Malaysia Corporate Training Market Outlook to 2029

By Market Structure (In-House and Outsourced Trainings), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), By Organization Size

- Product Code: TDR0026

- Region: Asia

- Published on: September 2024

- Total Pages: 110

Report Summary

The report titled "Malaysia Corporate Training Market Outlook to 2029 - By Market Structure (In-House and Outsourced Trainings), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), By Organization Size, By Age of Learners, and By Region" provides a comprehensive analysis of the corporate training market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a competitive landscape including competition scenario, cross-comparison, opportunities, bottlenecks, and company profiling of major players in the Corporate Training Market. The report concludes with future market projections based on sales revenue, by market, product types, region, and case studies highlighting major opportunities and cautions.

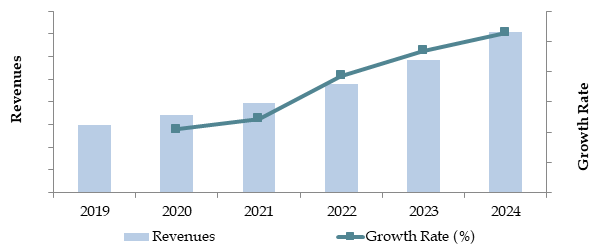

Malaysia Corporate Training Market Overview and Size

The Malaysia corporate training market reached a valuation of MYR 1.8 billion in 2023, reflecting a CAGR of 7.5% from 2018 to 2023. This growth is driven by the increasing need for skill development, the digital transformation across various industries, and the growing importance of compliance training in sectors such as finance, healthcare, and manufacturing.

In 2023, OpenLearning launched a new online training platform aimed at enhancing employee engagement and streamlining the learning process. This initiative aims to tap into the growing demand for digital training solutions in Malaysia and provide a more flexible and effective training experience. Kuala Lumpur and Penang are key markets due to their high concentration of corporate offices and robust business infrastructure.

Market Size for Malaysia Corporate Training Industry on the Basis of Revenue, 2018-2024

Source: TraceData Research Analysis.

What Factors are Leading to the Growth of Malaysia Corporate Training Market:

Digital Transformation: The ongoing digital transformation across industries has led to a surge in demand for training in digital skills, including data analytics, AI, and cybersecurity. In 2023, digital skills training accounted for approximately 45% of total corporate training revenues in Malaysia, as companies prioritize upskilling their workforce to remain competitive.

Regulatory Compliance: The increasing complexity of regulatory requirements in sectors such as finance, healthcare, and manufacturing has driven demand for compliance training. In recent years, compliance training has grown by 12%, reflecting the need for organizations to ensure their employees are up-to-date with the latest regulations and standards.

Growing Workforce: The expanding workforce in Malaysia, particularly in the technology and service sectors, has created a growing need for training programs that enhance productivity and employee engagement. In 2023, corporate training programs focused on soft skills development, such as leadership and communication, saw a 20% increase in demand.

Which Industry Challenges Have Impacted the Growth of Malaysia Corporate Training Market

Budget Constraints: Many companies face budgetary constraints that limit their ability to invest in comprehensive training programs. According to a recent industry survey, approximately 40% of companies cite budget limitations as a major barrier to implementing effective training initiatives. This issue has led to a focus on shorter, more targeted training sessions, potentially limiting the scope and impact of training.

Engagement and Retention: Ensuring employee engagement and retention in training programs remains a significant challenge. Data indicates that approximately 30% of employees do not complete mandatory training sessions, leading to gaps in skill development. This challenge has prompted training providers to explore more interactive and engaging training methods.

Access to Skilled Trainers: A shortage of skilled trainers in specialized fields, such as digital skills and regulatory compliance, poses a significant barrier to market growth. In 2023, it was reported that around 25% of companies struggled to find qualified trainers for their specific needs, leading to delays in training implementation.

What are the Regulations and Initiatives Which Have Governed the Market:

HRDF Regulations: The Malaysian government, through the Human Resources Development Fund (HRDF), mandates that certain sectors contribute a portion of their payroll towards employee training. These funds are then used to subsidize training programs, encouraging companies to invest in employee development. In 2022, over 70% of eligible companies utilized HRDF subsidies for training, indicating strong compliance with these regulations.

Digital Economy Blueprint: The government’s Digital Economy Blueprint, launched in 2021, emphasizes the need for digital skills training to support Malaysia's transition to a knowledge-based economy. The blueprint outlines incentives for companies that invest in digital training programs, particularly in emerging technologies such as AI, IoT, and big data.

Government Support for SMEs: The Malaysian government has introduced various initiatives to support small and medium enterprises (SMEs) in providing training for their employees. This includes grants and subsidies aimed at reducing the financial burden of training programs. In 2023, approximately 60% of SMEs reported receiving government support for their training initiatives.

