South Korea Digital Banking Market Outlook to 2029

By Market Structure, By Services Offered, By Consumer Segments, By Technology Adoption, By Region, and By Key Players

- Product Code: TDR0103

- Region: Asia

- Published on: December 2024

- Total Pages: 110

Want to Assess the Impact of US-Imposed Trade Tariff on

South Korea Digital Banking Market

Report Summary

The report titled “South Korea Digital Banking Market Outlook to 2029 - By Market Structure, By Services Offered, By Consumer Segments, By Technology Adoption, By Region, and By Key Players” provides a comprehensive analysis of the digital banking market in South Korea. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Digital Banking Market. The report concludes with future market projections based on revenue, market, services, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

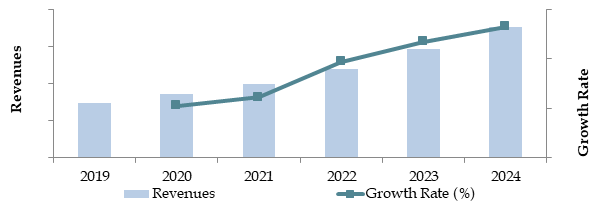

South Korea Digital Banking Market Overview and Size

The South Korea digital banking market reached a valuation of KRW 5 trillion in 2023, driven by rapid digitalization, increasing smartphone penetration, and changing consumer preferences towards seamless online financial services. The market is characterized by major players such as KakaoBank, K bank, Toss Bank, Shinhan Bank, and Woori Bank. These companies are recognized for their innovative digital offerings, expansive online platforms, and customer-focused services.

In 2023, KakaoBank introduced advanced AI-driven financial advisory tools to enhance customer experience and provide personalized recommendations. This initiative aims to cater to the growing demand for intelligent digital banking solutions and strengthen the bank’s position in the digital space. Seoul and Busan are key markets due to their high population density and well-developed technology infrastructure.

Market Size for South Korea Digital Banking Industry on the Basis of Revenue in KRW Trillion, 2018-2024

What Factors are Leading to the Growth of South Korea Digital Banking Market:

Technological Advancements: The adoption of advanced technologies such as artificial intelligence, blockchain, and big data analytics is transforming the digital banking landscape. In 2023, over 60% of South Korea’s digital banking transactions were powered by AI-enabled platforms, which provided enhanced security, speed, and convenience.

Consumer Behavior Shifts: Increasing demand for personalized and seamless financial services has driven significant growth in the digital banking sector. In 2023, around 70% of South Korean consumers preferred using digital banking apps over traditional branch visits, reflecting the convenience offered by digital channels.

Regulatory Support: Government initiatives aimed at fostering financial innovation, such as open banking policies and regulatory sandboxes, have significantly boosted the digital banking ecosystem. In 2023, South Korea implemented a new framework for open banking, allowing third-party providers to integrate seamlessly with established banks, encouraging competition and innovation in the market.

Which Industry Challenges Have Impacted the Growth of South Korea Digital Banking Market

Cybersecurity Concerns: Concerns about cybersecurity and data breaches remain significant challenges in the South Korea digital banking market. According to recent reports, approximately 45% of consumers express hesitation in fully adopting digital banking services due to fears of cyberattacks and unauthorized access to sensitive financial information. This has created a trust gap that could potentially deter around 20% of prospective users.

Regulatory Compliance: Stringent regulations, including those focused on anti-money laundering (AML) and Know Your Customer (KYC) protocols, pose operational challenges for digital banking platforms. In 2023, it was reported that compliance costs for digital-only banks increased by 15%, which could hinder the growth of smaller players in the market.

Digital Literacy Gap: While South Korea has high smartphone penetration, a segment of the population, particularly older adults, lacks sufficient digital literacy to utilize advanced banking apps effectively. In 2023, approximately 18% of consumers above 60 reported difficulties in accessing and navigating digital banking platforms, highlighting a barrier to market inclusivity.

What Are the Regulations and Initiatives That Have Governed the Market:

Open Banking Framework: South Korea’s Financial Services Commission (FSC) introduced an open banking framework to foster innovation and competition. This initiative allows third-party providers to access bank APIs, enabling seamless integration of services. In 2023, approximately 65% of digital banking transactions utilized open banking platforms, reflecting the success of this regulatory push.

