Malaysia Cold Chain Market Outlook to 2029

By Market Structure, By Service Type, By Temperature Type, By Application, By End-User, and By Region

- Product Code: TDR0025

- Region: Asia

- Published on: September 2024

- Total Pages: 110

Report Summary

The report titled "Malaysia Cold Chain Market Outlook to 2029 - By Market Structure, By Service Type, By Temperature Type, By Application, By End-User, and By Region" deals with the Malaysia cold chain market. The report provides an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and a comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, market structure, service type, region, cause and effect relationships, and success case studies highlighting the major opportunities and cautions.

Malaysia Cold Chain Market Overview and Size

The Malaysia cold chain market reached a value of MYR 2.5 Billion in 2023, while the growth is accelerating, the increasing demand for temperature-controlled logistics, growth in the food and pharmaceutical sector, and increasing expectations among consumers for fresh and safe products. Major players in the market include Tiong Nam Logistics, Tasco Berhad, GDEX, and Cold Chain Network. These firms are characterized by extensive logistics networks, a wide variety of service portfolios, and solutions that are need-based.

In 2023, Tiong Nam Logistics expanded its cold storage capacity to meet the demand for its cold chain services generated by customers from pharmaceutical and food industries. This addition will ensure seamless experiences in providing cold-chain services throughout Malaysia, which will further facilitate operational efficiency. Key markets like Kuala Lumpur and Johor Bahru are quite critical because of their large populations and great logistics infrastructure.

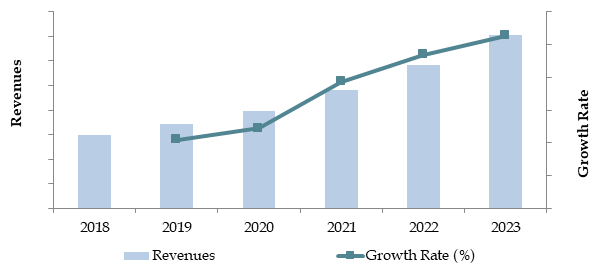

Market Size for Malaysia Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2023

Factors Leading to the Growth of the Malaysia Cold Chain Market:

Food and Beverage Growing: High demand for fresh and perishable food products, including dairy items, seafood, and meat items, led to phenomenal growth in the cold chain market. In 2023, around 45% of the overall cold chain demand in Malaysia came from the food and beverage segment. The segment is in a continuous growth phase due to the rising preference of consumers for fresh and high-quality food items, requiring efficient temperature-controlled logistics.

Cold Chain Growth in the Pharmaceutical Industry: One of the prime contributors to cold chain logistics growth may be attributed to vaccines, biologicals, or temperature-sensitive medicines. This could account for around 30% of the Cold Chain Services given by pharmaceutical company contributions in the year 2023, which was speculated. The increased complexity and volume of pharmaceutical products requiring precise temperature control have boosted demand for value-added cold chain solutions.

Regulatory Compliance and Quality Standards: With the strict legislations on food safety and pharmaceuticals, cold chain infrastructures in Malaysia have been tasked to be dependable. About 80% of the companies in the cold chain remained compliant with food safety regulations, while about 85% conformed to GDP for pharmaceuticals in 2023. This has led to the encouragement of companies in enhancing their cold chain capabilities in their compliance direction by ensuring product quality.

Industry Challenges Impacting the Growth of the Malaysia Cold Chain Market:

Regulatory Compliance: Cold chain operations are further complicated by the need to comply with detailed regulations concerning food safety and pharmaceutical distribution. As of 2013, it was expected that about 15% of cold chain operators faced difficulty in meeting regulatory requirements such as GDP and HACCP. Such problems with compliance would lead to increased cost and operational delay.

Infrastructure Limitations: The major problems are the inadequacy of cold storage and transport infrastructure. Even while demand is rising, about 30% of the cold chain facilities in Malaysia operate below capacity. Generally, inadequate storage and distribution networks with proper modern temperature control might trigger inefficiency and, in the long term, impact the overall growth.

High Operational Costs: The cold chain systems have high costs of maintenance and operation, which is one of the major challenges. Energy costs for refrigeration and investments in advanced technologies contribute to around 25% of the operational costs. Most of these costs are unaffordable for small companies or startups, which may hamper their competitiveness and expansion into the market.

