patient inflow.

Market Size for Thailand Healthcare Infrastructure Industry on the Basis of Revenues in USD Billion, 2018–2024

What Factors are Leading to the Growth of Thailand Healthcare Infrastructure Market:

Economic Factors: Economic growth, combined with increased spending on healthcare by both the government and private sectors, has propelled the development of healthcare facilities. In 2023, healthcare expenditure accounted for 6.5% of Thailand's GDP, reflecting a sustained focus on improving infrastructure. The government's Universal Health Coverage (UHC) program has been pivotal in expanding access to healthcare, particularly in underserved regions.

Growing Aging Population: Thailand's demographic shift towards an aging society has driven demand for specialized healthcare services. By 2023, 18% of the population was aged 60 and above, leading to growth in geriatric care, chronic disease management, and long-term care facilities.

Medical Tourism: Thailand remains a top destination for medical tourism, with over 3 million medical tourists recorded in 2023. High-quality services, affordable costs, and internationally accredited hospitals attract patients primarily from the Middle East, Europe, and Asia for procedures such as cosmetic surgery, dental care, and orthopedics.

Which Industry Challenges Have Impacted the Growth of Thailand Healthcare Infrastructure Market

Quality and Accessibility Gaps: Despite advancements in infrastructure, rural areas in Thailand still face significant challenges in accessing quality healthcare services. In 2023, it was estimated that 30% of rural patients had to travel over 50 kilometers to reach the nearest hospital, indicating a disparity in healthcare access. This gap has limited the equitable development of healthcare infrastructure across the country.

Staffing Shortages: A shortage of skilled healthcare professionals, including doctors, nurses, and specialists, has been a persistent challenge. According to a 2023 report, Thailand had a doctor-to-patient ratio of 1:2,000, significantly below the World Health Organization’s recommended standard of 1:1,000. These shortages impact service quality and delay the expansion of healthcare facilities in underserved areas.

Regulatory and Bureaucratic Hurdles: Lengthy approval processes for new healthcare projects and strict compliance requirements for private sector participation have slowed infrastructure development. For example, in 2023, approximately 15% of proposed hospital projects faced delays due to regulatory bottlenecks, leading to higher project costs and reduced investor interest.

What are the Regulations and Initiatives Which Have Governed the Market

Universal Health Coverage (UHC): Thailand’s UHC program, introduced in 2002, remains a cornerstone of the healthcare system. It ensures access to essential healthcare services for all citizens. In 2023, UHC covered 99.5% of the population, significantly boosting demand for healthcare services and infrastructure investments.

Medical Tourism Policy: To sustain its position as a global medical tourism hub, the Thai government has implemented policies encouraging private investments in high-quality healthcare facilities. In 2023, the Medical Hub Policy facilitated the expansion of 10 international-standard hospitals, attracting over 3 million medical tourists.

Regulations on Private Hospitals: The Ministry of Public Health has introduced stringent regulations requiring private hospitals to meet specific standards in service quality, patient safety, and equipment. In 2023, 85% of private hospitals complied with international accreditation standards, bolstering trust in Thailand’s healthcare system.