Data Protection Laws: The Personal Information Protection Act (PIPA) governs data usage in the digital banking ecosystem, emphasizing consumer data security and privacy. In 2023, digital banks allocated an average of 10% of their budgets to meet data protection and cybersecurity compliance requirements, ensuring consumer trust in the system.

Incentives for Fintech Collaboration: The government has introduced funding and tax incentives to encourage collaborations between traditional banks and fintech companies. These incentives aim to accelerate the adoption of innovative digital solutions. By 2023, over 40% of banks in South Korea had partnered with fintech firms to enhance their digital banking services.

South Korea Digital Banking Market Segmentation

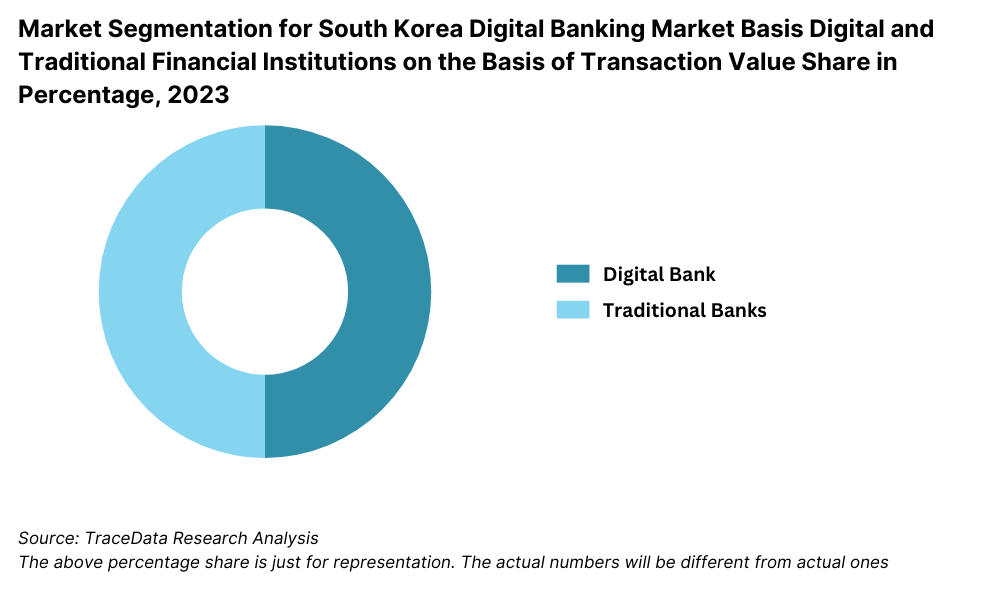

By Market Structure: Digital-only banks dominate the market due to their innovative service offerings, ease of access, and cost-effectiveness. Institutions such as KakaoBank and K bank are recognized for their streamlined platforms and user-friendly interfaces, which appeal to tech-savvy younger consumers. Traditional banks with digital services hold a significant share as they leverage their established trust, robust infrastructure, and integration of physical and digital banking services to attract a diverse customer base.