Regulations and Initiatives Governing the Malaysia Cold Chain Market:

Food Safety Regulations: The Malaysian government has very strict regulations regarding the integrity of products moving through the cold chain. These regulations include compliance with GDP and HACCP standards. Around 80% of the cold chain operators in 2023 said they were fully compliant with these regulations, which can be termed as very strong in terms of maintaining the quality and safety of products.

Green Logistics Initiatives: The Malaysian government has also initiated green logistics to reduce carbon footprints in cold chain operations by providing various incentives to operators for the adaptation of energy-efficient refrigeration systems and sustainable packaging solutions. For example, the incentives from these initiatives reached around 15% of cold chain operators in 2023, with a growing trend toward greening.

Pharmaceutical Distribution Guidelines: Under the distribution guidelines provided by the Government, pharmaceutical products are delivered to clients at the required temperatures always during the transportation and storage processes. This will help the medicinal products reach their consumers in perfect condition. Recently, these guidelines were renovated in 2023 to enhance monitoring and recording practices. The revised regulations forced close to a quarter of cold chain operators to replace their systems.

Malaysia Cold Chain Market Segmentation

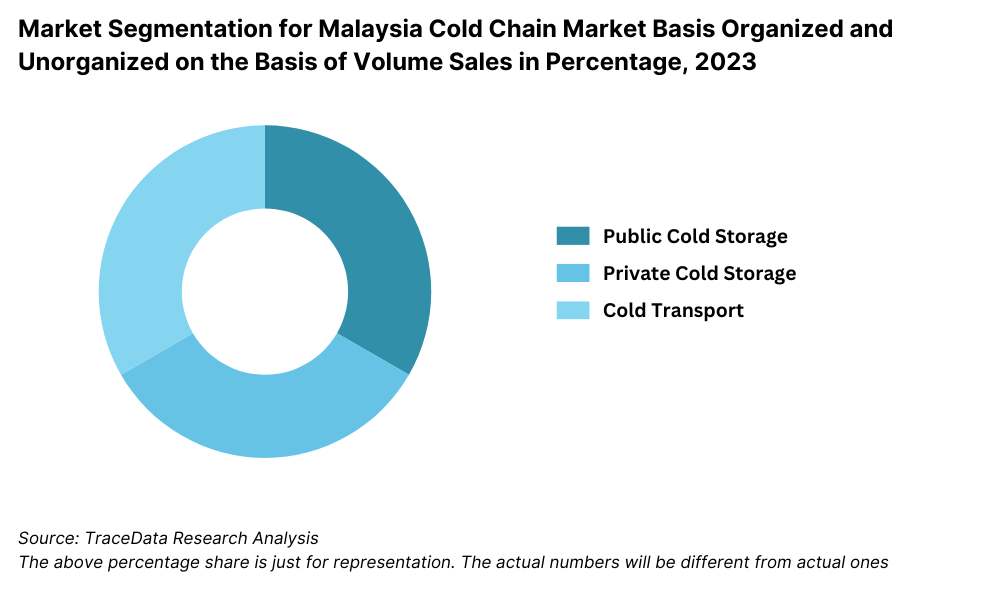

By Market Structure: Public cold storage facilities lead the forefront, being highly contributory to industries like food and beverages, pharmaceuticals, and retail. The segment is also driven by continuous upgrading and expansion of cold storage infrastructure. Cold Storage accounts for 60% of the market, driven by the demand for refrigerated warehouses and storage facilities. Cold transport represents 40% of the market, propelled by the need for efficient logistics solutions for perishable goods.

