Indonesia Geothermal Energy Market Outlook to 2029

By Market Structure, By Installed Capacity, By Energy Output, By Key Regions, By End-User Segments, and By Key Players

- Product Code: TDR0090

- Region: Asia

- Published on: December 2024

- Total Pages: 110

Report Summary

The report titled “Indonesia Geothermal Energy Market Outlook to 2029 - By Market Structure, By Installed Capacity, By Energy Output, By Key Regions, By End-User Segments, and By Key Players” provides a comprehensive analysis of the geothermal energy market in Indonesia. The report covers an overview and genesis of the industry, the overall market size in terms of installed capacity and revenue, market segmentation; trends and developments, regulatory landscape, project-level profiling, issues and challenges, and competitive landscape including major players, opportunities, and barriers. The report concludes with future market projections based on installed capacity, energy output, end-user segments, and success case studies highlighting major opportunities and cautions in the market.

Indonesia Geothermal Energy Market Overview and Size

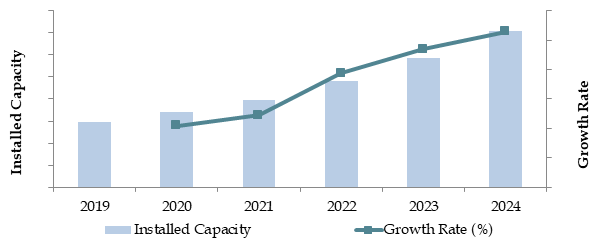

The Indonesia geothermal energy market reached an installed capacity of 2,500 MW in 2023, driven by the abundant availability of geothermal resources, growing demand for renewable energy, and supportive government policies promoting clean energy solutions. The market is characterized by major players such as Pertamina Geothermal Energy, Star Energy, Medco Energi, and Ormat Technologies. These companies are recognized for their robust project portfolios, advanced technology implementation, and significant contributions to Indonesia's renewable energy transition.

In 2023, Pertamina Geothermal Energy commissioned new capacity in the Lahendong and Ulubelu geothermal fields to enhance energy output and address the increasing demand for sustainable energy. This expansion supports Indonesia's target of achieving 23% renewable energy in the national energy mix by 2025. Key regions such as Java and Sumatra dominate the geothermal market due to their high-quality geothermal reserves and developed infrastructure, while areas like Sulawesi and Flores are emerging as potential growth zones.

Market Size for Indonesia Geothermal Energy Market on the Basis of Installed Capacity in MW, 2018–2024

What Factors are Leading to the Growth of Indonesia Geothermal Energy Market:

Resource Availability: Indonesia possesses an estimated geothermal potential of 24 GW, with only 10% of this potential being utilized as of 2023. The vast availability of untapped resources positions the country as a global leader in geothermal energy development. High-temperature geothermal fields, located across Java, Sumatra, and Sulawesi, present significant opportunities for new project development.

Government Initiatives: Supportive government policies and incentives, such as the feed-in tariff and renewable energy roadmap, have played a crucial role in market expansion. The Indonesian government targets 23% renewable energy in the energy mix by 2025, with geothermal energy contributing a significant share. The establishment of public-private partnerships (PPPs) has also facilitated funding for large-scale geothermal projects.

Rising Energy Demand: With an annual energy demand growth rate of 6%, Indonesia faces increasing pressure to diversify its energy portfolio. Geothermal energy offers a reliable and sustainable solution, particularly in remote and off-grid areas where traditional energy sources are less viable.

Which Industry Challenges Have Impacted the Growth of Indonesia Geothermal Energy Market

High Initial Investment Costs: The development of geothermal energy projects requires significant upfront capital investment for exploration, drilling, and infrastructure. On average, exploration and drilling account for approximately 40% of total project costs. This financial burden has deterred private sector participation, limiting the pace of market expansion.

Regulatory and Permitting Delays: Complex regulatory frameworks and lengthy permitting processes remain a major challenge for project developers. In 2023, it was reported that the average time to secure permits for geothermal projects in Indonesia was over three years, causing delays and increasing project costs. Streamlining these processes is critical to attracting more investment into the sector.