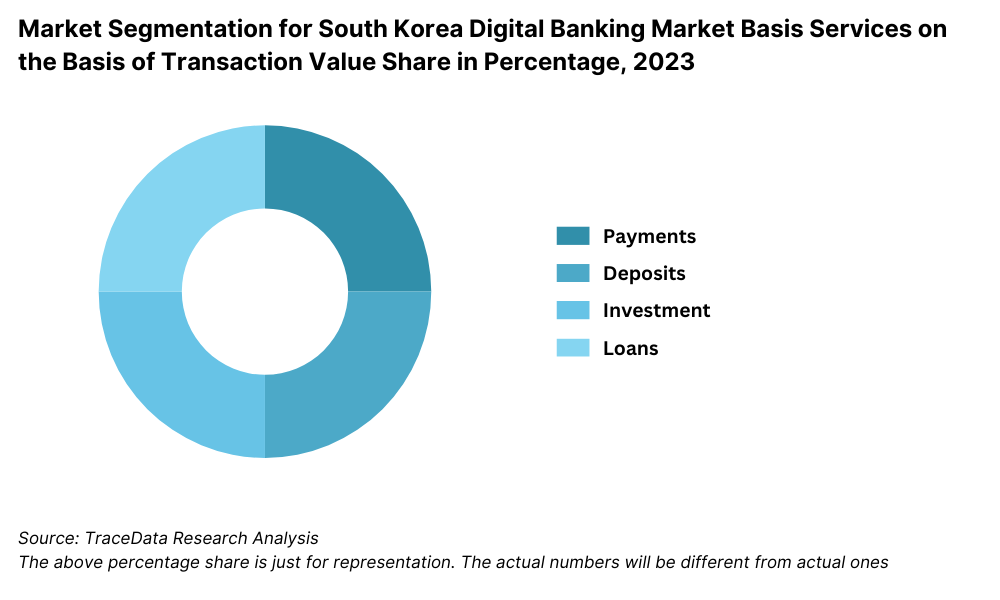

By Services Offered: Payment services account for the largest share in the digital banking market due to the popularity of seamless mobile payments, peer-to-peer (P2P) transfers, and QR code-based transactions. Savings and deposit accounts follow closely as more consumers shift to digital platforms for their primary banking needs, driven by high convenience and competitive interest rates. Loan and credit services also hold a growing share due to the introduction of instant loan approvals and personalized credit options enabled by advanced data analytics.

By Consumer Segments: Millennials and Gen Z dominate the market as they exhibit the highest adoption of digital banking services due to their familiarity with technology and preference for mobile-first solutions. The working-age population (30-50 years) also represents a significant segment, driven by the increasing demand for convenience and time-saving banking options. The senior segment, although smaller, is steadily growing as initiatives to enhance digital literacy and accessibility are implemented.

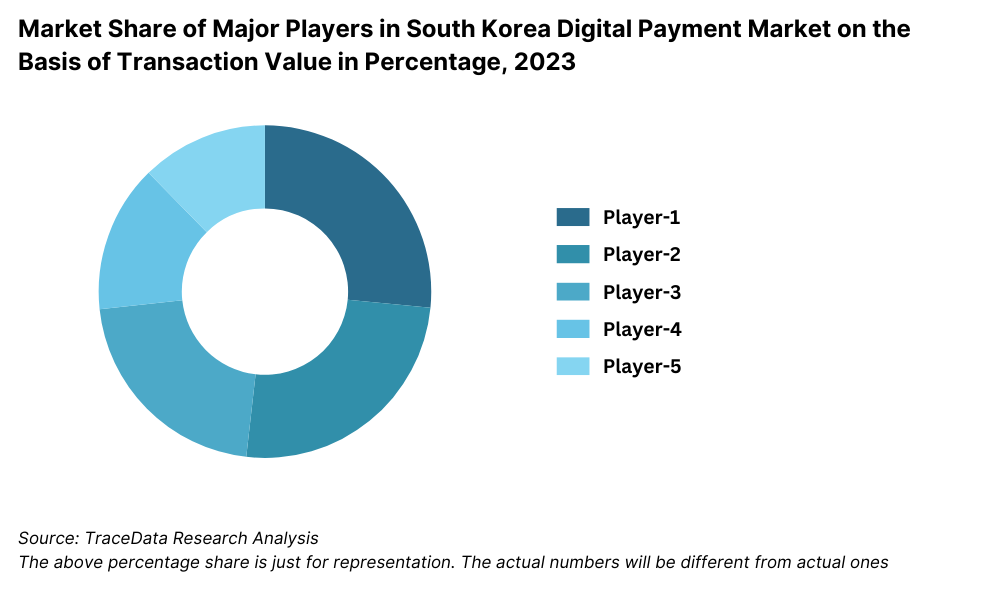

Competitive Landscape in South Korea Digital Banking Market

The South Korea digital banking market is relatively competitive, with a mix of digital-only banks and traditional banks with advanced digital services. Major players such as KakaoBank, K bank, Toss Bank, Shinhan Bank, and Woori Bank dominate the space. The introduction of new fintech startups and the rapid expansion of mobile-first platforms have diversified the market, offering consumers more innovative and convenient options.