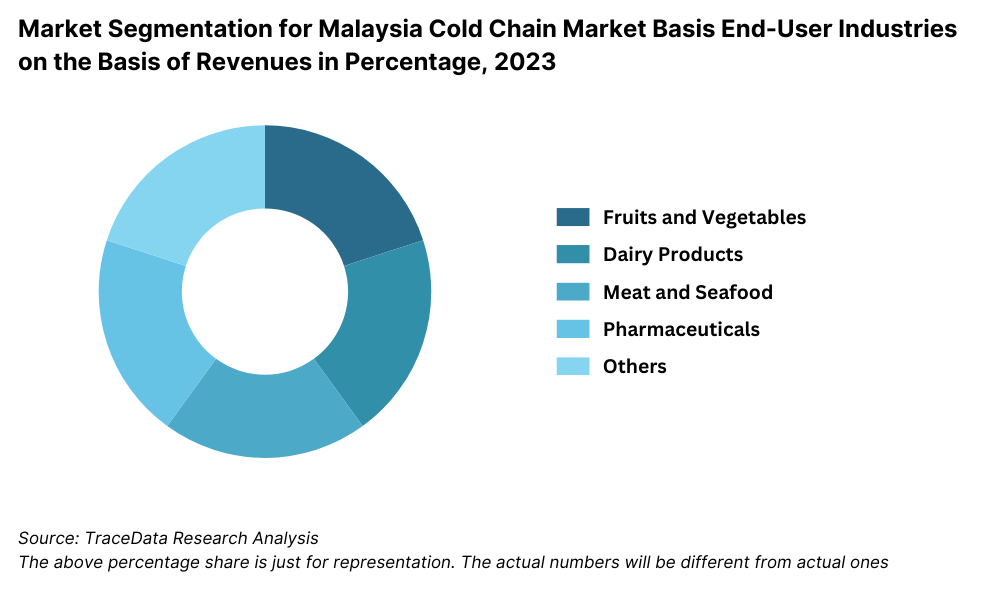

By End-User Industry: The cold chain market finds its application in industries such as food and beverages, pharmaceuticals, and healthcare. Food and beverages is the largest segment due to the demand for fresh produce, frozen foods, and dairy products that require consistent temperature control. Pharmaceuticals and healthcare is the second largest due to the need for precise temperature management for vaccines, biologics, and other sensitive products.

Temperature Range: Segmentation by temperature range includes three categories: chilled-0 to 8° C; frozen-below -18° C; and deep frozen-below -30° C. The chilled segment represents the major share in the market, as most of the perishable commodities, like fruits, vegetables, and dairy products, cover a huge demand segment that requires temperature-controlled logistics.

Frozen and Deep Frozen: Frozen foods are increasingly gaining demand, and also there are certain pharmaceutical products which need frozen temperatures; hence, these segments are growing accordingly.

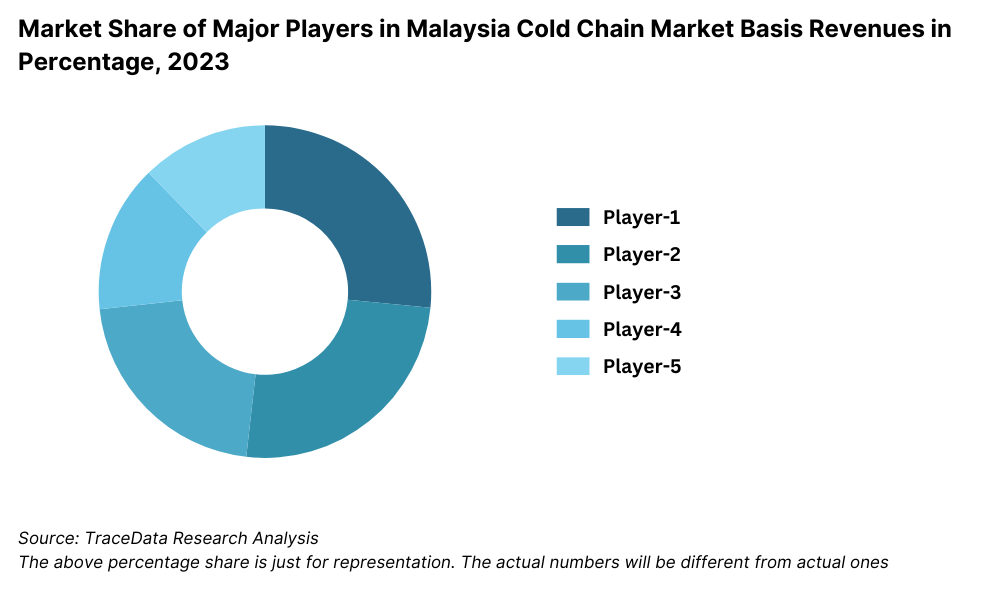

Competitive Landscape in Malaysia Cold Chain Market

The Malaysia cold chain market includes various key and emerging firms operating specialized services within the marketplace. There is increasing market entry with the development of new companies, technology advancements that increase the intensity of operation, and greater competitive multi-operator temperature-controlled logistics movements.

