India Corporate Training Market Outlook to 2029

By Market Structure (In-House and Outsourced Trainings), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), By Organization Size, By Age of

- Product Code: TDR004

- Region: Asia

- Published on: September 2024

- Total Pages: 110

Want to Assess the Impact of US-Imposed Trade Tariff on

India Corporate Training Market

Report Summary

The report titled “India Corporate Training Market Outlook to 2029 - By Market Structure (In-House and Outsourced Trainings), By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), By Organization Size, By Age of Learners, and By Region.” provides a comprehensive analysis of the corporate training market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Corporate Training Market. The report concludes with future market projections based on revenue, market, training types, region, cause-and-effect relationship, and success case studies highlighting the major opportunities and cautions.

India Corporate Training Market Overview and Size

The India corporate training market reached a valuation of INR 58 billion in 2023, driven by the increasing demand for upskilling and reskilling in the workforce, growing emphasis on digital literacy, and the expanding corporate sector. The market is characterized by major players such as NIIT, Centum Learning, Manipal Global, Simplilearn, and UpGrad. These companies are recognized for their extensive training portfolios, customized corporate solutions, and innovative learning platforms.

In 2023, UpGrad launched a new online learning platform that attracted over 500,000 corporate learners within its first six months, reflecting the growing demand for digital training solutions. Key regions such as Bangalore, Mumbai, and Delhi NCR are significant markets due to their high concentration of corporate offices and strong demand for training services.

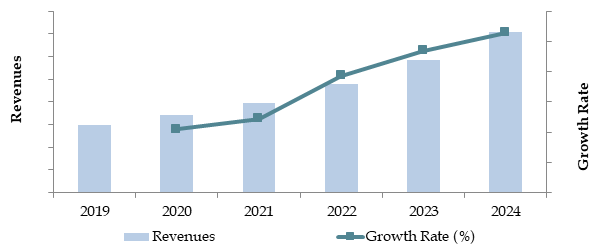

Market Size for India Corporate Training Industry on the Basis of Revenue, 2018-2024

What Factors are Leading to the Growth of the India Corporate Training Market:

Economic Factors: The rapid growth of the Indian economy, with a GDP growth rate of 6.5% in 2023, and the shift towards a knowledge-driven workforce have significantly increased the demand for corporate training. In 2023, corporate training programs accounted for approximately 15% of the total training expenditures in India, as companies strive to enhance productivity and stay competitive.

Digital Transformation: The accelerated adoption of digital tools and technologies in workplaces has led to a surge in demand for digital skills training. Around 40% of corporate training programs in India in 2023 focused on digital transformation and IT skills, reflecting the critical need for these competencies in the modern workplace.

Government Initiatives: Various government programs aimed at skill development, such as Skill India and the Digital India initiative, have provided a significant boost to the corporate training market. In 2023, these initiatives contributed to an 18% increase in corporate training investments compared to the previous year.

Which Industry Challenges Have Impacted the Growth of the India Corporate Training Market:

Quality and Relevance of Training: Concerns about the quality and relevance of training programs remain significant challenges. According to a recent industry survey, approximately 45% of companies are hesitant to invest in external training providers due to fears of outdated content and ineffective training methods. This issue has led to lower satisfaction levels, potentially deterring up to 30% of companies from engaging in formal training programs.

Regulatory Hurdles: Compliance with industry-specific regulations and certification requirements can limit the availability of certain training programs. In 2023, it was reported that around 22% of training programs offered in the market needed to be updated to meet new regulatory standards. These challenges can impose significant costs, particularly on smaller training providers, making it challenging for them to comply.

Financing and Budget Constraints: Limited access to financing and budget constraints are critical barriers in the corporate training market, particularly affecting small and medium enterprises (SMEs). Data indicates that approximately 35% of SMEs face difficulties in allocating sufficient budgets for employee training. This limitation not only restricts market access for a significant segment of the population but also constrains overall market growth.

What are the Regulations and Initiatives which have Governed the Market:

Mandatory Training Regulations: The Indian government mandates certain training programs, particularly in sectors like IT, BFSI, and healthcare, to ensure that employees meet specific industry standards. These training requirements are enforced through periodic audits and certifications. In 2022, approximately 80% of corporate training programs in these sectors complied with regulatory standards.

