Indonesia Palm Oil Market Outlook to 2029

By Market Structure, By Production Trends, By Export Markets, By Domestic Consumption, By End-Use Industries, and By Region

- Product Code: TDR0107

- Region: Asia

- Published on: December 2024

- Total Pages: 110

Report Summary

The report titled “Indonesia Palm Oil Market Outlook to 2029 - By Market Structure, By Production Trends, By Export Markets, By Domestic Consumption, By End-Use Industries, and By Region” provides a comprehensive analysis of the palm oil market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Indonesia Palm Oil Market. The report concludes with future market projections based on production, consumption, export volumes, regions, cause-and-effect relationships, and success case studies highlighting major opportunities and cautions.

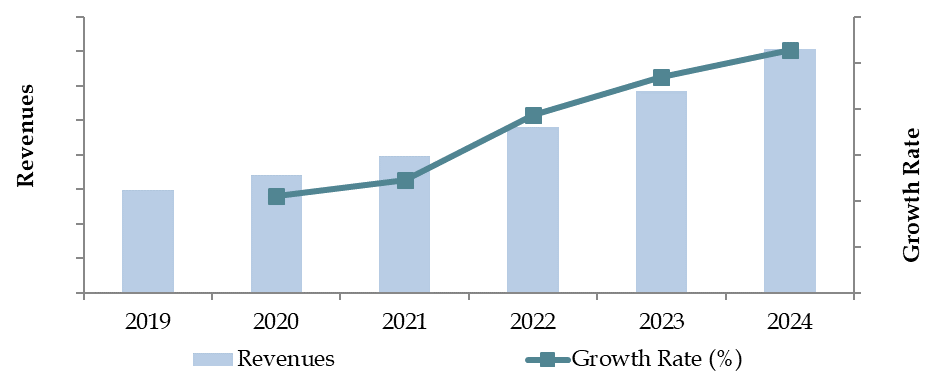

Indonesia Palm Oil Market Overview and Size

The Indonesia palm oil market reached a valuation of USD 30 billion in 2023, driven by increasing global demand for vegetable oils, growing consumption of biodiesel, and rising awareness of sustainable palm oil production practices. Indonesia is the world's largest producer and exporter of palm oil, accounting for approximately 60% of global output. Key players in the market include Wilmar International, Golden Agri-Resources, Musim Mas, and Indofood Agri Resources, all recognized for their extensive plantation assets, strong export networks, and innovation in downstream processing.

In 2023, Wilmar International announced an initiative to strengthen sustainable palm oil sourcing through digital traceability tools and collaborations with smallholder farmers. Key production regions, including Sumatra and Kalimantan, continue to dominate the market due to their favorable climatic conditions and extensive plantation infrastructure.

Market Size for Indonesia Palm Oil Industry on the Basis of Revenues in USD Billion, 2018-2024

What Factors are Leading to the Growth of the Indonesia Palm Oil Market

Economic Factors: The increasing global demand for vegetable oils, coupled with Indonesia's cost-effective production methods, has positioned the country as the largest palm oil producer globally. In 2023, palm oil exports contributed approximately 12% of Indonesia’s total export revenue. The affordability and versatility of palm oil have made it a preferred choice for both domestic consumption and international markets, driving consistent growth in production and trade.

Rising Global Food and Biofuel Demand: The growing need for edible oils and renewable energy sources has significantly boosted the palm oil industry in Indonesia. Palm oil, being a key raw material in food manufacturing and biofuel production, has seen increased demand from both developed and developing countries. In 2023, approximately 70% of Indonesia's palm oil output was exported, with China, India, and the EU being major importers.

Government Support and Policies: The Indonesian government has implemented policies and incentives to support the palm oil industry, including the B30 biodiesel mandate, which requires a 30% blend of palm oil in diesel fuel. This initiative has stimulated domestic consumption and reduced dependency on fossil fuels. In 2023, the mandate led to a 15% increase in domestic palm oil usage compared to the previous year.

