Indonesia Corporate Training Market Outlook to 2029

By Market Structure (In-House and Outsourced Training), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Vertical (Finance, IT, Manufacturing, Healthcare, and Retail) and By Region

- Product Code: TDR0015

- Region: Asia

- Published on: September 2024

- Total Pages: 110

Report Summary

The report titled "Indonesia Corporate Training Market Outlook to 2029 - By Market Structure (In-House and Outsourced Training), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Vertical (Finance, IT, Manufacturing, Healthcare, and Retail) and By Region" provides a comprehensive analysis of the corporate training market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Corporate Training Market. The report concludes with future market projections based on sales revenue, market structure, product types, region, cause-and-effect relationships, and success case studies highlighting major opportunities and cautions.

Indonesia Corporate Training Market Overview and Size

The Indonesia corporate training market reached a valuation of IDR 18 Trillion in 2023, driven by the growing demand for upskilling, a rapidly evolving digital economy, and the increased focus on enhancing workforce productivity across various industries. The market is characterized by key players such as PT Binus Center, Quadrant Utama, and PT Intermedia Persada, recognized for their broad training programs, strong regional presence, and innovative digital platforms.

In 2023, Quadrant Utama launched a new e-learning platform designed to elevate the employee training experience and streamline the delivery of digital skills courses. This initiative aims to capture the growing demand for digital learning solutions in Indonesia, providing a more flexible and scalable training model. Jakarta, Surabaya, and Bandung are key markets due to their high business concentration and strong demand for corporate training services.

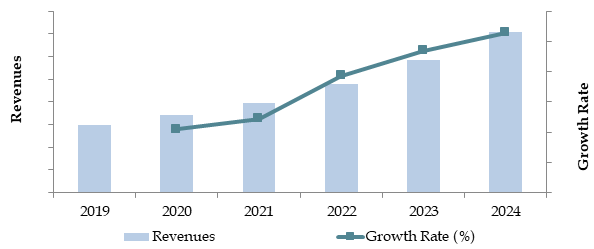

Market Size for Indonesia Corporate Training Industry on the Basis of Volume Sales in Units, 2018-2024

(Source: TraceData Research Analysis)

What Factors are Leading to the Growth of Indonesia Corporate Training Market:

Economic Factors: The rapid economic growth and the increasing competition within industries have heightened the demand for corporate training programs. In 2023, corporate training accounted for approximately 70% of employee development budgets across Indonesia’s leading companies. Organizations are investing heavily in employee skill development to stay competitive in both the local and global markets.

Growing SME Sector: The expansion of small and medium-sized enterprises (SMEs) has significantly driven demand for cost-effective corporate training solutions. SMEs now make up a large portion of Indonesia's corporate landscape, and many are turning to corporate training as a means to improve employee productivity and build competitive advantages.

Digital Transformation: The rise of digital tools and platforms has transformed corporate training into a more accessible and scalable offering. In 2023, around 55% of corporate training programs were conducted online in Indonesia, allowing organizations to train employees regardless of geographic location. This trend towards digital learning has made training more flexible, efficient, and cost-effective for companies across the country.

Which Industry Challenges Have Impacted the Growth for Indonesia Corporate Training Market:

Quality and Standardization Issues: Concerns about the varying quality of training programs pose significant challenges for the corporate training market in Indonesia. According to recent surveys, approximately 40% of companies have expressed dissatisfaction with the lack of standardized training programs, resulting in inconsistent outcomes. This issue undermines the return on investment and diminishes the overall trust in corporate training solutions.

Regulatory Hurdles: Strict government regulations regarding certification requirements for training providers have created barriers to entry for smaller firms. In 2023, around 15% of training providers struggled to comply with these regulatory standards, leading to limited participation in the market. These challenges often increase operational costs and limit the availability of diverse training programs.