Technical and Resource Risks: Uncertainties related to geothermal resource availability and potential drilling failures pose significant risks. Industry reports indicate that up to 20% of exploration wells drilled in Indonesia yield suboptimal results, leading to increased costs and delays. This risk factor discourages investors, particularly in high-potential but underdeveloped regions.

What are the Regulations and Initiatives that Have Governed the Market

Feed-in Tariff Mechanism: The Indonesian government introduced a feed-in tariff scheme in 2023 to incentivize geothermal energy development. This mechanism ensures competitive pricing for geothermal electricity, encouraging private sector investment. The tariff rates are adjusted based on project location and resource capacity, providing tailored support for different regions.

Renewable Energy Targets: Indonesia’s renewable energy roadmap mandates a 23% share of renewables in the national energy mix by 2025, with geothermal energy expected to contribute a significant portion. This target has driven government efforts to facilitate project development and streamline regulations.

Geothermal Fund Facility: To address the high upfront costs of geothermal projects, the government established the Geothermal Fund Facility (GFF), which provides risk mitigation support and financing for exploration activities. As of 2023, the GFF has supported over 15 projects, reducing exploration risks and attracting private investors.

Indonesia Geothermal Energy Market Segmentation

By Market Structure: The geothermal energy market in Indonesia is dominated by private developers, who have been pivotal in advancing new projects and introducing innovative technologies. These developers often partner with government entities to secure funding and permits. State-owned enterprises, such as Pertamina Geothermal Energy, also hold a significant share due to their access to government resources, established expertise in energy development, and focus on large-scale projects. Their ability to develop extensive geothermal fields, such as Wayang Windu and Sarulla, underscores their importance in the market.

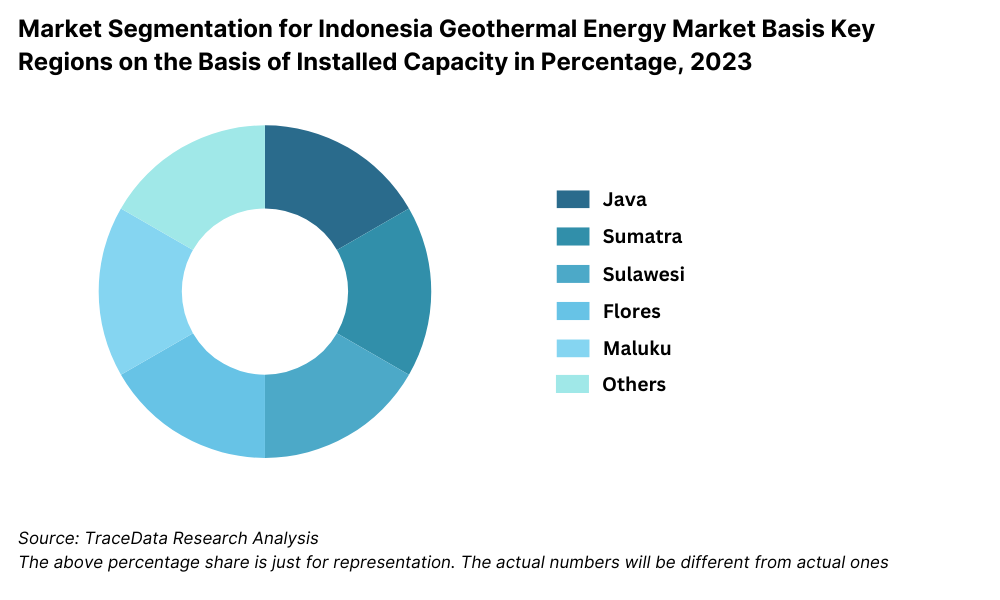

By Key Regions: Java leads the geothermal market due to its high population density, energy demand, and well-established infrastructure. The island accounts for over 60% of Indonesia's total geothermal capacity. Sumatra follows as a key region due to its significant geothermal reserves and increasing industrial activity. Emerging regions such as Sulawesi and Flores are gaining traction with ongoing exploratory projects and government initiatives targeting untapped geothermal potential.