| Name | Founding Year | Headquarters |

| Tiong Nam Logistics Holdings | 1975 | Johor Bahru, Johor |

| Cold Chain Network Sdn Bhd | 1994 | Subang Jaya, Selangor |

| GD Express Carrier Bhd (GDEX) | 1997 | Petaling Jaya, Selangor |

| Haisan Resources Berhad | 1980 | Klang, Selangor |

| MMC Corporation Berhad | 1911 | Kuala Lumpur |

| TLG Group (Total Logistics) | 1977 | Johor Bahru, Johor |

| DHL Supply Chain Malaysia | 1969 | Shah Alam, Selangor |

| Tasco Berhad | 1974 | Shah Alam, Selangor |

| Cameron Highlands Cold Storage Sdn Bhd | 2005 | Cameron Highlands, Pahang |

| Syarikat Sin Kwang Logistics Sdn Bhd | 1990 | Butterworth, Penang |

Haulier Sdn Bhd: It reported a 22% growth in refrigerated transport capacity in the year 2023. With its latest investment in temperature-controlled vehicles at a state-of-the-art level, combined with the real-time tracking systems, this has increased the company's market position. Haulier Sdn Bhd has been known to cover a wide area in Malaysia with a strong sense of commitment towards maintaining the best standards in maintaining temperature.

Cold Chain Solutions: Cold Chain Solutions deals in food and pharmaceutical cold storage. The company recorded a 20% increase in its cold storage capacity this year, 2023. Advanced cooling technologies have been fitted in the new expanded facilities of the company, including automated inventory management systems to further improve its efficiency and reliability of service.

Lineage Logistics: Lineage Logistics is a global player with a strong local presence. It gained 15% in market share due to its scalable cold storage solutions and innovative supply chain technologies. The company has been focusing on integrating digital solutions for inventory and temperature monitoring, further enhancing its operational capabilities.

Top Logistics: With Top Logistics' expanding cold chain services related to perishable fresh produce and pharmaceutical items, it shows an 18% market increase as early as 2023. To achieve such enormous growth, TOP focused on bringing up the best customised solutions, apart from engaging with selected small indigenous suppliers in strong strategic partnerships to satisfy the business and its valuable customers.

Titiwangsa Cold Storage: It has a longer period in the market with a 12% increase in storage volume. With already laid infrastructures, its reliability gives it continuous streams of customers in the line of food and beverages.

What Lies Ahead for Malaysia Cold Chain Market?

Malaysia's cold chain market is expected to grow significantly by 2029 owing to advances in technology, increase in demand for temperature-sensitive products, and government support given to improve logistic infrastructure. The following trends and development are likely to influence the future course of the market:

Expansion of cold chain infrastructure: The market will be driven by an increasing demand for fresh produce, pharmaceuticals, and other temperature-sensitive products. Investments in the latest cold storage facilities, sophisticated transportation solutions, and real-time monitoring systems will bring major drivers of better efficiency along the value chain.

Technological Advancements: IoT sensors, blockchain for traceability, and automated temperature controlling systems are some of the emerging technologies in the cold chain industry. This would further improve transparency, accuracy, and efficiency in temperature management while reducing spoilage and hence improving adherence to regulatory standards.

Sustainability Initiatives: Lots of attention is being directed toward sustainability in the cold chain market. Besides this, various companies are planning the installation of energy-efficient refrigeration systems, sustainable packaging solutions, and carbon offset programs. These initiatives will align with global sustainability goals and help companies attract more environmentally conscious clients while reducing operational costs.

Growing E-commerce Demand: The advancement in the e-commerce business, majorly with respect to perishable products, shall keep upping the need for advanced cold chain logistics. As online grocery shopping and other delivery models continue to see growth, their demand is set to grow increasingly high, driving the need for reliable cold chain solutions, and consequently encouraging more investment into technology and logistics infrastructure.