Thailand Healthcare Infrastructure Market Segmentation

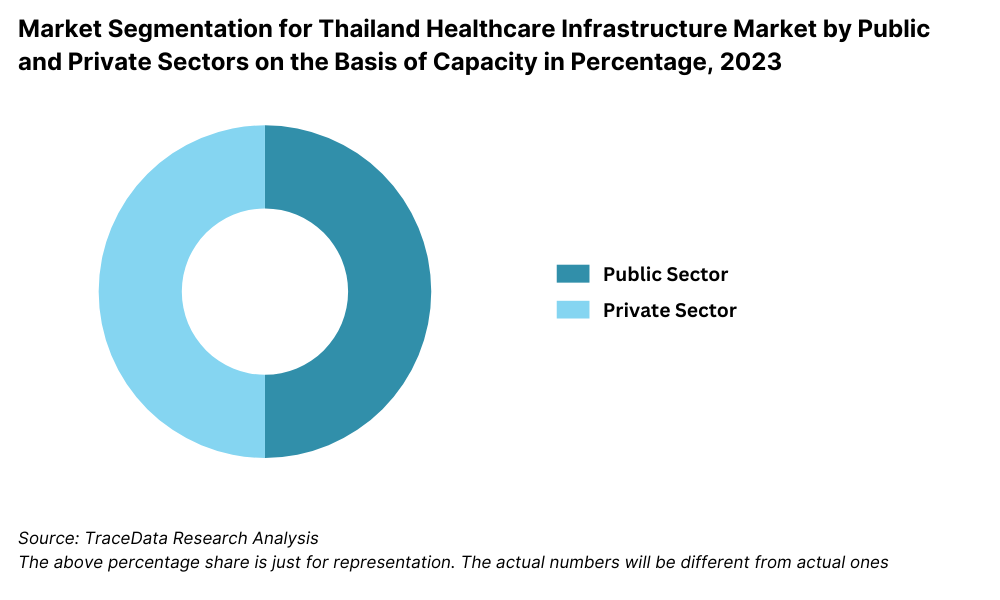

By Market Structure: The public healthcare sector dominates Thailand's healthcare infrastructure market, driven by government-funded hospitals and clinics under the Universal Health Coverage (UHC) program. Public facilities account for a majority share, offering affordable or free healthcare services to citizens. The private sector holds a significant share due to its advanced infrastructure, specialized services, and appeal to medical tourists. Private hospitals, such as Bumrungrad International Hospital and Bangkok Hospital, cater to higher-income patients and international clients with premium services and state-of-the-art facilities.

By Facility Type: General hospitals represent the largest share of healthcare infrastructure, addressing diverse medical needs with multi-specialty capabilities. Specialty hospitals focusing on areas such as cardiology, oncology, and orthopedics are gaining traction, driven by the rise in chronic diseases and medical tourism. Additionally, outpatient clinics and diagnostic centers are expanding rapidly, offering cost-effective solutions for routine and preventive care.

By Region: Bangkok dominates the market, being the hub of advanced healthcare facilities and attracting the highest number of medical tourists. Key provinces like Chiang Mai and Phuket follow, benefiting from growing investments in healthcare and robust tourism. However, rural areas remain underserved, with ongoing government initiatives aimed at reducing this disparity.

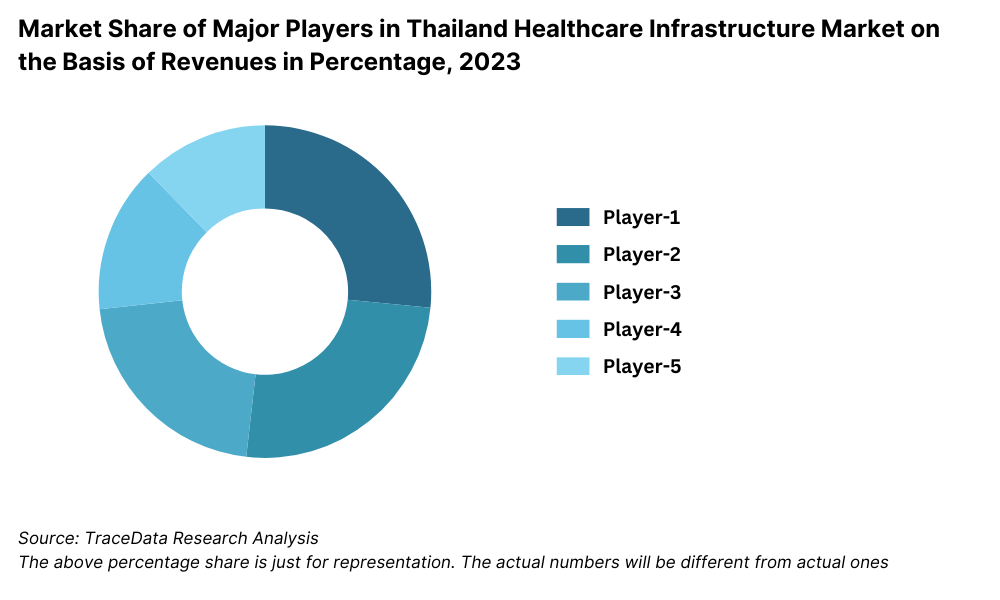

Competitive Landscape in Thailand Healthcare Infrastructure Market

The Thailand healthcare infrastructure market is moderately concentrated, with a mix of public and private players. Major contributors include Bangkok Dusit Medical Services (BDMS), Bumrungrad International Hospital, Samitivej Hospital, Thonburi Healthcare Group, and MedPark Hospital. The market is also witnessing growth in specialized healthcare providers and digital health solutions, further diversifying the competitive environment.

