Australia Health Insurance Market Outlook to 2029

By Market Structure, By Providers, By Insurance Types, By Demographics, By Income Levels, and By Region

- Product Code: TDR0109

- Region: Asia

- Published on: December 2024

- Total Pages: 110

Want to Assess the Impact of US-Imposed Trade Tariff on

Australia Health Insurance Market

Report Summary

The report titled, “Australia Health Insurance Market Outlook to 2029: By Providers, By Insurance Types, By Demographics, By Income Levels, and By Region” provides an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Health Insurance Market. The report concludes with future market projections based on premium revenue, by insurance type, demographics, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

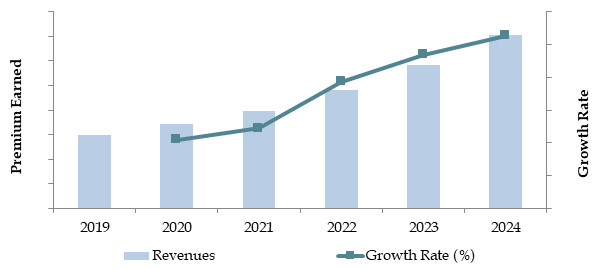

Australia Health Insurance Market Overview and Size

The Australia health insurance market was valued at AUD 25 billion in 2023, growing upwards on account of increasing healthcare costs, rising awareness related to health insurance, and supportive government policies like the Private Health Insurance Rebate. The major players in the market include Medibank, Bupa, nib, HCF, and Australian Unity. They dominate the segment due to their differentiated coverage plans at competitive premiums and extensive provider networks.

In 2023, Medibank introduced new policies to shift more resources toward mental health coverage and wellness benefits, reflecting increased consumer demand for holistic healthcare solutions. Major urban centres like Sydney, Melbourne, and Brisbane have, until now, represented the biggest markets. It is due to their high population density and more significant health infrastructure.

Market Size for Australia Health Insurance Industry on the Basis of Premium Amount in USD Billion, 2018–2024

What are the driving forces behind Australia's health insurance market's expansion?

Economic Factors: This was because the increase in medical treatment costs made health insurance indispensable for most Australians. People tried saving themselves from unexpected health expenditure. As a result of this, till the year 2023, approximately 55 percent of all Australians were getting covered under private health insurance.. Measures have been taken. For example, MMS, Levy Surcharge created by the government of Australia to pursue people for public health insurance so that the tendency of growth into the market can again be revived within the sector directly.

Demographic profile and aging population: The ageing of the Australian population is one of the major factors constituting demand in health insurance. By 2023, nearly 16% of the population in Australia had entered the age group of 65-plus years. This has increased the demand for full health care, particularly with regard to chronic conditions and aged-care services.

Digitalization and Innovation: Technology adoption allows customers to access health insurance much more quickly thus improving the customer experience. With digital platforms, customers can compare policies online, file claims online, and consult online. Over 60% of health insurance policies purchased or managed in the year 2023 were done online, depicting an increasing affinity of people to engage digitally. Insurers increasingly use AI and data analytics for personalization, improving customer satisfaction.

Which Industry Challenges Have Impacted the Growth of Australia Health Insurance Market?

Complexity of Policies: Many consumers are unable to comprehend the terms of health insurance policies and the specifics of their coverage. Indeed, according to a survey conducted in 2023, 35% of policyholders expressed dissatisfaction over unforeseen out-of-pocket costs brought on by exclusions or co-payment conditions.

Affordability and Rising Premium Costs: Affordability and increasing costs of premiums are some of the major deterrents for many Australians, especially the lower-income groups. Reports from 2023 state that over 40% of people not covered cited affordability as the main reason for exclusion. This factor has been exacerbated by inflation and cost increase pressures experienced within health provision that affect insurance pricing.

Costs of Regulatory Compliance: Insurers are under immense pressure to implement set regulations by the Australian Prudential Regulation Authority among other regulatory bodies. For instance, the set requirements on data protection and reporting have increased operational costs, especially for small providers. This inhibits competition and creates entry barriers into the business.

What are the regulations and initiatives that have governed the market?

Private Health Insurance Rebate: The government grants an incentive towards Australians taking up private health insurance-the rebate-entitled to those according to their income and age. In the year 2023, the rebates ranged between 8 and 33 per cent, depending on income and family status. This policy has been important in maintaining participation rates among middle-income groups.

Medicare Levy Surcharge: MLS refers to the additional cost paid by Australians when their incomes are above the threshold and without private hospital insurance. This surcharge is around 1% to 1.5% of the taxable income in 2023 and therefore incentivizes high-income earners to take up private insurance.