Tax Incentives for Skill Development: The government provides tax incentives to companies investing in employee skill development under programs like Skill India. In 2023, corporate tax deductions for training-related expenditures increased by 25%, encouraging more companies to enhance their training budgets.

Industry-Specific Certifications: Various industry bodies mandate certifications for certain job roles, particularly in technical fields. These certifications have become critical to career advancement and are often provided through corporate training programs. In 2023, certifications accounted for approximately 20% of the total corporate training market in India.

India Corporate Training Market Segmentation

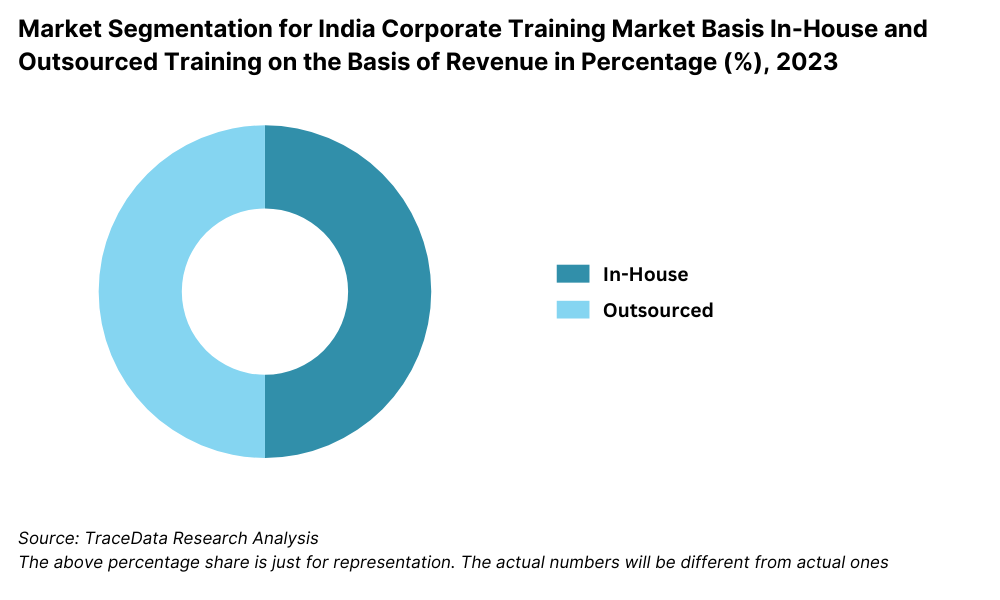

By Market Structure: Online Training Providers dominate the market due to their accessibility, scalability, and ability to offer a wide range of courses tailored to specific needs. They often feature flexible learning schedules, interactive platforms, and a variety of content delivery methods, making them a preferred choice for many companies. In-house Training Programs hold a significant share as they offer customized content directly aligned with organizational goals and allow for better control over the training process. These programs are particularly popular among large enterprises that have the resources to develop and maintain their training departments. Blended Learning Providers combine the advantages of online and offline methods, offering a balanced approach that caters to different learning styles.

By Training Type: Technical Skills training leads the market due to the increasing demand for digital literacy and technical competencies across various industries. Companies invest heavily in this area to keep their workforce updated with the latest technological advancements, ensuring they remain competitive in a rapidly changing digital landscape. Soft Skills training follows closely, focusing on developing interpersonal skills, communication, teamwork, and leadership qualities. This type of training is crucial for enhancing employee productivity and fostering a positive work environment, especially in service-oriented industries. Leadership Development programs are increasingly sought after, particularly in large enterprises that prioritize succession planning and leadership pipeline development. These programs help identify and nurture future leaders, ensuring that the organization is well-prepared for growth and transition. Compliance Training is essential in highly regulated industries such as BFSI, healthcare, and manufacturing.

By Industry Verticals: IT & ITES is the leading vertical in the corporate training market, driven by the need for continuous upskilling in a fast-paced, technology-driven industry. Companies in this sector heavily invest in training to keep their employees proficient in the latest software, programming languages, and IT management practices. BFSI (Banking, Financial Services, and Insurance) follows, with a focus on compliance training, risk management, and financial analysis skills. The sector’s strict regulatory environment necessitates frequent training to ensure adherence to legal standards and to enhance financial acumen. Manufacturing sees significant investment in technical and safety training, particularly in areas like machinery operation, quality control, and occupational health and safety.