Institution Name | Establishment Year | Headquarters |

|---|---|---|

Kakao Bank | 2017 | Seongnam, South Korea |

K Bank | 2017 | Seoul, South Korea |

Toss Bank | 2021 | Seoul, South Korea |

| Shinhan Bank (SOL Digital) | 1897 (Digital arm later) | Seoul, South Korea |

| KB Kookmin Bank (Liiv) | 1963 (Digital arm later) | Seoul, South Korea |

| Hana Bank (Hana 1Q) | 1967 (Digital arm later) | Seoul, South Korea |

| Woori Bank (Wibee) | 1899 (Digital arm later) | Seoul, South Korea |

| NongHyup Bank (NH Smart) | 1961 (Digital arm later) | Seoul, South Korea |

| Citi Bank Korea (Citi Mobile) | 1967 (Digital offerings later) | Seoul, South Korea |

| Internet-only Daegu Bank | 1967 (Digital service expansion) | Daegu, South Korea |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

KakaoBank: Known for its user-friendly app and innovative features, KakaoBank recorded over 25 million users in 2023, reflecting a 12% growth compared to the previous year. The bank’s integration with the Kakao ecosystem (including messaging apps and payment solutions) has significantly boosted its popularity, particularly among younger demographics.

K bank: As South Korea's first internet-only bank, K bank reported a 20% increase in loan disbursements in 2023, driven by its competitive interest rates and AI-powered credit evaluation tools. The bank’s partnerships with local e-commerce platforms have enhanced its reach among small business owners and online merchants.

Toss Bank: A rising star in the digital banking space, Toss Bank experienced a 30% growth in account registrations in 2023. The bank’s focus on providing seamless P2P payment solutions and real-time financial tracking tools has made it particularly appealing to millennials and Gen Z users.

Shinhan Bank: One of South Korea’s largest traditional banks, Shinhan Bank continues to strengthen its digital services, with 40% of its banking transactions conducted online in 2023. The bank launched a blockchain-based payment system to enhance transaction security, positioning itself as a leader in technological innovation.

Woori Bank: With a long history in South Korea, Woori Bank has successfully transitioned into the digital age by introducing AI-driven customer support and personalized financial planning tools. In 2023, the bank saw a 15% increase in mobile app usage, driven by enhanced functionality and user experience improvements.

What Lies Ahead for South Korea Digital Banking Market?

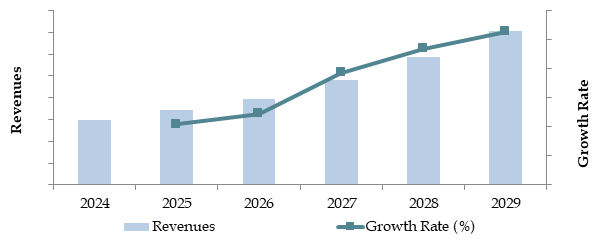

The South Korea digital banking market is projected to grow steadily by 2029, exhibiting a strong CAGR during the forecast period. This growth is expected to be fueled by technological advancements, increasing consumer preference for digital financial services, and supportive regulatory frameworks.

Expansion of Open Banking Systems: With the government's continued focus on open banking initiatives, the market is anticipated to see greater integration and collaboration between traditional banks, fintech companies, and third-party providers. This will enhance customer convenience and drive innovation in financial services.

Rise of Artificial Intelligence and Big Data: The adoption of AI and big data analytics in digital banking is expected to accelerate, enabling personalized financial solutions, advanced fraud detection, and seamless customer experiences. These technologies will play a pivotal role in driving operational efficiency and consumer trust in digital banking platforms.

Increased Adoption of Blockchain Technology: Blockchain is projected to gain prominence in areas such as secure payments, cross-border transactions, and digital identity verification. South Korea’s focus on blockchain innovation will likely drive significant advancements in digital banking security and transparency.

Growth in Mobile-First Banking Solutions: Mobile banking is expected to dominate the digital banking landscape as smartphone penetration remains high and consumer demand for on-the-go financial services continues to rise. Innovations such as app-based micro-loans and QR code payments will further enhance the appeal of mobile-first solutions.

Future Outlook and Projections for South Korea Digital Banking Market on the Basis of Transaction Value in USD Billion, 2024-2029

South Korea Digital Banking Market Segmentation

By Market Structure:

Digital-Only Banks

Traditional Banks with Digital Services

Fintech Platforms

Payment Service Providers

Investment and Wealth Management Platforms

By Services Offered:

Payment and Transfers

Savings and Deposit Accounts

Loan and Credit Services

Investment Services

Insurance Products

By Payments

Domestic Payments:

Bill payments (utilities, taxes, etc.)

