Thailand Consumer Electronics Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region

- Product Code: TDR0054

- Region: Asia

- Published on: October 2024

- Total Pages: 110

Want to Assess the Impact of US-Imposed Trade Tariff on

Thailand Consumer Electronics Market

Report Summary

The report titled “Thailand Consumer Electronics Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer electronics market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, consumer level profiling, issues and challenges, and a comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Thailand Consumer Electronics Market. The report concludes with future market projections based on sales revenue, product types, region, market dynamics, and case studies highlighting the major opportunities and challenges in the market.

Thailand Consumer Electronics Market Overview and Size

The Thailand consumer electronics market reached a valuation of THB 420 Billion in 2023, driven by the increasing adoption of smart devices, rising disposable incomes, and changing consumer preferences towards more advanced technology solutions. The market is characterized by major players such as Samsung, Apple, Huawei, Sony, and Xiaomi. These companies are recognized for their innovative product offerings, extensive distribution networks, and strong brand equity.

In 2023, Xiaomi launched a new line of budget smartphones and smart home products targeting the growing middle-class population. This initiative aims to capture a larger share of the Thailand consumer electronics market by providing affordable yet technologically advanced solutions. Bangkok and Chiang Mai are key markets due to their high population density, expanding urban areas, and robust retail infrastructure.

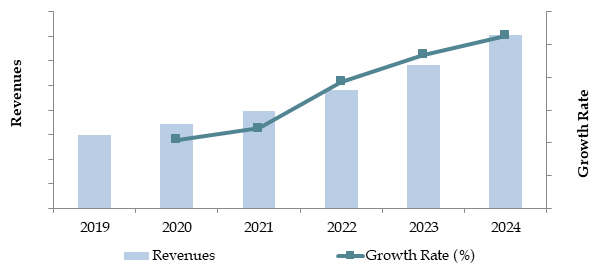

Market Size for Thailand Consumer Electronics Industry on the Basis of Revenue (in Billion THB), 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Thailand Consumer Electronics Market:

Economic Factors: Economic growth and rising disposable incomes have contributed to the increasing demand for premium consumer electronics in Thailand. In 2023, consumer electronics sales surged, as consumers increasingly favored upgrading to high-end smartphones, home appliances, and personal gadgets. This trend is particularly strong among urban buyers who are keen on investing in advanced technologies for convenience and entertainment.

Growing Middle Class: The expanding middle class in Thailand is a key driver for the consumer electronics market. With a growing segment of the population earning higher incomes, there has been a notable increase in spending on electronics. Over the past five years, Thailand's middle-income group has grown by 10%, fueling demand for affordable yet high-quality electronics such as smartphones, home appliances, and smart devices.

E-commerce Expansion: The rise of online marketplaces has revolutionized the consumer electronics shopping experience in Thailand, offering greater product variety, price transparency, and convenience. In 2023, around 35% of consumer electronics sales were conducted online, reflecting a growing reliance on digital platforms like Lazada and Shopee. These platforms offer detailed product comparisons, customer reviews, and frequent discounts, boosting market growth by making electronic products more accessible and affordable to a wider audience.

Which Industry Challenges Have Impacted the Growth of Thailand Consumer Electronics Market:

High Competition and Price Sensitivity: The Thailand consumer electronics market is highly competitive, with numerous global and local players vying for market share. This intense competition has led to price wars, making it challenging for smaller companies to sustain profitability. Consumers in Thailand are also highly price-sensitive, often seeking out discounts and promotions, which further compresses margins for retailers.

Counterfeit and Imitation Products: The prevalence of counterfeit and imitation consumer electronics poses a significant challenge, especially for premium brands. It is estimated that around 15% of electronic products sold in Thailand are counterfeit, leading to revenue losses and eroding consumer trust in legitimate brands. This issue not only impacts sales but also creates a negative perception of the overall market.

Supply Chain Disruptions: Global supply chain disruptions due to geopolitical tensions and the COVID-19 pandemic have affected the availability of key electronic components, leading to production delays and higher costs. In 2023, several brands faced difficulties in launching new products on schedule, contributing to a 5% increase in prices for consumer electronics in Thailand.