Access to Financing for Training Programs: Limited access to funding, particularly for SMEs, hinders the ability of smaller businesses to invest in corporate training. Data shows that approximately 25% of SMEs face difficulties securing adequate financial resources for employee development, which restricts their capacity to provide necessary skills training and curtails overall market growth.

What are the Regulations and Initiatives Which Have Governed the Market:

Certification Regulations for Training Providers: The Indonesian government mandates that corporate training providers obtain certification to ensure the quality and effectiveness of training programs. These certifications cover a wide range of standards, including curriculum design, trainer qualifications, and program outcomes. In 2022, approximately 65% of training providers were certified, ensuring compliance with industry standards and increasing trust in the market.

Government Support for Digital Training Initiatives: To promote digital skills development, the government has introduced various initiatives, including tax incentives for companies investing in digital learning platforms and e-learning programs. In 2023, these incentives contributed to a 20% increase in the adoption of digital training solutions, particularly in technology and service industries.

National Skills Development Program: The Indonesian government has launched national programs aimed at upskilling the workforce, such as the "Kartu Prakerja" initiative, which offers financial support for training. This program has helped over 5 million individuals access corporate training in various fields, fostering a culture of continuous learning and boosting market demand for specialized training services.

Indonesia Corporate Training Market Segmentation

By Market Structure: Independent training providers dominate the market due to their extensive range of specialized training programs and flexibility in tailoring content to meet specific corporate needs. They are well-known for their adaptability and innovation in delivering both in-person and digital training solutions. In-house corporate training departments also hold a significant share as many large organizations prefer to manage their training internally, focusing on customized programs aligned with their corporate objectives.

By Training Programs: Digital skills training leads the corporate training market in Indonesia due to the increasing demand for expertise in digital transformation, automation, and data analytics. Leadership and management training follows closely as companies prioritize the development of future leaders to navigate growing organizational complexities. Soft skills training, such as communication and teamwork, also plays a significant role, particularly in industries like service and retail.

%2C%202023.png)

By Company Size: Small and medium-sized enterprises (SMEs) represent the largest segment in the corporate training market, as they increasingly invest in skill development to enhance productivity and competitiveness. Larger corporations, while fewer in number, contribute significantly to market revenues due to their larger budgets and continuous need for training across various departments.

Competitive Landscape in Indonesia Corporate Training Market

The Indonesia corporate training market is relatively fragmented, with a mix of established players and emerging firms expanding their offerings across various industries. Key players such as PT Binus Center, Quadrant Utama, and PT Intermedia Persada dominate the market, while new entrants specializing in digital and hybrid training programs continue to diversify the landscape, providing businesses with a variety of choices for skill development.

| Name | Founding Year |

| PT. Dunamis Organization Services | 1991 |

| MarkPlus Institute | 1990 |

| Maven Consulting | 2012 |

| Piramid Training Consulting | 2003 |

| Lembaga Manajemen PPM | 1967 |

| INSPIRIT | 2008 |

| FranklinCovey Indonesia | 1996 |

| Pekerti Professional Development Center | 1987 |

| Quinn Training | 2013 |

| BINUS Corporate Learning & Development | 1996 |

Some of the recent competitor trends and key information about competitors include:

PT Binus Center: As one of the leading corporate training providers in Indonesia, PT Binus Center recorded a 15% increase in enrollment for its hybrid training programs in 2023. The center’s reputation for offering both technical and soft skills training has strengthened its position as a key player in the market.

Quadrant Utama: Known for its focus on digital skills training, Quadrant Utama saw a 25% growth in demand for its e-learning programs in 2023, driven by the increasing adoption of digital transformation initiatives across industries. The company’s strong presence in tech-driven sectors has contributed to its rapid growth.

PT Intermedia Persada: Specializing in leadership and management training, PT Intermedia Persada experienced a 20% increase in clients from medium-sized enterprises in 2023. Its success can be attributed to its comprehensive leadership programs, which cater to the growing need for organizational development in Indonesia's expanding corporate sector.