Malaysia Corporate Training Market Segmentation

By Market Structure: The market is segmented into in-house training, outsourced training, and blended learning solutions. In-house training programs are preferred by larger organizations that have the resources to develop customized training content, while outsourced training providers are increasingly popular among SMEs seeking expertise in specific areas. Blended learning, which combines online and offline training, is gaining traction due to its flexibility and effectiveness.

%2C%202023.png)

By Training Type: Technical skills training, soft skills development, compliance training, and leadership development are the major segments. Technical skills training is the largest segment, driven by the need for employees to keep pace with technological advancements. Soft skills development is also a key focus, particularly in industries such as finance, where communication and leadership are critical.

%2C%202023.png)

By Region: The Central Region, including Kuala Lumpur and Selangor, dominates the market due to the high concentration of corporate offices and businesses. The Northern Region, driven by the industrial and manufacturing sectors, also holds a significant share. The Southern Region is emerging as a key market, particularly in logistics and manufacturing, while the Eastern Region focuses on resource extraction industries. East Malaysia, with its emphasis on oil and gas, also contributes to the market.

Competitive Landscape in Malaysia Corporate Training Market

The Malaysia corporate training market is relatively fragmented, with a mix of local and international players. However, the entrance of new firms and the expansion of online platforms have diversified the market, offering companies more choices and tailored services.

Online Platforms

| Name | Founding Year | Headquarters |

| Leaderonomics | 2008 | Kuala Lumpur, Malaysia |

| eLearningMinds | 2004 | Kuala Lumpur, Malaysia |

| Go1 | 2015 | Brisbane, Australia |

| iTrain Asia | 2005 | Kuala Lumpur, Malaysia |

| Coursera (Malaysia) | 2012 | Mountain View, USA (Operations in Malaysia) |

| Udemy for Business (Malaysia) | 2010 | San Francisco, USA (Operations in Malaysia) |

| 360DigiTMG | 2013 | Kuala Lumpur, Malaysia |

Offline Companies

| Name | Founding Year | Headquarters |

| SMR Group | 1978 | Kuala Lumpur, Malaysia |

| Dale Carnegie Training Malaysia | 1912 | Kuala Lumpur, Malaysia |

| Asia HRDCampus | 1990 | Kuala Lumpur, Malaysia |

| K-Pintar | 2002 | Petaling Jaya, Malaysia |

| Malaysian Institute of Management (MIM) | 1966 | Kuala Lumpur, Malaysia |

| Trainocate (Formerly Global Knowledge) | 1994 | Kuala Lumpur, Malaysia |

| Renaissance Training Center | 1995 | Kuala Lumpur, Malaysia |

Some of the recent competitor trends and key information about competitors include:

Axcelasia: Known for its focus on governance and compliance training, Axcelasia reported a 20% increase in revenue in 2023, driven by rising demand for corporate governance programs. The company's comprehensive approach to training has made it a leader in this niche market.

Leaderonomics: A prominent provider of leadership and personal development training, Leaderonomics saw a 25% growth in its client base in 2023. The company's emphasis on experiential learning and community engagement has resonated with organizations looking to develop well-rounded leaders.

K-Pintar: Specializing in technical and digital skills training, K-Pintar reported a 30% increase in the enrollment of its digital skills programs in 2023. The company’s partnerships with global technology firms have enhanced its offerings and market reach.

OpenLearning: As a leading online learning platform, OpenLearning saw a 35% increase in user engagement in 2023. The platform’s focus on providing flexible, on-demand learning solutions has made it a popular choice among SMEs.

SMR HR Group: With a long-standing presence in the market, SMR HR Group continues to be a key player in the corporate training landscape. In 2023, the group expanded its offerings to include mental health and wellness training, responding to growing concerns about employee well-being.

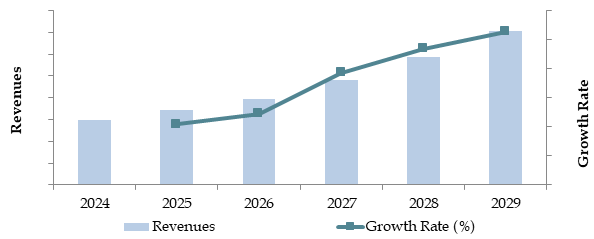

What Lies Ahead for Malaysia Corporate Training Market?

The Malaysia corporate training market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by digital transformation, regulatory requirements, and the increasing need for upskilling and reskilling in the workforce.

Focus on Digital Skills: As digital transformation continues to accelerate across industries, the demand for digital skills training is expected to grow. Companies will increasingly invest in training programs that equip employees with the necessary skills to thrive in a digital-first environment.