Competitive Landscape in India Corporate Training Market

The India corporate training market is relatively fragmented, with numerous players offering diverse training services. However, the market is witnessing increased consolidation as larger firms acquire smaller, specialized providers to expand their offerings.

Online Platforms

| Name | Founding Year | Original Headquarters |

| UpGrad | 2015 | Mumbai, India |

| Simplilearn | 2010 | Bangalore, India |

| Coursera (India operations) | 2012 | Mountain View, USA |

| edX (India operations) | 2012 | Cambridge, USA |

| Udemy for Business (India operations) | 2010 | San Francisco, USA |

| NIIT Imperia | 2006 | Gurgaon, India |

| Harappa Education | 2018 | New Delhi, India |

| Great Learning | 2013 | Gurgaon, India |

| edureka | 2011 | Bangalore, India |

| Jigsaw Academy | 2011 | Bangalore, India |

Offline Companies

| Name | Founding Year | Original Headquarters |

| NIIT Ltd. | 1981 | Gurgaon, India |

| Dale Carnegie Training India | 1912 (India: 2004) | New York, USA |

| FranklinCovey India | 1996 | Salt Lake City, USA |

| Right Management India | 1980 | Milwaukee, USA |

| Mercer India | 1937 (India: 1992) | New York, USA |

| Hero Mindmine | 2000 | New Delhi, India |

| Mavraac | 2015 | Mumbai, India |

| Manford | 1995 | New Delhi, India |

| Middle Earth HR | 1997 | Hyderabad, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

NIIT: As one of the leading corporate training providers in India, NIIT recorded a 20% increase in its digital training offerings in 2023, focusing on upskilling employees in emerging technologies such as AI and data analytics.

Centum Learning: Known for its strong presence in the BFSI sector, Centum Learning has expanded its training programs to include leadership and soft skills training, addressing the growing demand for holistic employee development.

Manipal Global: Specializing in healthcare and IT training, Manipal Global has launched several new certification programs in 2023, catering to the needs of professionals looking to upskill in specialized domains.

Simplilearn: A major player in online training, Simplilearn has seen a 25% increase in enrollments for its digital marketing and cybersecurity courses in 2023, reflecting the growing demand for these skills in the corporate sector.

UpGrad: Focusing on higher education and professional courses, UpGrad has collaborated with several international universities in 2023 to offer globally recognized certifications, enhancing its appeal among corporate clients seeking advanced training options.

What Lies Ahead for India Corporate Training Market?

The India corporate training market is projected to grow steadily by 2029, exhibiting a respectable CAGR of 8% during the forecast period. This growth is expected to be fueled by the increasing emphasis on digital transformation, the growing need for reskilling in a rapidly evolving job market, and supportive government policies.

Rise of Hybrid Training Models: The future of corporate training in India is likely to see a significant shift towards hybrid models, combining online and offline training methods. This trend is driven by the flexibility and scalability that hybrid models offer, catering to diverse learner needs.

Focus on Outcome-Based Training: As companies increasingly demand measurable outcomes from their training investments, there will be a greater focus on outcome-based training programs. This approach ensures that training efforts are closely aligned with organizational goals and deliver tangible results.

Expansion of Sector-Specific Training: There is expected to be a growing demand for sector-specific training programs, particularly in industries such as IT, BFSI, and healthcare. These sectors are likely to see specialized training solutions tailored to meet industry-specific needs.

Leveraging AI and Analytics: The use of AI and analytics in corporate training is expected to grow, enabling personalized learning experiences and better tracking of training outcomes. This technology will enhance the effectiveness of training programs and improve ROI for companies.