New Entrants: The market has seen the entrance of several digital-first training providers, focusing on niche areas such as AI, data analytics, and cyber security. These new entrants have quickly gained traction, particularly among tech companies and startups seeking specialized skill development solutions.

What Lies Ahead for Indonesia Corporate Training Market?

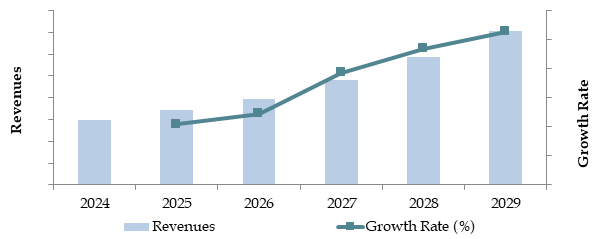

The Indonesia corporate training market is expected to grow steadily through 2029, driven by increasing investments in employee development, rising demand for digital skills, and the expanding SME sector. This growth will be further supported by government initiatives and a growing corporate focus on continuous learning.

Shift Towards Digital Learning: As companies continue to adopt digital transformation strategies, there is anticipated to be a significant increase in demand for digital learning platforms. This trend is supported by the rise of remote work, which has created a need for more flexible, online training programs that can be accessed by employees across various locations.

Adoption of AI and Data-Driven Learning: The integration of AI and data analytics into corporate training is expected to revolutionize the industry, providing personalized learning experiences, improving training outcomes, and enhancing employee engagement. Companies are likely to embrace these technologies to optimize training delivery and track employee progress more effectively.

Focus on Leadership and Soft Skills Development: As companies recognize the importance of strong leadership and effective communication in a rapidly changing business environment, there is expected to be a growing demand for leadership and soft skills training programs. These programs will play a critical role in equipping managers and employees with the skills needed to navigate organizational challenges and drive growth.

Growth of Tailored and Industry-Specific Programs: The market is witnessing a trend towards more specialized and industry-specific training programs, particularly in sectors such as finance, technology, and manufacturing. Customized programs that address specific corporate needs and challenges are expected to become more prevalent, catering to the diverse demands of Indonesia's growing industries.

Sustainability and Corporate Social Responsibility Training: There is a rising focus on sustainability and corporate social responsibility (CSR) within Indonesia’s corporate landscape. Companies are increasingly investing in training programs that educate employees on sustainable practices, ethical business operations, and CSR initiatives, reflecting the growing importance of these areas in corporate strategies.

Future Outlook and Projections for Indonesia Corporate Training Market on the Basis of Revenue, 2024-2029

Source: TraceData Research Analysis

Indonesia Corporate Training Market Segmentation

- By Market Structure:

- In-House Training Programs

- Outsourced Training Providers

- By Training Type:

- Technical Skills Training

- Soft Skills Development

- Compliance Training

- Leadership and Management Development

- Digital Skills Training

- Language and Communication Skills Training

- By Industry Verticals:

- Finance and Banking

- Technology and IT

- Manufacturing

- Healthcare

- Retail and Consumer Goods

- Oil and Gas

- By Company Size:

- Large Enterprises

- Medium-Sized Enterprises

- Small and Medium Enterprises (SMEs)

- By Deployment:

- Offsite

- Onsite

- By Designation:

- Managerial

- Non-Managerial

- Integrated

- By Type of Organization:

- MNCs

- Domestic

- By Mode of Learning:

- Instructor Led Classroom Only

- Blended Learning

- Virtual Classroom

- Online or Computer Based Methods Only

- Mobile only

- Social Learning

- By Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Bali

- Eastern Indonesia

Players Mentioned in the Report:

- PT. Dunamis Organization Services

- MarkPlus Institute

- Maven Consulting

- Piramid Training Consulting

- Lembaga Manajemen PPM

- INSPIRIT

- FranklinCovey Indonesia

- Pekerti Professional Development Center

- Quinn Training

- BINUS Corporate Learning & Development

Key Target Audience:

- Corporate Training Providers

- HR and Learning & Development (L&D) Departments

- SMEs

- Large Corporations

- Government Bodies (e.g., Ministry of Education and Culture)

- Industry Associations and Regulatory Bodies

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Indonesia Corporate Training Market

4. Value Chain Analysis

4.1. Delivery Model Analysis for Corporate Training- Online, Blended, In Person or Self-Paced- Discuss about Margins, Preference, Strength and Weakness

4.2. Revenue Streams for Indonesia Corporate Training Market

4.3. Business Model Canvas for Indonesia Corporate Training Market

5. Market Structure

5.1. Freelance Trainers V/S Full Time Trainers

5.2. Investment Model in India Corporate Training Market

5.3. Comparative Analysis of the Funnelling Process by Private and Government Organizations in India Corporate Training Market

5.4. Corporate Training Budget Allocation by Company Size, 2024

6. Market Attractiveness for Indonesia Corporate Training Market

7. Supply-Demand Gap Analysis

8. Market Size for Indonesia Corporate Training Market Basis

8.1. Revenues, 2018-2024

9. Market Breakdown for Indonesia Corporate Training Market Basis

9.1. By Market Structure (In-House and Outsourced Training), 2023-2024P

9.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2023-2024P

9.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2023-2024P

9.3.1. By Type of IT Training, 2023-2024P

9.3.2. By Type of Manufacturing Training, 2023-2024P

9.3.3. By Type of Finance Training, 2023-2024P

9.3.4. By Type of Soft Skill Training, 2023-2024P

9.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2023-2024P

9.5. By Employee Designation, 2023-2024P

9.6. By Mode of Learning, 2023-2024P

9.7. By Open and Customized Programs, 2023-2024P

9.8. By Major Provinces, 2023-2024P

10. Demand Side Analysis for Indonesia Corporate Training Market

10.1. Corporate Client Landscape and Cohort Analysis

10.2. Corporate Training Needs and Decision-Making Process

10.3. Training Program Effectiveness and ROI Analysis

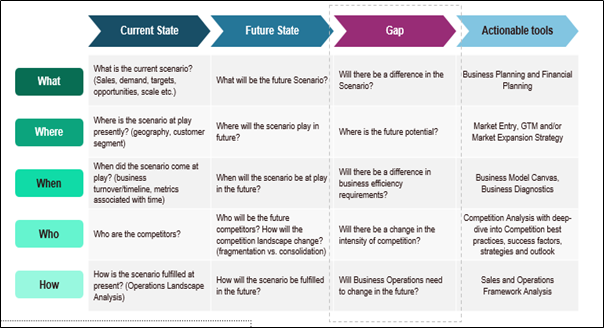

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Indonesia Corporate Training Market

11.2. Growth Drivers for Indonesia Corporate Training Market

11.3. SWOT Analysis for Indonesia Corporate Training Market

11.4. Issues and Challenges for Indonesia Corporate Training Market

11.5. Government Regulations for Indonesia Corporate Training Market

12. Snapshot on Online Corporate Training Market

12.1. Market Size and Future Potential for Online Corporate Training Industry in Indonesia, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Delivery Models and Type of Courses offered

12.4. Cross Comparison of Leading Online Corporate Training Companies based on Company Overview, Investment and Funding, Revenues, Number of Subscribers, Revenue Streams, Number of Courses, Fees and others

13. Opportunity Matrix for Indonesia Corporate Training Market - Presented with the Help of Radar Chart

14. PEAK Matrix Analysis for Indonesia Corporate Training Market

15. Competitor Analysis for Indonesia Corporate Training Market

15.1 Market Share of Key Players in Indonesia Corporate Training Market Basis Revenues, 2023

15.2. Benchmark of Key Competitors in Indonesia Corporate Training Market Including Variables such as Company Overview, USP, Business Strategies, Business Model, Number of Trainers, Revenues, Pricing Basis Type of Training, Technology Used, Best Selling Courses, Major Clients, Strategic Tie Ups, Marketing Strategy, Recent Development and others