Expansion of Blended Learning: The trend towards blended learning solutions is likely to continue, driven by the need for flexibility and the effectiveness of combining online and offline training methods. This approach allows companies to tailor training programs to the specific needs of their employees, improving engagement and retention.

Increased Focus on Employee Well-being: As awareness of the importance of mental health and well-being in the workplace grows, companies are expected to invest more in training programs that address these issues. This includes training on stress management, work-life balance, and mental health support, reflecting a broader trend towards holistic employee development.

Government Support: Continued government support for corporate training, particularly for SMEs, is expected to drive market growth. Initiatives such as grants, subsidies, and tax incentives will encourage more companies to invest in employee training, further boosting the market.

Future Outlook and Projections for Malaysia Corporate Training Market on the Basis of Revenue, 2024-2029

Source: TraceData Research Analysis

Malaysia Corporate Training Market Segmentation

- By Market Structure:

- In-House Training Programs

- Outsourced Training Providers

- By Training Type:

- Technical Skills Training

- Soft Skills Development

- Compliance Training

- Leadership and Management Development

- Digital Skills Training

- Language and Communication Skills Training

- By Industry Verticals:

- Finance and Banking

- Technology and IT

- Manufacturing

- Healthcare

- Retail and Consumer Goods

- Oil and Gas

- By Company Size:

- Large Enterprises

- Medium-Sized Enterprises

- Small and Medium Enterprises (SMEs)

- By Region:

- Central Region

- Northern Region

- Southern Region

- Eastern Region

- East Malaysia (Sabah and Sarawak)

- By Deployment:

- Offsite

- Onsite

- By Designation:

- Managerial

- Non-Managerial

- Integrated

- By Type of Organization:

- MNCs

- Domestic

- By Mode of Learning:

- Instructor Led Classroom Only

- Blended Learning

- Virtual Classroom

- Online or Computer Based Methods Only

- Mobile only

- Social Learning

Players Mentioned in the Report (Online):

Leaderonomics

eLearningMinds

Go1

iTrain Asia

Coursera (Malaysia)

Udemy for Business (Malaysia)

360DigiTMG

Players Mentioned in the Report (Offline):

SMR Group

Dale Carnegie Training Malaysia

Asia HRDCampus

K-Pintar

Malaysian Institute of Management (MIM)

Trainocate (Formerly Global Knowledge)

Renaissance Training Center

Key Target Audience:

Corporate Training Providers

Human Resources Departments

Government Bodies (e.g., HRDF, Ministry of Human Resources)

SMEs

Large Enterprises

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Malaysia Corporate Training Market

4. Value Chain Analysis

4.1. Delivery Model Analysis for Corporate Training- Online, Blended, In Person or Self-Paced- Discuss about Margins, Preference, Strength and Weakness

4.2. Revenue Streams for Malaysia Corporate Training Market

4.3. Business Model Canvas for Malaysia Corporate Training Market

5. Market Structure

5.1. Freelance Trainers V/S Full Time Trainers

5.2. Investment Model in India Corporate Training Market

5.3. Comparative Analysis of the Funnelling Process by Private and Government Organizations in India Corporate Training Market

5.4. Corporate Training Budget Allocation by Company Size, 2024

6. Market Attractiveness for Malaysia Corporate Training Market

7. Supply-Demand Gap Analysis

8. Market Size for Malaysia Corporate Training Market Basis

8.1. Revenues, 2018-2024

9. Market Breakdown for Malaysia Corporate Training Market Basis

9.1. By Market Structure (In-House and Outsourced Training), 2023-2024P

9.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2023-2024P

9.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2023-2024P

9.3.1. By Type of IT Training, 2023-2024P

9.3.2. By Type of Manufacturing Training, 2023-2024P

9.3.3. By Type of Finance Training, 2023-2024P

9.3.4. By Type of Soft Skill Training, 2023-2024P

9.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2023-2024P

9.5. By Employee Designation, 2023-2024P

9.6. By Mode of Learning, 2023-2024P

9.7. By Open and Customized Programs, 2023-2024P

9.8. By Region (Central, Northern, Southern, Eastern, and East Malaysia), 2023-2024P

10. Demand Side Analysis for Malaysia Corporate Training Market

10.1. Corporate Client Landscape and Cohort Analysis

10.2. Corporate Training Needs and Decision-Making Process

10.3. Training Program Effectiveness and ROI Analysis

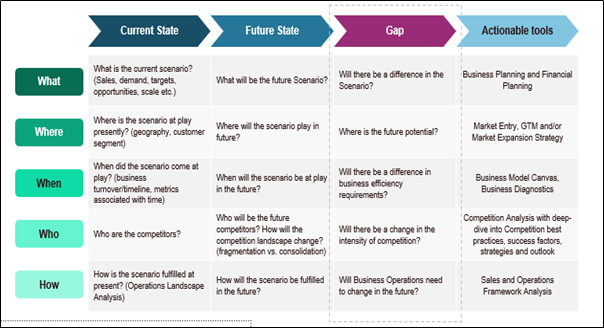

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Malaysia Corporate Training Market