By End-User Segments: Industrial users constitute the largest segment due to their high energy requirements and preference for cost-effective, sustainable energy sources. Geothermal energy is increasingly adopted by industries such as manufacturing, mining, and processing due to its reliability and low carbon emissions. Residential and commercial sectors also contribute significantly, driven by urbanization and a growing focus on clean energy solutions.

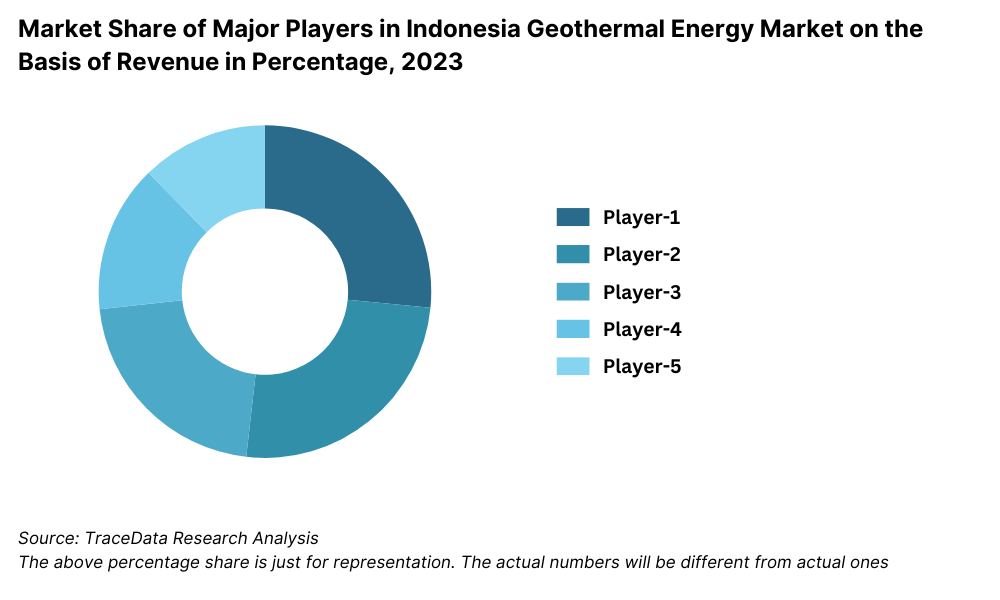

Competitive Landscape in Indonesia Geothermal Energy Market

The Indonesia geothermal energy market is relatively concentrated, with a few major players driving development across the country. These companies, including Pertamina Geothermal Energy, Star Energy, Medco Energi, and Ormat Technologies, dominate the sector due to their expertise, resources, and ability to manage large-scale projects. Emerging players and partnerships are adding diversity, bringing innovation and competition to the market.

Company Name | Establishment Year | Headquarters |

|---|---|---|

PT Pertamina Geothermal Energy | 2006 | Jakarta, Indonesia |

Star Energy Geothermal | 2003 | Jakarta, Indonesia |

PT Geo Dipa Energi | 2002 | Jakarta, Indonesia |

Sarulla Operations Ltd. | 2006 | Jakarta, Indonesia |

Supreme Energy | 2007 | Jakarta, Indonesia |

PT PLN (Persero) | 1945 | Jakarta, Indonesia |

Medco Power Indonesia | 2004 | Jakarta, Indonesia |

Ormat Technologies Inc. | 1965 | Reno, Nevada, USA |

KS Orka Renewables Pte Ltd | 2016 | Singapore |

PT Sokoria Geothermal Indonesia | 2013 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

Pertamina Geothermal Energy (PGE): PGE remains a dominant player, operating 14 geothermal working areas across Indonesia. In 2023, the company added 120 MW of capacity in the Ulubelu and Lahendong fields, contributing to its total installed capacity of over 1,877 MW. PGE’s focus on sustainability and community engagement has reinforced its market leadership.