Peer-to-peer (P2P) transfers

Merchant payments

Recurring payment setups

International Transfers:

Remittances

Cross-border payments

Foreign exchange services

Digital Payments:

Mobile wallets

Contactless payments (NFC, QR codes)

Payment gateways and APIs

Payroll Services:

Salary processing

Vendor payments

- Savings and Deposit Accounts

- Individual Savings:

- Basic savings accounts

- Premium/high-yield savings accounts

- Fixed deposits (term deposits)

- Recurring deposits

- Business/Corporate Accounts:

- Current accounts

- Overdraft facilities linked to accounts

- Specialized Savings:

- Children’s savings plans

- Senior citizen savings accounts

- NRI (Non-Resident Indian) accounts

- Hybrid Accounts:

- Sweep accounts (automatic transfer between checking and savings)

- Individual Savings:

Loan and Credit Services

- Personal Loans:

- Unsecured loans

- Education loans

- Wedding loans

- Home Loans:

- Mortgages

- Home equity loans

- Construction loans

- Vehicle Loans:

- Auto loans

- Two-wheeler loans

- Business Loans:

- Term loans

- Working capital loans

- Invoice financing

- Equipment financing

- Credit Facilities:

- Credit cards

- Line of credit

- Buy Now, Pay Later (BNPL) services

- Specialized Loans:

- Agricultural loans

- Gold loans

Insurance Products

- Life Insurance:

- Term insurance

- Endowment policies

- Unit Linked Insurance Plans (ULIPs)

- Health Insurance:

- Individual health plans

- Family floater plans

- Critical illness coverage

- Mediclaim policies

- General Insurance:

- Vehicle insurance

- Property insurance

- Travel insurance

- Business Insurance:

- Professional liability insurance

- Commercial property insurance

- Group health insurance

- Specialized Insurance:

- Cybersecurity insurance

- Agriculture insurance

- Insurance for gadgets and electronics

By Consumer Segments:

Millennials (18-34)

Gen Z (Below 18)

Working-Age Population (35-54)

Senior Citizens (55+)

By Technology Adoption:

Artificial Intelligence (AI)

Blockchain

Big Data Analytics

Cloud-Based Solutions

Internet of Things (IoT)

By Region:

Seoul

Busan

Incheon

Gyeonggi Province

Jeju Island

Players Mentioned in the Report:

KakaoBank

K bank

Toss Bank

Shinhan Bank

Woori Bank

Hana Bank

KB Kookmin Bank

NH NongHyup Bank

Key Target Audience:

Digital Banks

Fintech Companies

Traditional Banking Institutions

Payment Solution Providers

Regulatory Bodies (e.g., Financial Services Commission)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in South Korea Digital Banking Market

4. Value Chain Analysis

4.1. Revenue Streams for South Korea Digital Banking Market

4.2. Business Model Canvas for Stakeholders in South Korea Digital Banking Market

5. Market Structure

5.1. List of Traditional vs Digital-Only Banks in South Korea, 2018-2024

5.2. Growth of Mobile Banking Transactions in South Korea, 2018-2024

5.3. Penetration of Financial Services via Digital Channels, 2024

5.4. NPA Analysis in South Korea Digital Banking Market

6. Market Attractiveness for South Korea Digital Banking Market

7. Supply-Demand Gap Analysis

8. Market Size for South Korea Digital Banking Market Basis

8.1. Revenues, 2018-2024

8.2. User Adoption Rate, 2018-2024

9. Market Breakdown for South Korea Digital Banking Market Basis

9.1. By Market Structure (Digital-Only and Traditional Banks), 2023-2024P

9.2. By Service Category (Payments, Deposits, Loans, Investments), 2023-2024P

9.2.1. By Type of Payment Split, 2024P

9.2.2. By Type of Deposit Split, 2024P

9.2.3. By Type of Loan Split, 2024P

9.2.4. By Type of Investment Split, 2024P

9.3. By Consumer Segments (Millennials, Gen Z, Working Age, Seniors), 2023-2024P

9.4. By Region (Seoul, Busan, Incheon, Gyeonggi, Jeju), 2023-2024P

9.5. By Technology Adoption (AI, Blockchain, Cloud, Big Data), 2023-2024P

10. Demand Side Analysis for South Korea Digital Banking Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for South Korea Digital Banking Market