Which Industry Challenges Have Impacted the Growth of the Indonesia Palm Oil Market

Environmental Concerns and Sustainability Issues: The palm oil industry in Indonesia has faced criticism due to deforestation, biodiversity loss, and greenhouse gas emissions associated with plantation development. According to recent data, approximately 18% of Indonesia's palm oil plantations are located in areas classified as forest reserves, creating tension between environmental groups and industry stakeholders. These concerns have led to stricter regulations and decreased market appeal in environmentally conscious export markets.

Supply Chain Transparency: The lack of transparency and traceability in the supply chain remains a significant challenge for the Indonesian palm oil industry. A 2023 industry survey revealed that 40% of palm oil buyers faced difficulties verifying whether their products adhered to sustainability standards, such as the Roundtable on Sustainable Palm Oil (RSPO) certification. This issue has resulted in reduced trust among international buyers and limited access to premium markets.

Labor Issues: Reports of poor working conditions, low wages, and child labor in some plantations have tarnished the industry’s reputation. In 2023, around 25% of surveyed plantation workers reported inadequate access to basic facilities and fair compensation. These issues not only harm Indonesia’s global standing but also lead to increased scrutiny from international watchdogs and trade partners.

What Are the Regulations and Initiatives Which Have Governed the Market

Moratorium on New Plantations: The Indonesian government has extended a moratorium on the issuance of new licenses for palm oil plantations on primary forests and peatlands. This policy, introduced in 2018 and extended through 2023, aims to reduce deforestation and promote sustainable land use practices.

Mandatory Sustainability Certification: To enhance sustainability, the government has made the Indonesian Sustainable Palm Oil (ISPO) certification mandatory for all producers. In 2023, 85% of large-scale plantations were ISPO-certified, reflecting a significant compliance rate among major producers. However, smallholder farmers face challenges in meeting certification requirements due to limited resources.

Export Levy on Palm Oil: Indonesia has imposed a progressive export levy on palm oil products to fund replanting programs and biodiesel subsidies. In 2023, approximately $1.2 billion was collected through export levies, which was reinvested in industry improvements, including smallholder support and infrastructure development.

Indonesia Palm Oil Market Segmentation

By Market Structure: The palm oil market in Indonesia is dominated by large-scale plantation companies, which account for the majority of production due to their advanced infrastructure, high productivity levels, and ability to meet export demands. Smallholder farmers also play a crucial role, contributing approximately 40% of total production. Despite challenges in accessing technology and funding, smallholders are increasingly integrating sustainable practices to maintain market relevance.

By Export Markets: Indonesia’s primary export markets include India, China, and the European Union. India leads as the largest importer, accounting for approximately 30% of Indonesia’s palm oil exports in 2023, driven by high demand for edible oils. China follows closely, with palm oil being a key ingredient in food processing and cooking. The EU remains a significant market despite ongoing scrutiny over sustainability issues, reflecting demand for certified sustainable palm oil (CSPO).

By End-Use Industries: The food and beverage industry dominates palm oil consumption, utilizing approximately 60% of total production for cooking oil, margarine, and processed foods. The biodiesel industry accounts for 20% of domestic consumption, supported by the government’s B30 biodiesel mandate. Other industries, such as cosmetics and pharmaceuticals, contribute the remaining share, leveraging palm oil derivatives for their diverse applications.