LHC Loading: The government's financial penalty for people who delay buying private health insurance once they have turned 30. For 2023, a person pays an extra 2% on premiums for each year they delay, to a maximum of 70%. This was enacted to push younger people into the market earlier.

Segmentation of the Health Insurance Market in Australia

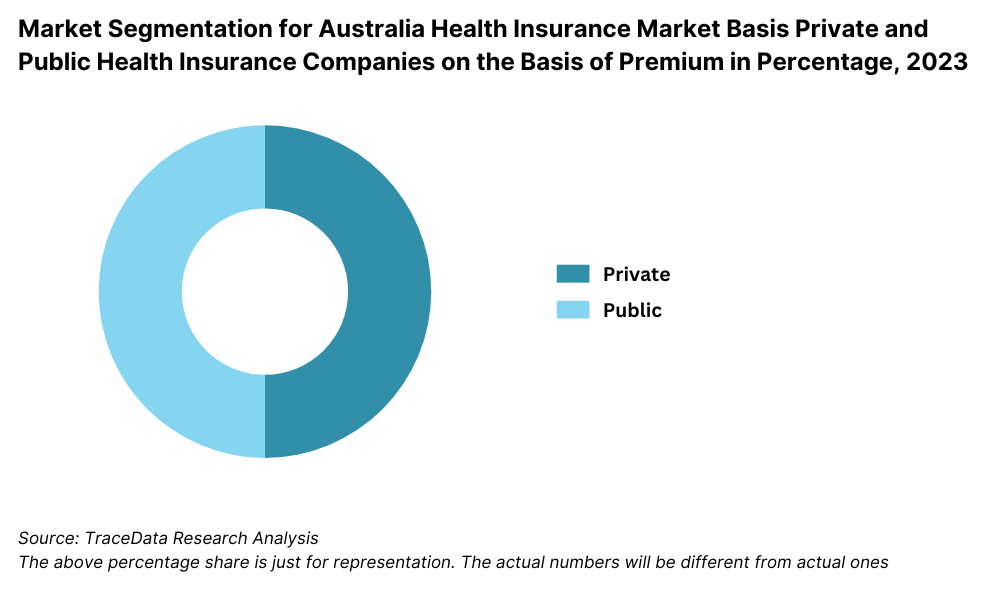

By Market Structure: The private health insurers dominate the market, with their wide array of customizable policies, wider coverage options, and tax incentives on uptake. Public health insurance, mainly provided through Medicare, acts as the backbone for all essential health services; however, its limitation to elective procedures and specialized treatments generates demand in private health insurance.

By Insurance Types: The hospital cover takes the lead because it addresses the big medical needs, such as surgeries and inpatient care. Extras cover, comprising ancillary services such as dental, optical, and physiotherapy, follows closely and is focused on preventative and lifestyle health. Combined policies are comprehensive and are increasingly preferred by families and individuals for holistic coverage.