What are the Regulations and Initiatives Which Have Governed the Market:

Regulation on Electronic Waste Management: The Thai government has introduced strict regulations to manage electronic waste (e-waste), requiring manufacturers to comply with proper disposal and recycling practices. In 2022, these regulations were further tightened, imposing higher penalties for non-compliance.

Import Tariffs on Electronic Goods: Thailand imposes specific tariffs on imported electronic goods to protect the local manufacturing industry. In 2023, import tariffs on selected consumer electronics increased by 5%, impacting the overall market pricing.

Incentives for Green Electronics: The government is promoting the adoption of eco-friendly consumer electronics by offering tax incentives and subsidies for products with low energy consumption and sustainable materials. This initiative is expected to drive the growth of green electronics in Thailand over the next few years.

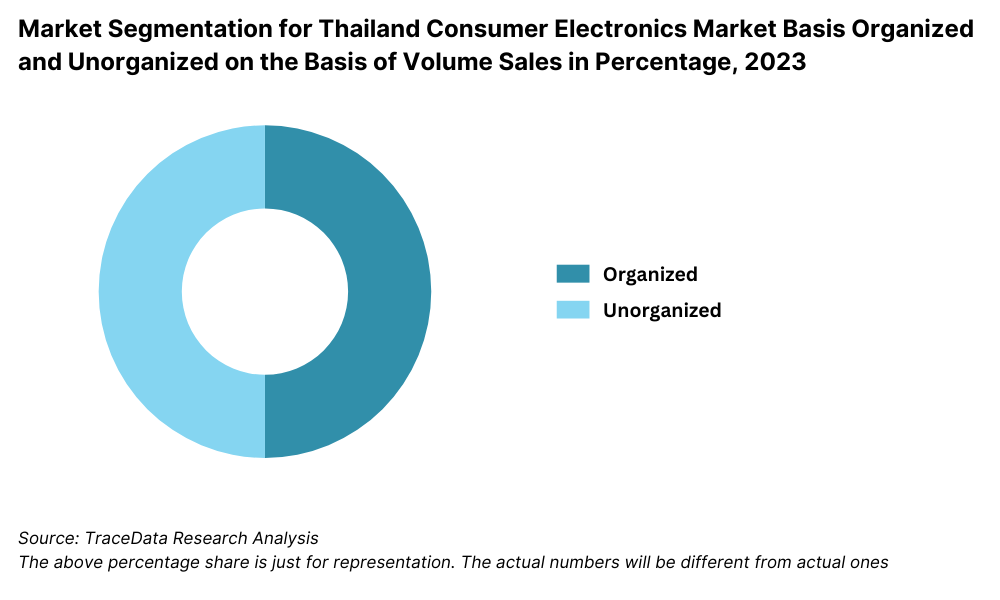

Thailand Consumer Electronics Market Segmentation

By Market Structure: Brick-and-mortar retailers dominate the market due to their established presence, brand reliability, and ability to offer in-store experience and immediate product availability. E-commerce platforms, however, are rapidly growing, driven by increasing internet penetration and consumer preference for convenience and competitive pricing. Online marketplaces like Lazada and Shopee have made significant inroads, capturing a notable share of total sales in 2023. Company-owned outlets hold a strong position, especially for premium brands that focus on providing a seamless retail experience.

By Product Categories: Smartphones are the leading product category, reflecting high consumer demand for connectivity and access to digital services. Home appliances, such as air conditioners, washing machines, and refrigerators, represent a significant portion due to urbanization and increasing household incomes. Wearable devices are gaining popularity, driven by rising health awareness. Personal computers and laptops see steady demand, supported by the growing need for remote work and education tools.

.png)

By Consumer Demographics: The 18-34 age group dominates the market, accounting for a large share of total sales, as they are early adopters of new technology and more likely to upgrade their devices frequently. The 35-54 age group follows, with a preference for reliable and durable products. The 55+ age group contributes a smaller share, focusing mainly on essential and practical products like home appliances.