11.2. Growth Drivers for South Korea Digital Banking Market

11.3. SWOT Analysis for South Korea Digital Banking Market

11.4. Issues and Challenges for South Korea Digital Banking Market

11.5. Government Regulations for South Korea Digital Banking Market

12. Opportunity Matrix for South Korea Digital Banking Market - Presented with the Help of Radar Chart

13. PEAK Matrix Analysis for South Korea Digital Banking Market

14. Competitor Analysis for South Korea Digital Banking Market

14.1. Market Share of Major Players in Digital Payment Market, 2024

14.2. Market Share of Major Players in Digital Deposits Market, 2024

14.3. Market Share of Major Players in Digital Loans Market, 2024

14.4. Benchmark of Key Competitors in South Korea Digital Banking Market Basis Financial and Operational Variables

14.5. Strength and Weakness Analysis

14.6. Operating Model Analysis Framework

14.7. Gartner Magic Quadrant

14.8. Bowman’s Strategic Clock for Competitive Advantage

15. Future Market Size for South Korea Digital Banking Market Basis

15.1. Revenues, 2025-2029

15.2. User Adoption Rate, 2025-2029

16. Market Breakdown for South Korea Digital Banking Market Basis

16.1. By Market Structure (Digital-Only and Traditional Banks), 2025-2029

16.2. By Service Category (Payments, Deposits, Loans, Investments), 2025-2029

16.2.1. By Type of Payment Split, 2025-2029

16.2.2. By Type of Deposit Split, 2025-2029

16.2.3. By Type of Loan Split, 2025-2029

16.2.4. By Type of Investment Split, 2025-2029

16.3. By Consumer Segments (Millennials, Gen Z, Working Age, Seniors), 2025-2029

16.4. By Region (Seoul, Busan, Incheon, Gyeonggi, Jeju), 2025-2029

16.5. By Technology Adoption (AI, Blockchain, Cloud, Big Data), 2025-2029

17. Recommendation

18. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: Identify all the demand-side and supply-side entities in the South Korea Digital Banking Market. Based on this ecosystem, shortlist leading 5-6 players in the market using financial information, market share, and technological capabilities.

Data Sourcing: Source data through industry articles, government reports, and proprietary databases to perform desk research, gathering industry-level insights.

Step 2: Desk Research

Exhaustive Analysis: Engage in an extensive desk research process using diverse secondary and proprietary databases to gather detailed market insights. Areas of focus include market size, revenue streams, competition landscape, pricing trends, and consumer behavior.

Company-Level Insights: Supplement market data with detailed analyses of company-level information, including press releases, annual reports, and financial statements. This step provides a foundational understanding of market dynamics and key players.

Step 3: Primary Research

In-Depth Interviews: Conduct interviews with C-level executives, stakeholders, and end-users in the South Korea Digital Banking Market. These interviews validate market hypotheses, statistical data, and financial and operational insights from industry representatives.

Validation Strategy: Employ disguised interviews, approaching companies as potential customers to cross-check operational and financial information. This step ensures data reliability by corroborating with secondary sources and provides insights into revenue streams, value chains, and pricing structures.

Step 4: Sanity Check

- Cross-Validation: Perform bottom-to-top and top-to-bottom analysis to verify market size and ensure the reliability of the data through modeling exercises.

FAQs

1. What is the potential for the South Korea Digital Banking Market?

The South Korea Digital Banking Market is projected to grow significantly, reaching a valuation of KRW 5 trillion in 2023. Growth is driven by rapid digitalization, high smartphone penetration, and increasing consumer preference for online financial solutions. Supportive government policies, such as open banking initiatives, further bolster the market's potential.

2. Who are the Key Players in the South Korea Digital Banking Market?

Key players include KakaoBank, K bank, Toss Bank, Shinhan Bank, and Woori Bank. These institutions dominate the market due to their innovative digital services, strong customer bases, and advanced technological integration.

3. What are the Growth Drivers for the South Korea Digital Banking Market?

The primary growth drivers include advancements in technology, such as AI and blockchain, increased consumer demand for convenient financial solutions, and government initiatives supporting digital transformation. High smartphone penetration and the growing popularity of mobile-first banking solutions also contribute significantly to market growth.

4. What are the Challenges in the South Korea Digital Banking Market?

Challenges include cybersecurity concerns, regulatory compliance costs, and a digital literacy gap among older populations. Intense competition among digital banks and traditional players also pressures profitability. Addressing these challenges is crucial for sustained market growth.

Want to Assess the Impact of US-Imposed Trade Tariff on

South Korea Digital Banking Market