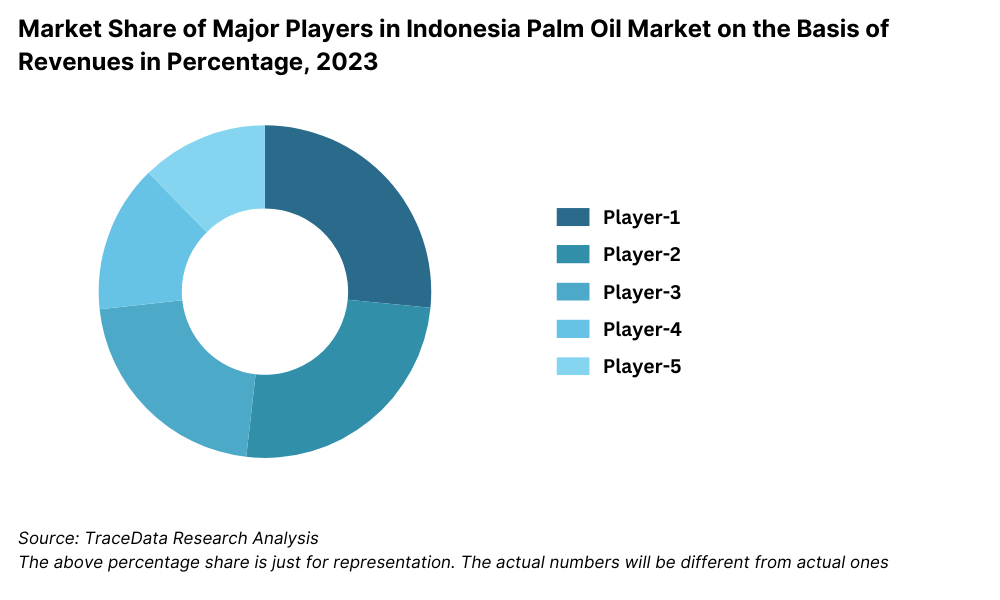

Competitive Landscape in Indonesia Palm Oil Market

The Indonesia palm oil market is highly competitive, with a mix of large-scale plantation companies, cooperatives, and smallholder farmers dominating the landscape. Major players such as Wilmar International, Golden Agri-Resources, Musim Mas, Asian Agri, and Astra Agro Lestari are leading the market, supported by advanced infrastructure, robust export networks, and strong government backing.

| Company Name | Establishment Year | Headquarters |

|---|---|---|

| PT Sinar Mas Agro Resources and Technology (SMART) | 1962 | Jakarta, Indonesia |

| PT Astra Agro Lestari Tbk | 1988 | Jakarta, Indonesia |

| PT Salim Ivomas Pratama Tbk | 1992 | Jakarta, Indonesia |

| PT Triputra Agro Persada | 2005 | Jakarta, Indonesia |

| PT Eagle High Plantations Tbk | 2000 | Jakarta, Indonesia |

| Asian Agri | 1979 | Jakarta, Indonesia |

| Wilmar International | 1991 | Singapore |

| Golden Agri-Resources | 1996 | Singapore |

| PT PP London Sumatra Indonesia Tbk | 1906 | Jakarta, Indonesia |

| PT Sampoerna Agro Tbk | 1993 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

Wilmar International: In 2023, Wilmar International reported a 10% increase in revenue, driven by strong export demand and investments in sustainability initiatives. The company expanded its refining capacity and strengthened its RSPO certification coverage, making it a preferred supplier in premium markets like the EU.

Golden Agri-Resources: Golden Agri-Resources saw a 15% growth in biodiesel sales in 2023, driven by the Indonesian government's B30 biodiesel mandate. The company also invested in digital tools to improve plantation productivity and traceability, helping to meet global sustainability demands.

Musim Mas: As a vertically integrated player, Musim Mas has focused on building downstream capabilities, such as oleochemical production. In 2023, the company recorded a 12% increase in exports to China and India, supported by its extensive distribution network and competitive pricing.

Asian Agri: Asian Agri is a leader in smallholder partnerships, collaborating with over 30,000 farmers to improve yields and sustainability. In 2023, the company reported a 20% increase in smallholder production volumes, attributed to training programs and financial support initiatives.

Astra Agro Lestari: Known for its innovation in plantation management, Astra Agro Lestari introduced AI-powered monitoring tools in 2023, resulting in a 5% improvement in yields. The company also achieved 90% ISPO certification across its plantations, enhancing its reputation in sustainable production.

What Lies Ahead for Indonesia Palm Oil Market?