Competitive Landscape in Thailand Consumer Electronics Market

The Thailand consumer electronics market is relatively fragmented, with both global and local players competing for market share. However, the market is dominated by major brands like Samsung, Apple, Huawei, Sony, and Xiaomi. The expansion of e-commerce platforms such as Lazada and Shopee, along with the entry of new brands and the rise of local players, has diversified the market, offering consumers more choices and improved services.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Samsung Electronics | Televisions, Mobile Devices, Home Appliances | 1938 | Suwon, South Korea |

Sony Corporation | Televisions, Imaging Devices | 1946 | Tokyo, Japan |

LG Electronics | Televisions, Home Appliances | 1958 | Seoul, South Korea |

Apple Inc. | Computers, Mobile Devices | 1976 | Cupertino, California, USA |

Lenovo Group Ltd. | Computers and Peripherals | 1984 | Beijing, China |

Canon Inc. | Imaging Devices | 1937 | Tokyo, Japan |

Panasonic Corporation | Home Appliances, Audio Devices | 1918 | Osaka, Japan |

HP Inc. | Computers and Peripherals | 1939 | Palo Alto, California, USA |

Huawei Technologies Co., Ltd. | Mobile Devices, Wearables | 1987 | Shenzhen, China |

GoPro, Inc. | Action Cameras, Imaging Devices | 2002 | San Mateo, California, USA |

Sharp Corporation | Televisions, Home Appliances | 1912 | Sakai, Osaka, Japan |

Some of the recent competitor trends and key information about competitors include:

Samsung: In 2023, Samsung experienced a 12% increase in revenue, primarily driven by strong sales of its flagship smartphones and home appliances. The company continues to invest in research and development to launch innovative products with AI capabilities and 5G connectivity, solidifying its position as a market leader.

Apple: Apple saw a 15% growth in its revenue in Thailand in 2023, fueled by the launch of new iPhone models and the expansion of its services ecosystem. The brand’s focus on premium quality, strong after-sales service, and a loyal customer base has helped maintain its competitive edge.

Huawei: Despite global challenges, Huawei recorded a 10% increase in sales in Thailand due to its focus on offering affordable smartphones with high-end features. The company’s partnerships with local retailers have also expanded its distribution network across the country.

Sony: Sony has continued to focus on its audio and video equipment segment, reporting an 8% increase in sales in 2023. Its emphasis on premium home theater systems and innovative audio products has helped attract high-income consumers seeking superior entertainment solutions.

Xiaomi: Xiaomi expanded its product range in Thailand, introducing new budget smartphones and smart home devices. This strategy resulted in a 20% increase in market share in 2023, making it one of the fastest-growing brands in the Thai consumer electronics market. Xiaomi's competitive pricing and emphasis on value-for-money products resonate well with budget-conscious consumers.

.png)

What Lies Ahead for Thailand Consumer Electronics Market?

The Thailand consumer electronics market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by factors such as rising disposable incomes, technological advancements, and increased consumer demand for high-quality electronics.

Adoption of Smart Home Technology: The adoption of smart home devices is expected to witness significant growth in Thailand, driven by consumer interest in home automation and convenience. Products such as smart speakers, connected lighting, and smart appliances are gaining traction as more households look to integrate technology into their everyday lives.

Emergence of 5G Technology: With the continued rollout of 5G networks in Thailand, there is anticipated to be a surge in demand for 5G-enabled devices. This development will boost the overall market for smartphones, tablets, and other connected devices, as consumers seek faster connectivity and improved performance.

Expansion of E-commerce Platforms: E-commerce channels will continue to play a pivotal role in driving consumer electronics sales. Platforms like Lazada and Shopee are expected to further expand their reach, offering a broader range of products, improved delivery options, and enhanced customer experiences, thus contributing to the overall market growth.

Rising Demand for Energy-Efficient and Eco-friendly Products: As environmental awareness grows among Thai consumers, there is an increasing demand for energy-efficient and eco-friendly electronics. This trend is expected to push manufacturers to innovate and offer products that align with sustainability goals, such as energy-saving home appliances and products made from recyclable materials.