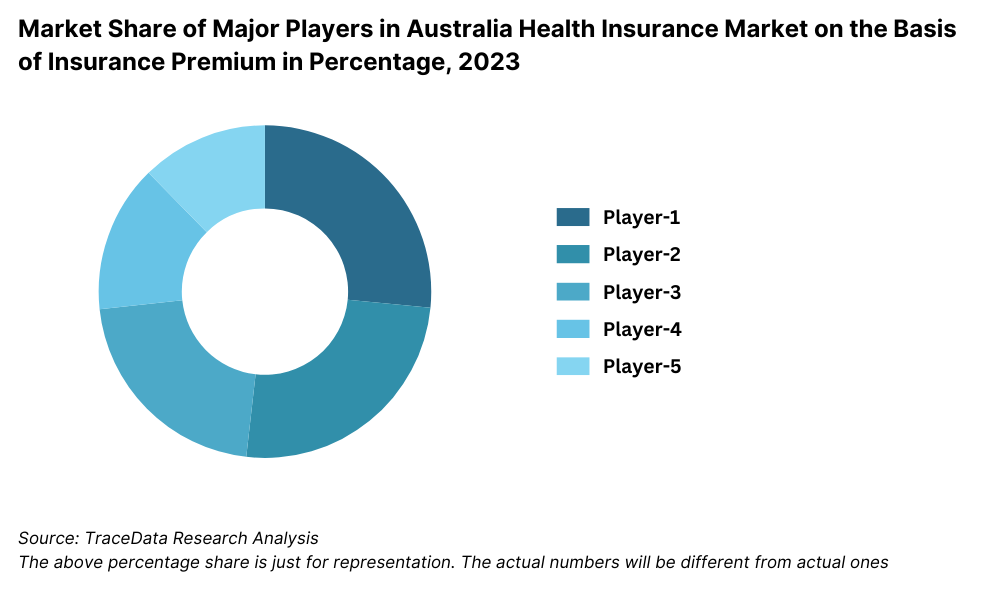

Competitive Landscape in Australia Health Insurance Market

The Australian health insurance market is fairly concentrated, with a few big players holding important market shares. However, with the increasing influx of small insurers and the emergence of digital platforms, this market has been diversified, offering more personalized choices with competitive deals to consumers.

Health Insurance Companies

Company Name | Establishment Year | Headquarters |

|---|---|---|

Medibank Private Limited | 1976 | Melbourne, Australia |

Bupa Australia | 2002 | Melbourne, Australia |

HCF (Hospitals Contribution Fund) | 1932 | Sydney, Australia |

nib Health Funds | 1952 | Newcastle, Australia |

HBF Health Limited | 1941 | Perth, Australia |

Australian Unity Health Limited | 1840 | Melbourne, Australia |

GMHBA Limited | 1934 | Geelong, Australia |

Teachers Health Fund | 1954 | Sydney, Australia |

Defence Health Limited | 1953 | Melbourne, Australia |

CBHS Health Fund | 1951 | Sydney, Australia |

Online Health Insurance

Platform Name | Establishment Year | Headquarters |

|---|---|---|

iSelect | 2000 | Melbourne, Australia |

Compare the Market | 2012 | Brisbane, Australia |

Finder | 2006 | Sydney, Australia |

Canstar | 1992 | Brisbane, Australia |

Health Insurance Comparison | 2009 | Melbourne, Australia |

Choosi | 2007 | Sydney, Australia |

Savvy | 2010 | Adelaide, Australia |

Compare Health Insurance Online | 2013 | Melbourne, Australia |

Compare Club | 2014 | Melbourne, Australia |

Compare Policy | 2015 | Sydney, Australia |

Recent Competitor Trends and Key Information:

Medibank: It recorded a 10% growth in premium revenue in the year 2023. Hence, it is one of the biggest health insurers within the country, Australia. It has a strong focus on digital health solutions, including launching a telehealth app to boost member engagement and accessibility.

Bupa: Because of its very diverse health, dental, and aged-care services, membership for Bupa grew 15% in the year 2023. Putting a strong focus on delivering health programs together with wellness programs has strongly positioned it in the market, where it is one of the premier health partners in the country today.

nib Health Insurance: With customer-centric solutions, nib has carved a niche for itself. It has achieved an 18% increase in the number of policyholders aged between 18-34 years in 2023. Innovation in its partnerships with some of the big names in the fitness and wellness categories has helped bring in more youths.

HBF Health Limited: During 2023, HBF recorded a growth of 9% in premium revenue owing to its specialized health plans designed for families and seniors. Strong market presence in Western Australia combined with the company's focused community initiatives strengthened the business position of this company.

HCF: Australia's largest not-for-profit health insurer, HCF, saw customer retention increase by 12% in 2023. Its popularity has been driven by affordable and transparent policies, along with increased customer service via digital tools.

What Awaits the Australia Health Insurance Market?

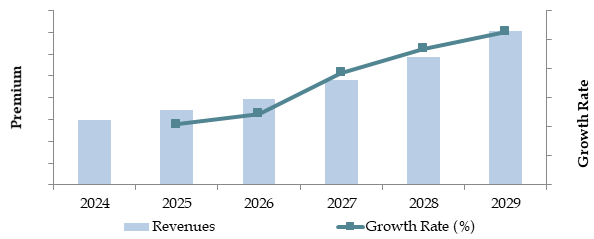

It is projected that the Australian health insurance industry will grow steadily from 2023 to 2029. This growth will be mostly driven by rising healthcare service costs, rising awareness of preventative care, and government initiatives to promote private health insurance. Further, the market will show a moderate CAGR in the forecasted period, with innovation and digital transformation becoming major growth catalysts.

Increase in Demand for Preventative Health Cover: Preventive health programs and wellness initiatives may increase demand for comprehensive extras policy. Consumers seek to include coverage of services like dental, optical, physiotherapy, and mental health within their plans with the view to get ahead of illnesses before they arise.