Thailand's healthcare system is renowned for its high-quality services, attracting both local and international patients. Here is a list of 10 major hospitals and clinics operating in Thailand:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Bumrungrad International Hospital | 1980 | Bangkok, Thailand |

Bangkok Hospital | 1972 | Bangkok, Thailand |

Siriraj Hospital | 1888 | Bangkok, Thailand |

King Chulalongkorn Memorial Hospital | 1914 | Bangkok, Thailand |

Samitivej Hospital | 1979 | Bangkok, Thailand |

BNH Hospital | 1898 | Bangkok, Thailand |

Vejthani Hospital | 1994 | Bangkok, Thailand |

Yanhee International Hospital | 1984 | Bangkok, Thailand |

Phyathai Hospital | 1976 | Bangkok, Thailand |

Paolo Hospital | 1972 | Bangkok, Thailand |

Recent Competitor Trends and Key Information

Bangkok Dusit Medical Services (BDMS): As the largest private healthcare provider in Thailand, BDMS operates a network of over 40 hospitals nationwide. In 2023, BDMS invested THB 10 billion in digital healthcare technologies, including telemedicine and AI-powered diagnostics, to improve service efficiency and accessibility.

Bumrungrad International Hospital: Known for its focus on medical tourism, Bumrungrad served over 500,000 international patients in 2023. The hospital's adoption of telemedicine services, coupled with its state-of-the-art facilities, has bolstered its reputation as a leading global medical destination.

Samitivej Hospital: Part of the BDMS network, Samitivej specializes in pediatric and maternity care. In 2023, it launched a new facility dedicated to advanced pediatric care, attracting both domestic and international patients seeking specialized services.

Thonburi Healthcare Group: The group expanded its presence in rural areas with the construction of five new community hospitals in 2023. This move aligns with the government's push to improve healthcare access in underserved regions.

MedPark Hospital: A new entrant in the market, MedPark focuses on tertiary care and high-complexity medical cases. It reported a 35% increase in patient visits in 2023, driven by its cutting-edge technologies and collaborations with international medical institutions.

What Lies Ahead for Thailand Healthcare Infrastructure Market?

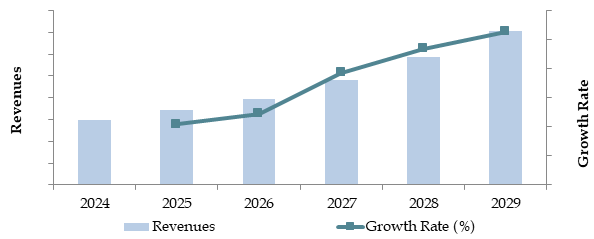

The Thailand healthcare infrastructure market is projected to grow steadily by 2029, exhibiting a healthy CAGR during the forecast period. This growth is expected to be driven by factors such as increasing government expenditure on healthcare, rising medical tourism, advancements in digital health technologies, and an aging population requiring specialized care.

Focus on Geriatric Care: With Thailand's aging population projected to reach 25% of the total population by 2030, investments in geriatric hospitals, nursing homes, and chronic disease management facilities are expected to grow. The demand for long-term care and specialized services for age-related conditions will significantly shape the healthcare landscape.

Advancements in Digital Healthcare: The integration of telemedicine, AI diagnostics, and electronic medical records (EMRs) is anticipated to revolutionize healthcare delivery in Thailand. These technologies will improve operational efficiency, enhance patient care, and expand access to underserved regions. By 2029, it is expected that over 70% of healthcare providers will adopt digital health solutions.

Expansion of Medical Tourism: As a global leader in medical tourism, Thailand is expected to see continued growth in international patient numbers. High-quality care at competitive prices, coupled with government support for the Medical Hub Policy, will strengthen Thailand's position in this market. Medical tourism revenue is anticipated to grow at a CAGR of 8% during the forecast period.

Public-Private Partnerships (PPPs): Collaborative efforts between the government and private sector are expected to play a significant role in infrastructure development. PPPs will facilitate the construction of new hospitals, clinics, and specialized centers, particularly in underserved areas, helping to reduce healthcare disparities.

Market Size for Thailand Healthcare Infrastructure Industry on the Basis of Revenues in USD Billion, 2025-2029

Thailand Healthcare Infrastructure Market Segmentation

By Market Structure:

Government Hospitals

Private Hospitals

Clinics and Diagnostic Centers

Specialty Hospitals

Nursing Homes and Long-Term Care Facilities

Public-Private Partnerships (PPPs)

By Facility Type:

General Hospitals

Specialty Hospitals (Oncology, Cardiology, Orthopedics, etc.)