Future Outlook and Projections for Thailand Consumer Electronics Market on the Basis of Revenue in THB Billion, 2024-2029

Source: TraceData Research Analysis

Thailand Consumer Electronics Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Computer and Peripherals

- In-Car Entertainment

- In-Home Consumer Electronics

- Television

- Headphones

- Imaging Devices

- By Computer and Peripherals

- Desktops

- Laptops

- Tablets

- Monitors

- Printers

- In-Car Entertainment:

- In-Car Navigation

- In-Car Speakers

- In-Dash Media Players

- In-Home Consumer Electronics:

- Audio Separates

- Digital Media Player Docks

- Hi-Fi System

- Home Cinema & Speaker System

- Speakers

- Others

- Television and Video Players:

- TV Types:

- Analog TV

- LCD

- OLED

- Plasma

- Other TVs

- Video Players:

- BD Players

- DVD Players

- Video Recorders

- TV Types:

- Headphones:

- Wireless Headbands

- Wireless Earphones

- TWS Earbuds

- Imaging Devices:

- Cameras

- Camcorders

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

By Region:

Central

Northern

Southern

Eastern

Players Mentioned in the Report:

Samsung Electronics

Sony Corporation

LG Electronics

Apple Inc.

Dell Technologies

Hewlett-Packard (HP)

Panasonic Corporation

Lenovo Group Ltd.

Huawei Technologies Co., Ltd.

Acer Inc.

Canon Inc.

Nikon Corporation

GoPro

JBL

Philips

Sharp Corporation

Bosch

Pioneer Corporation

TCL Corporation

Hisense Co., Ltd

Key Target Audience:

Consumer Electronics Manufacturers

Online Electronics Marketplaces

Distribution Channels

Regulatory Bodies (e.g., Ministry of Commerce)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Thailand Consumer Electronics Market

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4. Market Overview and Genesis

4.1. Value Chain Process - Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the Thailand Consumer Electronics Market

5. Market Structure

5.1. Overview and Business Cycle

5.2. Household Penetration for Each Type of Consumer Electronics in Thailand, 2018-2023

5.3. Replacement Cycle of Consumer Electronics by Each Category, 2018-2023

6. Market Attractiveness for Thailand Consumer Electronics Market

7. Supply-Demand Gap Analysis

8. Market Size for Thailand Consumer Electronics Market Basis

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9. Market Breakdown for Thailand Consumer Electronics Market Basis

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2018-2024

9.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2018-2024

9.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2018-2024

9.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2018-2024

9.2.4. By Television and Video Players

9.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2018-2024

9.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2018-2024

9.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2018-2024

9.2.6. By Imaging Devices (Camers and Camcorders), 2018-2024

9.3. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.4. By Region (Northern, Southern, Western, Eastern, Central), 2023-2024P

9.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10. Demand Side Analysis for Thailand Consumer Electronics Market