Star Energy: As the largest private geothermal operator in Indonesia, Star Energy manages significant projects such as Wayang Windu and Darajat. In 2023, the company reported a 10% increase in power generation efficiency through the adoption of enhanced geothermal system (EGS) technologies.

Medco Energi: Medco Energi is expanding its geothermal portfolio with the recent commissioning of the Sarulla Geothermal Power Plant Phase III, bringing its total capacity to 330 MW. The company focuses on leveraging local expertise and building long-term partnerships with global technology providers.

Ormat Technologies: Ormat is a global leader in geothermal technology and has partnered with local developers to provide modular power plants and advanced drilling technologies. In 2023, Ormat announced a joint venture with Supreme Energy to explore untapped geothermal fields in Sulawesi, aiming to add 200 MW by 2027.

Supreme Energy: A relatively new entrant, Supreme Energy specializes in developing projects in high-potential but underdeveloped regions like Sumatra and Flores. The company commissioned its first 80 MW project in Muara Laboh in 2023, emphasizing sustainable development and environmental protection.

What Lies Ahead for Indonesia Geothermal Energy Market?

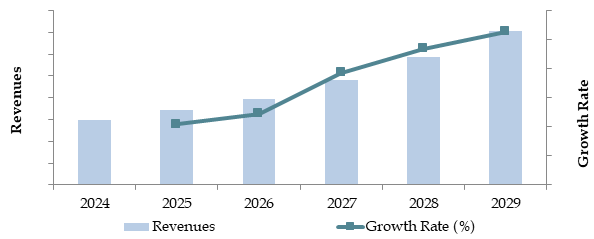

The Indonesia geothermal energy market is projected to grow significantly by 2029, with a robust CAGR during the forecast period. This growth will be driven by increasing energy demand, government incentives, and the global shift towards renewable energy sources.

Expansion of Installed Capacity: Indonesia aims to increase its geothermal installed capacity from 2,500 MW in 2023 to 4,500 MW by 2029, supported by large-scale projects in Java, Sumatra, and Sulawesi. The government’s renewable energy targets and international partnerships will play a key role in achieving this expansion.

Adoption of Advanced Technologies: The deployment of Enhanced Geothermal Systems (EGS), modular power plants, and advanced drilling techniques is expected to reduce project risks and costs. These technologies will enable efficient utilization of geothermal resources in untapped areas, particularly in remote regions like Flores and Sulawesi.

Public-Private Partnerships (PPPs): The government’s focus on fostering PPPs will attract both domestic and foreign investments, accelerating project development timelines. These partnerships are anticipated to bring in technological expertise and funding, addressing critical challenges such as high upfront costs and resource risks.

Regional Development Focus: Regions like Flores, Sulawesi, and Maluku, currently underdeveloped in terms of geothermal capacity, are expected to emerge as new growth hubs. Strategic investments in transmission infrastructure and localized energy solutions will unlock the geothermal potential in these regions.

Future Outlook and Projections for Indonesia Geothermal Energy Market on the Basis of Revenues in USD Billion, 2024-2029

Indonesia Geothermal Energy Market Segmentation

• By Market Structure:

State-Owned Enterprises

Private Developers

Public-Private Partnerships

Independent Power Producers (IPPs)

• By Installed Capacity Range:

<50 MW

50–100 MW

100–300 MW

300 MW

• By Energy Output:

Industrial Sector

Residential Sector

Commercial Sector

Off-Grid Solutions

• By Regions:

Java

Sumatra

Sulawesi

Flores

Maluku

• By Technology Type:

Flash Steam Power Plants

Dry Steam Power Plants

Binary Cycle Power Plants

Enhanced Geothermal Systems (EGS)

• By End-User Segments:

Industrial Users

Commercial Establishments

Rural and Off-Grid Consumers

Government and Utilities

Players Mentioned in the Report:

PT Pertamina Geothermal Energy

Star Energy Geothermal

PT Geo Dipa Energi

Sarulla Operations Ltd.