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowman’s Strategic Clock for Competitive Advantage

16. Future Market Size for Indonesia Corporate Training Market Basis

16.1. Revenues, 2025-2029

17. Market Breakdown for Indonesia Corporate Training Market Basis

17.1. By Market Structure (In-House and Outsourced Training), 2025-2029

17.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2025-2029

17.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2025-2029

17.3.1. By Type of IT Training, 2025-2029

17.3.2. By Type of Manufacturing Training, 2025-2029

17.3.3. By Type of Finance Training, 2025-2029

17.3.4. By Type of Soft Skill Training, 2025-2029

17.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2025-2029

17.5. By Employee Designation, 2025-2029

17.6. By Mode of Learning, 2025-2029

17.7. By Open and Customized Programs, 2025-2029

17.8. By Region (Central, Northern, Southern, Eastern, and East Indonesia), 2025-2029

17.9. Recommendation

17.10. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: The corporate training ecosystem in Indonesia consists of various demand-side entities (corporations, SMEs, government agencies) and supply-side entities (training providers, universities, and digital learning platforms). A detailed analysis will be conducted to identify the top 5-6 training providers in the country, based on their financial information, volume of training programs, and market presence.

Sourcing Information: Sourcing of industry insights will be achieved through a combination of industry articles, proprietary databases, and secondary research. The research will cover key industry metrics, such as training budgets, pricing levels, and demand trends.

Step 2: Desk Research

Comprehensive Desk Research: An exhaustive desk research process will be undertaken, leveraging secondary and proprietary databases to gather detailed market information. This will include analysis of corporate spending on training programs, market size, growth drivers, challenges, and key players. Company-level analysis will involve reviewing annual reports, financial statements, press releases, and other official documents.

Step 3: Primary Research

In-Depth Interviews: The research process will include conducting in-depth interviews with C-level executives, HR managers, and corporate training providers in Indonesia. These interviews will validate market hypotheses, confirm statistical data, and provide operational insights. Data will be gathered through top-to-bottom and bottom-to-top approaches, ensuring a comprehensive understanding of training volumes, pricing models, and service offerings.

Disguised Interviews: Disguised interviews will also be conducted with training providers, under the guise of potential clients, to validate operational information such as revenue streams, value chains, and pricing structures.

Step 4: Sanity Check

- Modeling and Analysis: A combination of top-down and bottom-up market modeling approaches will be used to ensure the accuracy of the data. Multiple iterations will be conducted for market size modeling, validation, and projections for the corporate training industry.

FAQs

01 What is the potential for the Indonesia Corporate Training Market?

The Indonesia corporate training market is expected to experience significant growth, with the market reaching a valuation of IDR 18 Trillion in 2023. This growth is driven by factors such as the increasing emphasis on digital skills, the expanding SME sector, and the shift towards e-learning solutions.

02 Who are the Key Players in the Indonesia Corporate Training Market?

The key players in the Indonesia corporate training market include PT Binus Center, Quadrant Utama, and PT Intermedia Persada. These companies dominate the market through their extensive program offerings, digital platforms, and strong industry presence.

03 What are the Growth Drivers for the Indonesia Corporate Training Market?

Key growth drivers include the rise of digital transformation, increased corporate spending on employee development, and the expansion of the SME sector. The adoption of digital training solutions and the demand for specialized skill development are expected to fuel market growth.

04 What are the Challenges in the Indonesia Corporate Training Market?

Challenges in the Indonesia corporate training market include quality standardization, regulatory compliance issues, and limited access to funding for training programs. These barriers impact smaller training providers and SMEs seeking to invest in workforce development.