Digital Transformation in Service Delivery: Advanced technologies-integration of the Telehealth platforms, AI-based claims processing, and mobile health applications-are very much bound to bring a sea of change in the health insurance arena. These will improve customer experience through smooth claim settlement, real-time health data, and easy accessibility to services, especially in remote areas.

Senior-Specific Policies Growth: With Australia having an aging population, more and more policies for chronic disease management, aged care services, and reasonable premium structures on the part of insurers would become warranted. The demographic shift, in other words, is one of the drivers of market growth.

Senior-Specific Policies Growth: With Australia having an aging population, more and more policies for chronic disease management, aged care services, and reasonable premium structures on the part of insurers would become warranted. The demographic shift, in other words, is one of the drivers of market growth.

Future Outlook and Projections for Australia Health Insurance Market on the Basis of Premium in USD Billion, 2024-2029

Australia Health Insurance Market Segmentation

- By Market Structure:

- Private Insurers

- Public Insurers (Medicare)

- By Insurance Type:

- Disease Insurance

- Medical Insurance

- By Coverage Type:

- Preferred Provider Organizations (PPOS)

- Point Of Service (POS)

- Health Maintenance Organization (HMOS)

- Exclusive Provider Organizations (EPOS)

- By End User:

- Group

- Individual

- By Distribution Channel:

- Direct Sales

- Brokers

- Banks

- Online

- Others

- By Demographics:

- Age Groups:

- 18-29

- 30-50

- 51-64

- 65+

- Income Levels:

- Low Income

- Middle Income

- High Income

- Age Groups:

- By Region:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Northern Territory

- Australian Capital Territory

Players Mentioned in the Report (Health Insurance):

- Medibank Private Limited

- Bupa Australia

- HCF (Hospitals Contribution Fund)

- nib Health Funds

- HBF Health Limited

- Australian Unity Health Limited

- GMHBA Limited

- Teachers Health Fund

- Defence Health Limited

- CBHS Health Fund

Players Mentioned in the Report (Online Platforms):

- iSelect

- Compare the Market

- Finder

- Canstar

- Health Insurance Comparison

- Choosi

- Savvy

- Compare Health Insurance Online

- Compare Club

- Compare Policy

Key Target Audience:

- Health Insurance Providers

- Healthcare Service Providers

- Digital Health Technology Companies

- Government Bodies and Regulators (e.g., Australian Prudential Regulation Authority)

- Research Institutions

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Australia Health Insurance Market

4. Value Chain Analysis

4.1. Value Chain Process – Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Australia Health Insurance Market

4.3. Business Model Canvas for Australia Health Insurance Market

4.4. Relationship and Agreement Terms Between Hospitals and Insurance Companies- TAT, Commission, Role of TPAs and other aspects

4.5. Role of Agents, Targets and Commission for Agents in Australia Health Insurance Market

5. Market Structure

5.1. Historical Growth of Health Insurance Policies in Australia, 2018–2024

5.2. Private vs. Public Insurance Coverage Ratio in Australia, 2018–2024

5.3. Health Expenditure Trends in Australia, 2024

6. Market Attractiveness for Australia Health Insurance Market

7. Supply-Demand Gap Analysis

8. Market Size for Australia Health Insurance Market Basis

8.1. Premium Revenue, 2018–2024

8.2. Number of Policies, 2018–2024

8.3. Healthcare Insurance Penetration by Cities, 2024

8.4. Claim Ratio, 2018-2024

9. Market Breakdown for Australia Health Insurance Market Basis

9.1. By Market Structure (Public and Private Insurers), 2023–2024P

9.2. By Insurance Type (Disease and Medical), 2023–2024P

9.3. By Demographics (Age and Income Levels), 2023–2024P

9.4. By Region, 2023–2024P

9.5. By Coverage (Preferred Provider Organizations, Point of Service, Health Maintenance Organization, Exclusive Provider Organizations), 2023-2024

9.6. By Group and Individual, 2023-2024

9.7. By Distribution Channel (Direct Sales, Brokers, Banks and others), 2023-2024

10. Demand Side Analysis for Australia Health Insurance Market

10.1. Policyholder Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Needs, Preferences, and Pain Point Analysis

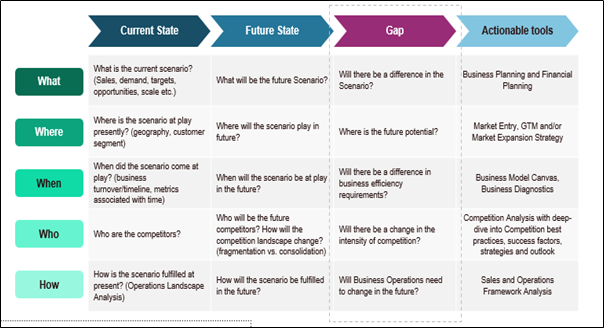

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Australia Health Insurance Market