Supreme Energy

PT PLN (Persero)

Medco Power Indonesia

Ormat Technologies Inc.

KS Orka Renewables Pte Ltd

PT Sokoria Geothermal Indonesia

Key Target Audience:

Geothermal Energy Developers

Renewable Energy Investors

Equipment Manufacturers and Suppliers

Regulatory Bodies (e.g., Ministry of Energy and Mineral Resources)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Indonesia Geothermal Energy Market

4. Value Chain Analysis

4.1. Value Chain Process - Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Indonesia Geothermal Energy Market

4.3. Business Model Canvas for Indonesia Geothermal Energy Market

4.4. Project Development and Financing Decision-Making Process

5. Market Structure

5.1. Geothermal Energy Installed Capacity in Indonesia, 2018-2024

5.2. Role of State-Owned Enterprises and Private Developers in the Market

5.3. Investment Trends in Geothermal Projects, 2023-2024

5.4. Distribution of Geothermal Fields by Region in Indonesia

6. Market Attractiveness for Indonesia Geothermal Energy Market

7. Supply-Demand Gap Analysis

8. Market Size for Indonesia Geothermal Energy Market Basis

8.1. Installed Capacity, 2018-2024

8.2. Energy Output, 2018-2024

8.3. Revenue, 2018-2024

9. Market Breakdown for Indonesia Geothermal Energy Market Basis

9.1. By Market Structure (Public and Private Developers), 2023-2024P

9.2. By Regions (Java, Sumatra, Sulawesi, Flores, and Maluku), 2023-2024P

9.3. By Installed Capacity Range (<50 MW, 50–100 MW, 100–300 MW, >300 MW), 2023-2024P

9.4. By Technology Type (Flash Steam, Binary Cycle, Dry Steam, and Enhanced Geothermal Systems), 2023-2024P

9.5. By End-User Segments (Industrial, Residential, Commercial, and Rural Consumers), 2023-2024P

10. Demand Side Analysis for Indonesia Geothermal Energy Market

10.1. Consumer and Industrial Landscape Analysis

10.2. Decision-Making Process for Energy Procurement

10.3. Needs, Desires, and Barriers to Adoption

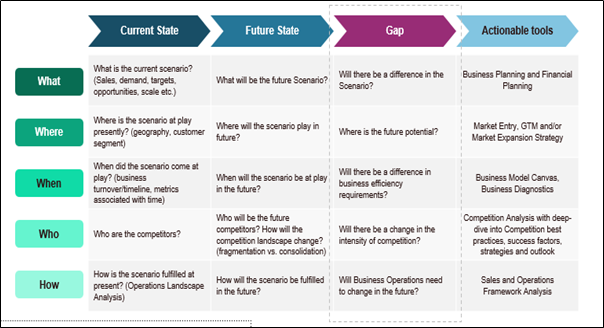

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Indonesia Geothermal Energy Market

11.2. Growth Drivers for Indonesia Geothermal Energy Market

11.3. SWOT Analysis for Indonesia Geothermal Energy Market

11.4. Issues and Challenges for Indonesia Geothermal Energy Market

11.5. Government Regulations for Indonesia Geothermal Energy Market

12. Snapshot on Emerging Geothermal Projects in Indonesia

12.1. Current Status of Exploratory and Operational Projects, 2018-2029

12.2. Business Model and Revenue Streams for New Projects

12.3. Cross Comparison of Key Geothermal Fields in Indonesia (Sarulla, Wayang Windu, Darajat and others) across Operational and Financial Variables

13. Indonesia Geothermal Financing Market

13.1. Financing Trends and Models for Geothermal Projects, 2018-2029

13.2. Government Incentives and Private Sector Participation

13.3. Financing Splits by Domestic and International Sources, 2023-2024P

13.4. Tenure and Risk Mitigation for Geothermal Financing

13.5. Capital Flow into Geothermal Energy in Indonesia, 2018-2024P

14. Opportunity Matrix for Indonesia Geothermal Energy Market - Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Indonesia Geothermal Energy Market