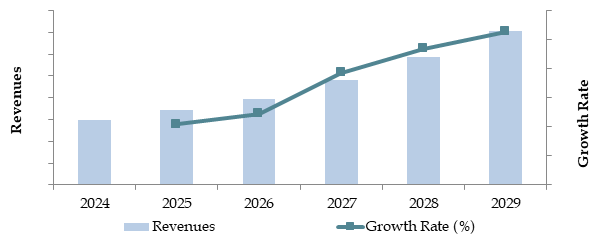

Future Outlook and Projections for India Corporate Training Market on the Basis of Revenue, 2024-2029

India Corporate Training Market Segmentation

- By Market Structure:

- In-House Training Programs

- Outsourced Training Providers

- By Training Type:

- Technical Skills Training

- Soft Skills Development

- Compliance Training

- Leadership and Management Development

- Digital Skills Training

- Language and Communication Skills Training

- By Industry Verticals:

- Finance and Banking

- Technology and IT

- Manufacturing

- Healthcare

- Retail and Consumer Goods

- Oil and Gas

- By Company Size:

- Large Enterprises

- Medium-Sized Enterprises

- Small and Medium Enterprises (SMEs)

- By Region:

- Central Region

- Northern Region

- Southern Region

- Eastern Region

- East Malaysia (Sabah and Sarawak)

- By Deployment:

- Offsite

- Onsite

- By Designation:

- Managerial

- Non-Managerial

- Integrated

- By Type of Organization:

- MNCs

- Domestic

- By Mode of Learning:

- Instructor Led Classroom Only

- Blended Learning

- Virtual Classroom

- Online or Computer Based Methods Only

- Mobile only

- Social Learning

- By Region:

- North

- South

- East

- West

Players Mentioned in the Report:

- NIIT Ltd.

- Dale Carnegie Training India

- FranklinCovey India

- Right Management India

- Mercer India

- Hero Mindmine

- Mavraac

- Manford

- Middle Earth HR

- UpGrad

- Simplilearn

- Coursera (India operations)

- edX (India operations)

- Udemy for Business (India operations)

- NIIT Imperia

- Harappa Education

- Great Learning

- edureka

- Jigsaw Academy

Key Target Audience:

- Corporate Training Providers

- Online Learning Platforms

- HR and Learning & Development Departments

- Government Bodies (e.g., Ministry of Skill Development and Entrepreneurship)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in India Corporate Training Market

4. Value Chain Analysis

4.1. Delivery Model Analysis for Corporate Training- Online, Blended, In Person or Self-Paced- Discuss about Margins, Preference, Strength and Weakness

4.2. Revenue Streams for India Corporate Training Market

4.3. Business Model Canvas for India Corporate Training Market

5. Market Structure

5.1. Freelance Trainers V/S Full Time Trainers

5.2. Investment Model in India Corporate Training Market

5.3. Comparative Analysis of the Funnelling Process by Private and Government Organizations in India Corporate Training Market

5.4. Corporate Training Budget Allocation by Company Size, 2024

6. Market Attractiveness for India Corporate Training Market

7. Supply-Demand Gap Analysis

8. Market Size for India Corporate Training Market Basis

8.1. Revenues, 2018-2024

9. Market Breakdown for India Corporate Training Market Basis

9.1. By Market Structure (In-House and Outsourced Training), 2023-2024P

9.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2023-2024P

9.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2023-2024P

9.3.1. By Type of IT Training, 2023-2024P

9.3.2. By Type of Manufacturing Training, 2023-2024P

9.3.3. By Type of Finance Training, 2023-2024P

9.3.4. By Type of Soft Skill Training, 2023-2024P

9.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2023-2024P

9.5. By Employee Designation, 2023-2024P

9.6. By Mode of Learning, 2023-2024P

9.7. By Open and Customized Programs, 2023-2024P

9.8. By Region (Northern, Southern, Eastern, and East India), 2023-2024P

10. Demand Side Analysis for India Corporate Training Market

10.1. Corporate Client Landscape and Cohort Analysis

10.2. Corporate Training Needs and Decision-Making Process

10.3. Training Program Effectiveness and ROI Analysis

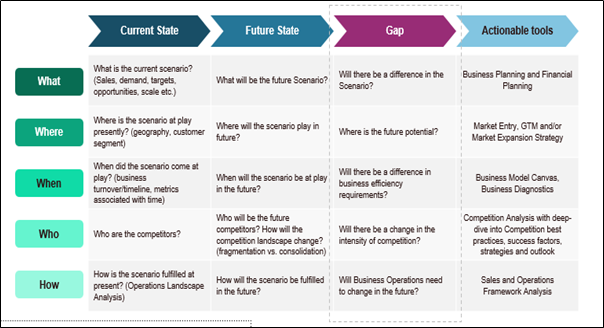

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for India Corporate Training Market