Diagnostic Centers

Outpatient Clinics

Rehabilitation Centers

By Ownership:

Public Sector

Private Sector

By Region:

Bangkok

Northern Thailand

Southern Thailand

Eastern Thailand

Central Thailand

By Patient Demographics:

Geriatric (60+ years)

Adults (18-59 years)

Pediatric (0-17 years)

Medical Tourists

By Service Type:

Inpatient Services

Outpatient Services

Emergency Care

Preventive Care

Players Mentioned in the Report:

Bumrungrad International Hospital

Bangkok Hospital

Siriraj Hospital

King Chulalongkorn Memorial Hospital

Samitivej Hospital

BNH Hospital

Vejthani Hospital

Yanhee International Hospital

Phyathai Hospital

Paolo Hospital

Key Target Audience:

Public and Private Hospital Administrators

Healthcare Infrastructure Investors

Medical Tourism Agencies

Regulatory Bodies (e.g., Ministry of Public Health)

Technology Providers (Telemedicine and Digital Health Solutions)

Research and Development Institutions

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Thailand Healthcare Infrastructure (Clinics and Hospital) Market

4. Revenue Stream and Business Model Analysis

4.2. Revenue Streams for Thailand Healthcare Infrastructure (Clinics and Hospital) Market

4.3. Business Model Canvas for Thailand Healthcare Infrastructure (Clinics and Hospital) Market

5. Market Structure

5.1. Public and Private Healthcare Facilities in Thailand, 2018-2024

5.2. Share of Public vs. Private Healthcare Infrastructure, 2018-2024

5.3. Spend on Healthcare Infrastructure Development in Thailand, 2024

5.4. Number of Healthcare Facilities (Clinics and Hospital) by Region in Thailand, 2024

6. Market Attractiveness for Thailand Healthcare Infrastructure Market

7. Supply-Demand Gap Analysis

8. Market Size for Thailand Healthcare Infrastructure Market Basis

8.1. Number of Clinics and Hospitals, 2018-2024

8.2. Revenues. 2018-2024

8.3. Investments, 2018-2024

8.4. Bed Capacity, 2018-2024

9. Market Breakdown for Thailand Healthcare Infrastructure Market Basis

9.1. By Market Structure (Public and Private), 2023-2024P

9.2. By Facility Type (General Hospitals, Specialty Hospitals, Clinics, and Others), 2023-2024P

9.3. By Ownership (Government vs. Private Sector), 2023-2024P

9.4. By Region (Bangkok, Northern Thailand, Southern Thailand, Central Thailand, and Eastern Thailand), 2023-2024P

9.5. By Patient Demographics (Geriatric, Adult, Pediatric, Medical Tourists), 2023-2024P

9.6. By Type of Services (Inpatient, Outpatient, Emergency, Preventive Care), 2023-2024P

10. Demand Side Analysis for Thailand Healthcare Infrastructure Market

10.1. Patient Journey and Cohort Analysis

10.2. Patient Decision-Making Process

10.3. Need, Desire, and Pain Point Analysis

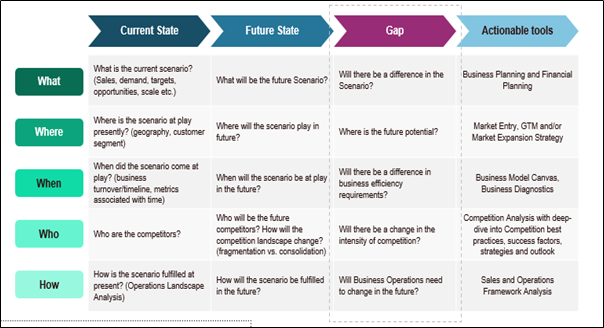

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Thailand Healthcare Infrastructure Market

11.2. Growth Drivers for Thailand Healthcare Infrastructure Market

11.3. SWOT Analysis for Thailand Healthcare Infrastructure Market

11.4. Issues and Challenges for Thailand Healthcare Infrastructure Market

11.5. Government Regulations for Thailand Healthcare Infrastructure Market

12. Snapshot on Digital Healthcare Market

12.1. Market Size and Future Potential for Telemedicine and Digital Solutions, 2018-2029

12.2. Business Model and Revenue Streams

13. Healthcare Financing Market in Thailand

13.1. Trends in Public and Private Healthcare Financing

13.2. Financing Split by Government, Insurance, and Private Entities, 2023-2024P

13.3. Average Healthcare Financing Tenure and Policies in Thailand

13.4. Financing Disbursement for Healthcare Infrastructure, 2018-2024P

14. Opportunity Matrix for Thailand Healthcare Infrastructure Market - Presented with the help of Radar Chart

15. PEAK Matrix Analysis for Thailand Healthcare Infrastructure Market

16. Competitor Analysis for Thailand Healthcare Infrastructure Market

16.1. Market Share of Key Players in Thailand Healthcare Infrastructure Market Basis Number of Clinics, 2024

16.2. Market Share of Key Players in Thailand Healthcare Infrastructure Market Basis Number of Hospitals by Beds, 2024

16.3. Benchmark of Key Competitors in Thailand Healthcare Infrastructure Market, Basis 15-20 Operational and Financial Parameters