16. Competitor Analysis for Indonesia Geothermal Energy Market

16.1. Market Share of Key EPC Companies in Indonesia Geothermal Energy Market, 2023-2024P

16.2. Benchmark of Key Competitors in Indonesia Geothermal Energy Market including across Operational and Financial Variables

16.3. Strength and Weakness Analysis

16.4. Operating Model Analysis Framework

16.5. Gartner Magic Quadrant for Market Positioning

16.6. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Indonesia Geothermal Energy Market Basis

17.1. Installed Capacity, 2025-2029

17.2. Energy Output, 2025-2029

17.3. Revenue Projections, 2025-2029

18. Market Breakdown for Indonesia Geothermal Energy Market Basis

18.1. By Market Structure (Public and Private Developers), 2025-2029

18.2. By Regions (Java, Sumatra, Sulawesi, Flores, and Maluku), 2025-2029

18.3. By Installed Capacity Range (<50 MW, 50–100 MW, 100–300 MW, >300 MW), 2025-2029

18.4. By Technology Type (Flash Steam, Binary Cycle, Dry Steam, and Enhanced Geothermal Systems), 2025-2029

18.5. By End-User Segments (Industrial, Residential, Commercial, and Rural Consumers), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: Identify all demand-side and supply-side entities within the Indonesia Geothermal Energy Market. This includes developers, technology providers, government agencies, and end-users. Based on this ecosystem, we shortlist 5–6 key players in the market, focusing on factors such as installed capacity, project portfolio, and financial performance.

Source Data: Use industry reports, government publications, and proprietary databases to perform desk research. This helps in collecting foundational market information, including resource availability, project status, and market dynamics.

Step 2: Desk Research

Comprehensive Analysis: Conduct an exhaustive desk research process by leveraging secondary and proprietary databases. Explore aspects such as installed capacity, market segmentation, key players, pricing trends, and regulatory frameworks.

Company-Level Data: Gather insights from press releases, annual reports, project announcements, and financial statements of market players. This helps build a detailed understanding of both market and company-level dynamics.

Step 3: Primary Research

In-Depth Interviews: Engage in interviews with key stakeholders, including developers, regulators, and industry experts. These interactions are critical for validating hypotheses, ensuring statistical accuracy, and extracting operational insights.

Validation Strategy: Perform disguised interviews with market participants under the guise of potential partners or stakeholders to cross-verify shared data with secondary sources. This ensures accuracy in operational details, revenue streams, and market structure.

Step 4: Sanity Check

- Market Modeling: Conduct top-to-bottom and bottom-to-top market modeling exercises. Cross-validate findings from desk and primary research to ensure coherence in data and projections.

FAQs

1. What is the potential for the Indonesia Geothermal Energy Market?

The Indonesia geothermal energy market is poised for significant growth, with installed capacity projected to increase from 2,500 MW in 2023 to 4,500 MW by 2029. This growth is driven by abundant geothermal resources, supportive government policies, and increasing demand for renewable energy.

2. Who are the Key Players in the Indonesia Geothermal Energy Market?

Key players include Pertamina Geothermal Energy, Star Energy, Medco Energi, and Ormat Technologies. These companies dominate the market through their expertise, large-scale projects, and innovative technologies. Emerging players like Supreme Energy also contribute to the market's growth.

3. What are the Growth Drivers for the Indonesia Geothermal Energy Market?

The market's growth is fueled by Indonesia's commitment to renewable energy targets, abundant geothermal resources, and technological advancements in geothermal power generation. Government incentives, such as feed-in tariffs and risk mitigation funds, further encourage investment in this sector.

4. What are the Challenges in the Indonesia Geothermal Energy Market?

The market faces challenges such as high upfront capital costs, regulatory complexities, and infrastructure limitations in remote areas. Additionally, technical risks during exploration and drilling can lead to delays and cost overruns, posing significant hurdles for developers.