11.2. Growth Drivers for India Corporate Training Market

11.3. SWOT Analysis for India Corporate Training Market

11.4. Issues and Challenges for India Corporate Training Market

11.5. Government Regulations for India Corporate Training Market

12. Snapshot on Online Corporate Training Market

12.1. Market Size and Future Potential for Online Corporate Training Industry in India, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Delivery Models and Type of Courses offered

12.4. Cross Comparison of Leading Online Corporate Training Companies based on Company Overview, Investment and Funding, Revenues, Number of Subscribers, Revenue Streams, Number of Courses, Fees and others

13. Opportunity Matrix for India Corporate Training Market - Presented with the Help of Radar Chart

14. PEAK Matrix Analysis for India Corporate Training Market

15. Competitor Analysis for India Corporate Training Market

15.1 Market Share of Key Players in India Corporate Training Market Basis Revenues, 2023

15.2. Benchmark of Key Competitors in India Corporate Training Market Including Variables such as Company Overview, USP, Business Strategies, Business Model, Number of Trainers, Revenues, Pricing Basis Type of Training, Technology Used, Best Selling Courses, Major Clients, Strategic Tie Ups, Marketing Strategy, Recent Development and others

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowman’s Strategic Clock for Competitive Advantage

16. Future Market Size for India Corporate Training Market Basis

16.1. Revenues, 2025-2029

17. Market Breakdown for India Corporate Training Market Basis

17.1. By Market Structure (In-House and Outsourced Training), 2025-2029

17.2. By Training Type (Technical Skills, Soft Skills, Compliance, and Leadership Development), 2025-2029

17.3. By Industry Verticals (Finance, IT, Manufacturing, Healthcare, and Retail), 2025-2029

17.3.1. By Type of IT Training, 2025-2029

17.3.2. By Type of Manufacturing Training, 2025-2029

17.3.3. By Type of Finance Training, 2025-2029

17.3.4. By Type of Soft Skill Training, 2025-2029

17.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, and SMEs), 2025-2029

17.5. By Employee Designation, 2025-2029

17.6. By Mode of Learning, 2025-2029

17.7. By Open and Customized Programs, 2025-2029

17.8. By Region (Northern, Southern, Eastern, and East India), 2025-2029

17.9. Recommendation

17.10. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the India Corporate Training Market. Based on this ecosystem, we will shortlist leading 5-6 training providers in the country based on their financial information, market reach, and client base.

Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market revenues, number of training providers, pricing structures, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various India Corporate Training Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process.

FAQs

01 What is the potential for the India Corporate Training Market?

The India Corporate Training Market is poised for substantial growth, reaching a valuation of INR [X] Billion in 2023. This growth is driven by factors such as the increasing demand for upskilling and reskilling, digital transformation initiatives, and the expanding corporate sector. The market's potential is further bolstered by the growing emphasis on continuous learning and development within organizations.

02 Who are the Key Players in the India Corporate Training Market?

The India Corporate Training Market features several key players, including NIIT, Centum Learning, and UpGrad. These companies dominate the market due to their extensive training portfolios, strong client relationships, and innovative learning solutions. Other notable players include Manipal Global and Simplilearn.

03 What are the Growth Drivers for the India Corporate Training Market?

The primary growth drivers include economic factors, such as the rapid growth of the Indian economy and the shift towards a knowledge-driven workforce. The digital transformation across industries, supported by government initiatives like Skill India, also contributes to the growing demand for corporate training. Additionally, the rise of online learning platforms has made it easier for organizations to access a wide range of training solutions, enhancing India Corporate Training Market growth.

04 What are the Challenges in the India Corporate Training Market?

The India Corporate Training Market faces several challenges, including quality and relevance issues related to training content. Regulatory challenges, such as compliance with industry-specific standards and certifications, can also impact the availability of certain training programs. Additionally, budget constraints, particularly for SMEs, and the need for measurable training outcomes pose significant barriers to market growth.

Want to Assess the Impact of US-Imposed Trade Tariff on

India Corporate Training Market