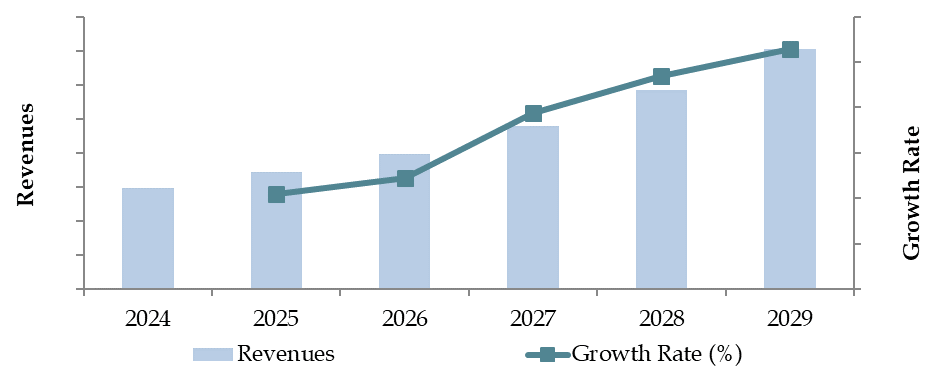

The Indonesia palm oil market is projected to grow steadily by 2029, driven by increasing global demand for vegetable oils, government mandates for biodiesel, and advancements in sustainable production practices. This growth is expected to be supported by innovations in technology, export expansion, and regulatory measures promoting sustainability.

Expansion of Biodiesel Programs: Indonesia’s commitment to renewable energy through programs like the B35 biodiesel mandate, set to roll out by 2024, is expected to drive significant domestic demand for palm oil. This initiative not only reduces reliance on fossil fuels but also stabilizes the local palm oil market against global price volatility.

Focus on Sustainable Certification: Global demand for sustainably produced palm oil is anticipated to rise, particularly from markets in the EU and North America. Indonesia’s push for widespread adoption of ISPO and RSPO certifications will likely enhance its market share in premium export markets. By 2029, it is projected that over 90% of large-scale plantations will be sustainably certified.

Diversification into Downstream Industries: The palm oil industry is expected to see significant growth in downstream segments such as oleochemicals, food processing, and personal care products. These value-added applications will help Indonesia capture higher margins and reduce dependency on raw palm oil exports.

Advancements in Technology: The integration of AI, drones, and satellite imagery for plantation monitoring and yield optimization is expected to enhance productivity and cost-efficiency. These technological innovations will help Indonesia maintain its leadership position in global palm oil production while addressing concerns over deforestation and inefficient land use.

Future Outlook and Projections for Indonesia Palm Oil Market on the Basis of Revenues in USD Billion, 2024-2029

Indonesia Palm Oil Market Segmentation

• By Market Structure:

Branded

Local Players

• By Export Markets:

India

China

European Union

Middle East

Africa

Southeast Asia

• By End-Use Industries:

Food and Beverage Industry

Biodiesel Production

Cosmetics and Personal Care Products

Pharmaceuticals

Industrial Applications

• By Production Region:

Sumatra

Kalimantan

Sulawesi

Papua

Java

• By Certification:

ISPO Certified Producers

RSPO Certified Producers

Non-Certified Producers

• By Plantation Size:

Large-Scale Plantations (>1,000 hectares)

Medium-Scale Plantations (500-1,000 hectares)

Smallholder Plantations (<500 hectares)

Players Mentioned in the Report:

PT Sinar Mas Agro Resources and Technology (SMART)

PT Astra Agro Lestari Tbk

PT Salim Ivomas Pratama Tbk

PT Triputra Agro Persada

PT Eagle High Plantations Tbk

Asian Agri

Wilmar International

Golden Agri-Resources

PT PP London Sumatra Indonesia Tbk

PT Sampoerna Agro Tbk

Key Target Audience:

Plantation Owners and Managers

Exporters and Trade Organizations

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Ministry of Trade)

Sustainability Certification Bodies (e.g., RSPO, ISPO)

Research and Development Institutions

Investors and Financial Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Indonesia Palm Oil Market

4. Value Chain Analysis

4.1. Value Chain Process - Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Indonesia Palm Oil Market

4.3. Business Model Canvas for Indonesia Palm Oil Market

4.4. Supply Chain Analysis for Indonesia Palm Oil Market- Discuss about Production and Refining Process

5. Market Structure

5.1. Domestic Consumption vs. Export Share, 2018-2024

5.2. Crude vs. Refined Palm Oil Production in Indonesia, 2018-2024

5.3. Smallholder vs. Large Plantation Contribution, 2024

5.4. Palm Oil Production Plants in Indonesia Basis Location

6. Market Attractiveness for Indonesia Palm Oil Market

7. Supply-Demand Gap Analysis

8. Market Size for Indonesia Palm Oil Market Basis

8.1. Revenues, 2018-2024

8.2. Production Volume, 2018-2024

8.3. Production Capacity, 2018-2024

9. Market Breakdown for Indonesia Palm Oil Market Basis

9.1. By Market Structure (Branded and Local Players), 2023-2024P

9.2. By End-Use Industries (Food and Beverage, Biodiesel, Cosmetics, and Others), 2023-2024P

9.3. By Certification (ISPO, RSPO, and Non-Certified), 2023-2024P

9.4. By Plantation Size (Smallholders, Medium, and Large Plantations), 2023-2024P

10. Demand Side Analysis for Indonesia Palm Oil Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Trade Scenario for Indonesia Palm Oil Market