16.4. Strength and Weakness Analysis

16.5. Operating Model Analysis Framework

16.6. Gartner Magic Quadrant

16.7. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Thailand Healthcare Infrastructure Market Basis

17.1. Number of Clinics and Hospitals, 2025-2029

17.2. Revenues. 2025-2029

17.3. Investments, 2025-2029

17.4. Bed Capacity, 2025-2029

18. Market Breakdown for Thailand Healthcare Infrastructure Market Basis

18.1. By Market Structure (Public and Private), 2025-2029

18.2. By Facility Type (General Hospitals, Specialty Hospitals, Clinics, and Others), 2025-2029

18.3. By Ownership (Government vs. Private Sector), 2025-2029

18.4. By Region (Bangkok, Northern Thailand, Southern Thailand, Central Thailand, and Eastern Thailand), 2025-2029

18.5. By Patient Demographics (Geriatric, Adult, Pediatric, Medical Tourists), 2025-2029

18.6. By Type of Services (Inpatient, Outpatient, Emergency, Preventive Care), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: Identify all demand-side and supply-side entities within the Thailand Healthcare Infrastructure Market. This includes public and private hospitals, clinics, diagnostic centers, government bodies, and medical tourism agencies. Based on the ecosystem, leading 5-6 healthcare providers in the country are shortlisted using criteria such as financial performance, patient capacity, and market share.

Sourcing Information: Utilize a combination of industry reports, government publications, secondary research articles, and proprietary databases to gather foundational market data and create a comprehensive view of the industry landscape.

Step 2: Desk Research

Secondary Research: Conduct extensive desk research by analyzing secondary and proprietary databases. This process includes examining market-level insights such as investment trends, service demand, facility capacities, and pricing levels.

Company Analysis: Gather company-level data through press releases, annual reports, financial statements, and other corporate documents. This analysis provides a foundational understanding of leading players, their operations, and their financial health.

Data Aggregation: Combine market and company data to develop a detailed understanding of both macro and micro trends influencing the healthcare infrastructure market in Thailand.

Step 3: Primary Research

Stakeholder Interviews: Engage in detailed interviews with C-level executives, government officials, and stakeholders representing Thailand's healthcare infrastructure providers. These interviews validate hypotheses, confirm statistical data, and provide deeper operational insights.

Validation Strategy: Conduct disguised interviews with company representatives under the pretense of potential collaborators to validate data provided by executives. This includes cross-referencing information with secondary research and gathering insights on operational processes, pricing, and revenue streams.

Step 4: Sanity Check

- Perform top-to-bottom and bottom-to-top analyses along with market size modeling exercises to ensure the accuracy of data. This step involves reconciling projections with historical data and validating market size and growth estimates.

FAQs

1. What is the potential for the Thailand Healthcare Infrastructure Market?

The Thailand Healthcare Infrastructure Market is poised for significant growth, reaching a valuation of THB 400 Billion in 2023 and projected to grow at a robust CAGR until 2029. The market's potential is driven by factors such as increased government investments, a growing aging population, and Thailand's position as a leading medical tourism destination.

2. Who are the Key Players in the Thailand Healthcare Infrastructure Market?

The market includes major players such as Bangkok Dusit Medical Services (BDMS), Bumrungrad International Hospital, Samitivej Hospital, Thonburi Healthcare Group, and MedPark Hospital. These entities dominate due to their expansive hospital networks, advanced medical technologies, and significant investments in digital healthcare.

3. What are the Growth Drivers for the Thailand Healthcare Infrastructure Market?

Key drivers include the aging population, which increases demand for geriatric care; the rise of medical tourism, contributing to infrastructure expansion; and digital transformation, enhancing efficiency and accessibility. Additionally, public-private partnerships (PPPs) are expected to play a crucial role in expanding healthcare services to underserved regions.

4. What are the Challenges in the Thailand Healthcare Infrastructure Market?

Challenges include disparities in healthcare access between urban and rural areas, shortages of skilled healthcare professionals, and regulatory hurdles that delay the approval and implementation of infrastructure projects. Rising costs associated with advanced medical technologies also pose challenges for maintaining affordability and equitable access.