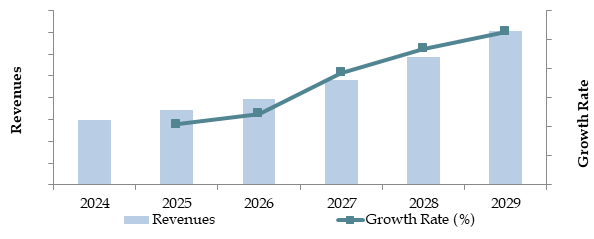

Future Outlook and Projections for Malaysia Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Malaysia Cold Chain Market Segmentation

• By Type of Cold Chain Service:

- Cold Storage

- Cold Transportation

- Cold Packaging

- Temperature Monitoring Systems

• By End-Use Industry:

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Others (e.g., cosmetics, other temperature-sensitive goods)

• By Temperature Range:

- Chilled (2°C to 8°C)

- Frozen (-18°C and below)

- Ambient

• By Technology:

- Refrigerated Containers

- Real-Time Monitoring Systems

- Energy-Efficient Systems

• By Region:

- Northern Region

- Southern Region

- Central Region

- Eastern Region

- Western Region

Players Mentioned in the Report:

- Yusen Logistics

- Kerry Logistics

- Tiong Nam Logistics

- Cool World

- Groupe Charles André

Key Target Audience:

- Cold Chain Service Providers

- Food and Beverage Companies

- Pharmaceutical Companies

- Logistics and Transportation Companies

- Regulatory Bodies (e.g., Ministry of Health, Ministry of Agriculture and Food Industries)

- Technology Providers for Temperature Monitoring

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology Including Market Definitions, Market Size and Modelling (Consolidated Research approach, Variables (Independent), Multi Factor Based Sensitivity Model, Sample Size, Limitations, Conclusion)

3. Operating Model/Value Chain for Malaysia Cold Chain Companies (List of entities, their problems, margins, Industry Level Financial Margins*, solutions tvalue chain will be covered

4. Stakeholders in Malaysia Cold Chain Market (Supply and Demand Side Entities)

5. Existing Technologies in Malaysia Cold Chain Market

6. Malaysia Cold Chain Market Size Basis

Revenues, 2018-2024P

7. Malaysia Cold Chain Market Segmentation Basis

By Cold Storage and Cold Transport, 2023-2024P

By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

8. Market Attractiveness for Malaysia Cold Chain Market

9. Supply-Demand Gap Analysis

10. Malaysia Cold Storage Market

Malaysia Cold Storage Market Size

1. By Revenue, 2018-2024P

2. By Number of Pallets, 2018-2024P

Malaysia Cold Storage Market Segmentation

1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

3. By Major Cities, 2023-2024P

Malaysia Cold Storage Market Future Outlook and Projections, 2025-2029

1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

2. By Major Cities, 2025-2029

11. Malaysia Cold Transport Market

Malaysia Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

Malaysia Cold Transport Market Segmentation

1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

2. By Location (Domestic and International), 2023-2024P

Malaysia Cold Transport Market Future Outlook and Projections, 2025-2029

1. By Mode of Transport (Land, Sea and Air), 2025-2029

2. By Location (Domestic and International), 2025-2029

12. Industry Analysis

Trends and Developments in Malaysia Cold Chain Market

Issues and Challenges in Malaysia Cold Chain Market

Decision Making Parameters for End Users in Malaysia Cold Chain Market

SWOT Analysis of Malaysia Cold Chain Industry

Government Regulations and Associations in Malaysia Cold Chain Market

Macroeconomic Factors Impacting Malaysia Cold Chain Market

13. Detailed End User Analysis tDetermine Cold Storage Potential in Malaysia for Segments including Fruits and Vegetables, QSR, Confectionary, Bakery, Pharmaceuticals, Dairy, Meat and Seafood

Parameters tbe covered for Each End Users tDetermine Business Potential:

1. Production Clusters

2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering tEnd Users

3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

14. Opportunity Matrix for Malaysia Cold Chain Market - Presented with the help of Radar Chart

15. PEAK Matrix Analysis for Malaysia Cold Chain Market

16. Competitive Landscape in Malaysia Cold Chain Market

Competitive Landscape in Malaysia Cold Chain Market

Competition Scenariin Malaysia Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2024) and Employee Base) for Major Players in Malaysia Cold Chain Market

Company Profiles of Major Companies in Malaysia Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

Strength and Weakness

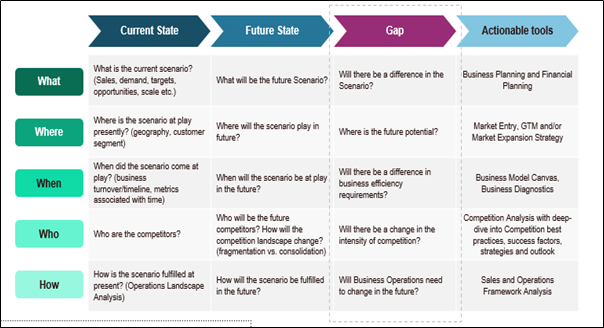

Operating Model Analysis Framework

Gartner Magic Quadrant

Bowman’s Strategic Clock for Competitive Advantage

17. Malaysia Cold Chain Market Size Basis

Revenues, 2025-2029

18. Malaysia Cold Chain Market Segmentation Basis

By Cold Storage and Cold Transport, 2025-2029

By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

Recommendation

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem Identify and map all demand-side and supply-side entities in the Malaysia cold chain market. This includes cold storage facilities, logistics and transportation companies, packaging solutions providers, temperature monitoring technology suppliers, and regulatory agencies.

Shortlist Key Players Based on financial performance, operational capacity, and market impact, shortlist 5-6 leading companies. This is achieved through sourcing information from industry articles, secondary research, and proprietary databases.

Step 2: Desk Research

Comprehensive Analysis Engage in extensive desk research by utilizing a variety of secondary and proprietary databases. This process involves analyzing key market aspects such as sales revenues, market player numbers, pricing levels, and demand patterns.

Company-Level Insights Conduct a detailed review of company-specific data from press releases, annual reports, financial statements, and other relevant documents to gain insights into market dynamics and the competitive landscape.

Step 3: Primary Research

In-Depth Interviews Perform interviews with C-level executives and key stakeholders from major companies in the Malaysia cold chain market. This helps to validate market hypotheses, verify statistical data, and obtain operational and financial insights.

Disguised Interviews Conduct disguised interviews where team members approach companies as potential clients. This method helps in validating the information provided by executives, ensuring accuracy in revenue streams, processes, and pricing. It also aids in understanding the value chain and operational practices.

Step 4: Sanity Check

- Validation Carry out a sanity check using both bottom-up and top-down analyses, including market size modeling exercises. This process ensures the accuracy and consistency of the market findings and projections, confirming the reliability of the data collected.

FAQs

01 What is the potential for the Malaysia Cold Chain Market?

The Malaysia cold chain market is projected to experience significant growth, driven by increasing demand for temperature-sensitive goods in industries such as food and beverages, pharmaceuticals, and chemicals. The market’s expansion is supported by advancements in cold storage technologies and growing consumer expectations for product quality and safety.

02 Who are the Key Players in the Malaysia Cold Chain Market?

Key players in the Malaysia cold chain market include Yusen Logistics, Kerry Logistics, Tiong Nam Logistics, Cool World, and Groupe Charles André. These companies are prominent due to their extensive networks, technological capabilities, and service offerings.

03 What are the Growth Drivers for the Malaysia Cold Chain Market?

Growth drivers include the rising demand for fresh and frozen food products, increasing pharmaceutical and chemical industries' reliance on cold storage, and technological advancements in temperature monitoring and storage solutions. Regulatory requirements for maintaining product quality and safety also contribute to market growth.

04 What are the Challenges in the Malaysia Cold Chain Market?

Challenges include high operational costs associated with maintaining temperature-controlled environments, infrastructure limitations in certain regions, and regulatory compliance issues. Additionally, competition among service providers and the need for continuous technological upgrades pose significant hurdles to market expansion.