11.1. Export Scenario for Indonesia Palm Oil Market Basis Value, Volume and Major Export Destinations, 2018-2024

11.2. Import Scenario for Indonesia Palm Oil Market Basis Value, Volume and Major Import Destinations, 2018-2024

12. Industry Analysis

12.1. Trends and Developments for Indonesia Palm Oil Market

12.2. Growth Drivers for Indonesia Palm Oil Market

12.3. SWOT Analysis for Indonesia Palm Oil Market

12.4. Issues and Challenges for Indonesia Palm Oil Market

12.5. Government Regulations for Indonesia Palm Oil Market

13. Snapshot on Sustainable Palm Oil Market

13.1. Market Size and Future Potential for Sustainable Palm Oil (ISPO and RSPO) Based on Production Volume, 2018-2029

13.2. Business Model and Revenue Streams

13.3. Cross-Comparison of Leading Certified Producers Based on Key Variables

14. Opportunity Matrix for Indonesia Palm Oil Market - Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Indonesia Palm Oil Market

16. Competitor Analysis for Indonesia Palm Oil Market

16.1. Market Share of Major Players in Indonesia Palm Oil Market Basis Revenues/Sales Volume, 2023

16.2. Benchmark of Key Competitors in Indonesia Palm Oil Market Basis Operational and Financial Variables

16.3. Strengths and Weaknesses

16.4. Operating Model Analysis Framework

16.5. Gartner Magic Quadrant

16.6. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Indonesia Palm Oil Market Basis

17.1. Revenues, 2025-2029

17.2. Production Volume, 2025-2029

18. Market Breakdown for Indonesia Palm Oil Market Basis

18.1. By Market Structure (Branded and Local Players), 2025-2029

18.2. By End-Use Industries (Food and Beverage, Biodiesel, Cosmetics, and Others), 2025-2029

18.3. By Certification (ISPO, RSPO, and Non-Certified), 2025-2029

18.4. By Plantation Size (Smallholders, Medium, and Large Plantations) 2025-2029

19. Recommendation

20. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Indonesia Palm Oil Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based on their financial information, production capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the sales revenues, number of market players, price levels, demand, and other variables.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Indonesia Palm Oil Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives.

A bottom-to-top approach is undertaken to evaluate production volumes for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analyses, along with market size modeling exercises, are undertaken to assess sanity check processes.

FAQs

1. What is the potential for the Indonesia Palm Oil Market?

The Indonesia Palm Oil Market is poised for substantial growth, supported by increasing global demand for vegetable oils, expanding biodiesel programs, and advancements in sustainable practices. By 2029, the market is expected to witness consistent growth in production, exports, and value-added downstream applications.

2. Who are the Key Players in the Indonesia Palm Oil Market?

The Indonesia Palm Oil Market features several key players, including Wilmar International, Golden Agri-Resources, Musim Mas, Asian Agri, and Astra Agro Lestari. These companies dominate the market due to their extensive plantations, robust export capabilities, and commitment to sustainability initiatives.

3. What are the Growth Drivers for the Indonesia Palm Oil Market?

The primary growth drivers include the government's biodiesel mandate (e.g., B35 program), increasing demand for sustainable palm oil in international markets, and the diversification into downstream industries such as food processing, cosmetics, and oleochemicals.

4. What are the Challenges in the Indonesia Palm Oil Market?

The Indonesia Palm Oil Market faces several challenges, including environmental concerns, regulatory scrutiny, price volatility, and supply chain transparency issues. These factors pose significant barriers that the industry must address to sustain growth and enhance its global competitiveness.