10.1. Consumer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

10.5. By Income, Age and Gender Split, 2024

11. Industry Analysis

11.1. Trends and Developments in the Thailand Consumer Electronics Market

11.2. Growth Drivers for Thailand Consumer Electronics Market

11.3. SWOT Analysis for Thailand Consumer Electronics Market

11.4. Issues and Challenges in the Thailand Consumer Electronics Market

11.5. Government Regulations and Initiatives for Thailand Consumer Electronics Market

12. Snapshot on Thailand Online Consumer Electronics Market

12.1. Market Size and Future Potential for Online Consumer Electronics Market, 2018-2029

12.2. Business Model and Revenue Streams of Leading Online Platforms

12.3. Cross Comparison of Leading Online Consumer Electronics Platforms Based on Operational and Financial Parameters

13. Consumer Electronics Financing Market in Thailand

13.1. Finance Penetration Rate and Average Ticket Size for Consumer Electronics, 2018-2029

13.2. Trends in Financing Options for Consumer Electronics

13.3. Popular Consumer Electronics Segments with Higher Finance Penetration Rates

13.4. Finance Split by Banks/NBFCs/Private Finance Companies, 2023-2024P

13.5. Average Loan Tenure for Consumer Electronics Financing in Thailand

13.6. Finance Disbursement for Consumer Electronics in INR Crores, 2018-2024P

14. Opportunity Matrix for Thailand Consumer Electronics Market – Presented with the help of a Radar Chart

15. PEAK Matrix Analysis for Thailand Consumer Electronics Market

16. Competitor Analysis for Thailand Consumer Electronics Market

16.1. Market Share of Key Players in Thailand Consumer Electronics Market, 2018-2024

16.2. Market Share of Key Players in Thailand Computer and Peripherals Market, 2018-2024

16.3. Market Share of Key Players in Thailand In-Car Entertainment Market, 2018-2024

16.4. Market Share of Key Players in Thailand In-Home Consumer Electronics Market, 2018-2024

16.5. Market Share of Key Players in Thailand Television Market, 2018-2024

16.6. Market Share of Key Players in Thailand Headphones Market, 2024

16.7. Market Share of Key Players in Thailand Imaging Devices Market, 2024

16.8. Benchmarking of Key Competitors in Thailand Consumer Electronics Market including Operational and Financial Parameters

16.9. Heat Map Analysis for Major Players in Thailand Consumer Electronics Market

16.10. Strengths and Weaknesses Analysis

16.11. Operating Model Analysis Framework

16.12. Gartner Magic Quadrant

16.13. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Thailand Consumer Electronics Market Basis

17.1. Revenues, 2025-2029

17.2. Sales Volume, 2025-2029

18. Market Breakdown for Thailand Consumer Electronics Market Basis

18.1. By Market Structure (Branded and Local Brands), 2025-2029

18.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2025-2029

18.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2025-2029

18.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2025-2029

18.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2025-2029

18.2.4. By Television and Video Players

18.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2025-2029

18.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2025-2029

18.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2025-2029

18.2.6. By Imaging Devices (Camers and Camcorders), 2025-2029

18.3. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

18.4. By Region (Northern, Southern, Western, Eastern, Central), 2025-2029

18.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

18.6. Recommendations

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand and supply side entities for Thailand Consumer Electronics Market. Based on this ecosystem, we will shortlist leading 5-6 manufacturers in the country based on their financial information, production capacity, and product portfolio.

Sourcing is made through industry reports, multiple secondary, and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a comprehensive analysis of the market, aggregating industry-level insights. We delve into aspects like market size, revenue, number of market players, product categories, demand trends, and pricing strategies. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of the overall market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Thailand Consumer Electronics Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-up approach is undertaken to evaluate volume sales for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom-up and top-down analyses, along with market size modeling exercises, are undertaken to assess and validate the sanity check process, ensuring that the gathered data accurately reflects the market dynamics.

FAQs

01 What is the potential for the Thailand Consumer Electronics Market?

The Thailand consumer electronics market is set for substantial growth, reaching a valuation of THB 420 Billion in 2023. This growth is driven by rising disposable incomes, increasing demand for smart devices, and a growing focus on premium electronics. The market's potential is further bolstered by the expanding e-commerce landscape, which offers consumers easier access to a wide range of electronic products.

03 Who are the Key Players in the Thailand Consumer Electronics Market?

The Thailand Consumer Electronics Market features several key players, including Samsung, Apple, Huawei, Sony, and Xiaomi. These companies dominate the market due to their innovative product offerings, strong brand presence, and extensive distribution networks. Other notable players include LG, Panasonic, and Oppo, which are known for their diverse range of high-quality electronics.

03 What are the Growth Drivers for the Thailand Consumer Electronics Market?

The primary growth drivers include rising consumer incomes, the growing adoption of smart home technology, and the emergence of 5G technology, which is expected to increase the demand for 5G-enabled devices. The rise of online retail channels has also made it easier for consumers to access a wider selection of products, further fueling market growth.

04 What are the Challenges in the Thailand Consumer Electronics Market?

The Thailand Consumer Electronics Market faces several challenges, including high competition and price sensitivity among consumers, the prevalence of counterfeit products, and supply chain disruptions affecting the availability of components. Regulatory challenges, such as compliance with e-waste management and import tariffs, also pose barriers to market growth. Additionally, the digital divide in rural areas limits the penetration of advanced electronics outside of urban centers.

Want to Assess the Impact of US-Imposed Trade Tariff on

Thailand Consumer Electronics Market