11.2. Growth Drivers for Malaysia Corporate Training Market

11.3. SWOT Analysis for Malaysia Corporate Training Market

11.4. Issues and Challenges for Malaysia Corporate Training Market

11.5. Government Regulations for Malaysia Corporate Training Market

12. Snapshot on Online Corporate Training Market

12.1. Market Size and Future Potential for Online Corporate Training Industry in Malaysia, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Delivery Models and Type of Courses offered

12.4. Cross Comparison of Leading Online Corporate Training Companies based on Company Overview, Investment and Funding, Revenues, Number of Subscribers, Revenue Streams, Number of Courses, Fees and others

13. Opportunity Matrix for Malaysia Corporate Training Market - Presented with the Help of Radar Chart

14. PEAK Matrix Analysis for Malaysia Corporate Training Market

15. Competitor Analysis for Malaysia Corporate Training Market

15.1 Market Share of Key Players in Malaysia Corporate Training Market Basis Revenues, 2023

15.2. Benchmark of Key Competitors in Malaysia Corporate Training Market Including Variables such as Company Overview, USP, Business Strategies, Business Model, Number of Trainers, Revenues, Pricing Basis Type of Training, Technology Used, Best Selling Courses, Major Clients, Strategic Tie Ups, Marketing Strategy, Recent Development and others

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowman’s Strategic Clock for Competitive Advantage

16. Future Market Size for Malaysia Corporate Training Market Basis

16.1. Revenues, 2025-2029

17. Market Breakdown for Malaysia Corporate Training Market Basis

17.1. By Market Structure (In-House and Outsourced Training), 2025-2029

17.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2025-2029

17.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2025-2029

17.3.1. By Type of IT Training, 2025-2029

17.3.2. By Type of Manufacturing Training, 2025-2029

17.3.3. By Type of Finance Training, 2025-2029

17.3.4. By Type of Soft Skill Training, 2025-2029

17.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2025-2029

17.5. By Employee Designation, 2025-2029

17.6. By Mode of Learning, 2025-2029

17.7. By Open and Customized Programs, 2025-2029

17.8. By Region (Central, Northern, Southern, Eastern, and East Malaysia), 2025-2029

17.9. Recommendation

17.10. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand and supply side entities for the Malaysia Corporate Training Market. Based on this ecosystem, we will shortlist leading 5-6 training providers in the country based on their financial information, service offerings, and client base.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Engage in exhaustive desk research by referencing diverse secondary and proprietary databases. This enables a thorough analysis of the market, aggregating industry-level insights. Aspects like market revenues, number of training providers, pricing, demand, and other variables are examined. This is supplemented with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents.

Step 3: Primary Research

Conduct in-depth interviews with C-level executives and other stakeholders representing various Malaysia Corporate Training Market companies and end-users. This serves a multi-faceted purpose: validating market hypotheses, authenticating statistical data, and extracting valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate market size for each player, thereby aggregating to the overall market.

Disguised interviews are conducted to validate operational and financial information shared by company executives, corroborating this data against available secondary sources. These interactions also provide comprehensive insights into revenue streams, value chain processes, pricing, and other factors.

Step 4: Sanity Check

- Perform bottom-to-top and top-to-bottom analysis along with market size modeling exercises to ensure the accuracy and consistency of the data.

FAQs

01 What is the potential for the Malaysia Corporate Training Market?

The Malaysia corporate training market is poised for substantial growth, with a projected CAGR that reflects the increasing importance of continuous learning and development. This growth is driven by factors such as digital transformation, regulatory compliance needs, and the expanding workforce across various sectors.

02 Who are the Key Players in the Malaysia Corporate Training Market?

The Malaysia Corporate Training Market features several key players, including Axcelasia, Leaderonomics, K-Pintar, and OpenLearning. These companies dominate the market due to their comprehensive training solutions, strong client relationships, and innovative approaches to learning.

03 What are the Growth Drivers for the Malaysia Corporate Training Market?

The primary growth drivers include the ongoing digital transformation across industries, the need for regulatory compliance, and the growing emphasis on employee well-being. Additionally, government support for corporate training initiatives, particularly for SMEs, is expected to drive further growth.

04 What are the Challenges in the Malaysia Corporate Training Market?

The Malaysia Corporate Training Market faces challenges such as budget constraints, engagement and retention issues in training programs, and a shortage of skilled trainers in specialized fields. These challenges require innovative solutions and strategic investments by training providers and companies alike.