11.2. Growth Drivers for Australia Health Insurance Market

11.3. SWOT Analysis for Australia Health Insurance Market

11.4. Issues and Challenges for Australia Health Insurance Market

11.5. Government Regulations for Australia Health Insurance Market

12. Snapshot on Digital Health Insurance Market

12.1. Market Size and Future Potential for Digital Insurance Platforms in Australia Basis Premium, 2018–2029

12.2. Business Model and Revenue Streams

12.3. Cross-Comparison of Leading Digital Platforms Basis Operational and Financial Performance

13. Opportunity Matrix for Australia Health Insurance Market – Presented with the Help of Radar Chart

14. PEAK Matrix Analysis for Australia Health Insurance Market

15. Competitor Analysis for Australia Health Insurance Market

16.1. Market Share of Key Players in Australia Health Insurance Market Basis Premium/Number of Policies, 2023

16.1. Benchmark of Key Competitors in Australia Health Insurance Market Basis Operational and Financial Parameters

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

16. Future Market Size for Australia Health Insurance Market Basis

16.1. Premium Revenue, 2025–2029

16.2. Number of Policies, 2025–2029

16.3. Healthcare Insurance Penetration by Cities, 2025–2029

16.4. Claim Ratio, 2025–2029

17. Market Breakdown for Australia Health Insurance Market Basis

17.1. By Market Structure (Public and Private Insurers), 2025–2029

17.2. By Insurance Type (Disease and Medical), 2025–2029

17.3. By Demographics (Age and Income Levels), 2025–2029

17.4. By Region, 2025–2029

17.5. By Coverage (Preferred Provider Organizations, Point of Service, Health Maintenance Organization, Exclusive Provider Organizations), 2025–2029

17.6. By Group and Individual, 2025–2029

17.7. By Distribution Channel (Direct Sales, Brokers, Banks and others), 2025–2029

18. Recommendations

19. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: The first step involves identifying and mapping all the demand-side and supply-side entities within the Australia Health Insurance Market. This includes insurers, healthcare providers, regulators, and consumers. Based on this ecosystem, leading 5-6 insurance providers are shortlisted using metrics such as market share, premium revenue, and customer satisfaction levels.

Data Sourcing: We leverage industry reports, government publications, and proprietary databases to gather preliminary insights into market dynamics, identifying key trends and players.

Step 2: Desk Research

Secondary Data Collection: Extensive desk research is conducted using diverse sources such as government reports, annual financial statements, and industry publications. This step allows us to analyze market size, segmentation, premium trends, and policyholder demographics.

Company-Level Insights: Focused analysis on individual companies is performed using financial statements, press releases, and other public disclosures to understand their market positioning and operational strategies.

Step 3: Primary Research

In-depth Stakeholder Interviews: A series of structured interviews are conducted with key stakeholders, including executives from insurance companies, healthcare providers, and regulatory authorities. These interviews aim to validate desk research findings, gather insights on market trends, and identify growth drivers and challenges.

Disguised Interviews: To ensure unbiased data validation, disguised interviews are conducted where our researchers pose as potential policy buyers. This strategy provides additional insights into pricing, coverage, and customer service dynamics.

Step 4: Sanity Check

- Cross-Validation and Modeling: Bottom-up and top-down market modeling techniques are used to cross-validate findings. The final market size and projections undergo multiple sanity checks to ensure accuracy and reliability.

FAQs

1. What is the potential for the Australia Health Insurance Market?

The Australia health insurance market is expected to grow significantly, driven by rising healthcare costs, increasing private health coverage, and government incentives. The market is projected to expand at a steady CAGR, reaching a considerable valuation by 2029.

2. Who are the Key Players in the Australia Health Insurance Market?

Major players in the market include Medibank, Bupa, HCF, nib Health Insurance, and HBF Health Limited. These companies dominate due to their extensive offerings, customer-centric solutions, and strong digital presence.

3. What are the Growth Drivers for the Australia Health Insurance Market?

Key growth drivers include increasing demand for preventative healthcare, rising chronic disease prevalence, and government incentives such as rebates and tax benefits. The adoption of digital health technologies and customized insurance plans is also contributing to market growth.

4. What are the Challenges in the Australia Health Insurance Market?

Challenges include rising premium costs, regulatory compliance burdens, and limited accessibility in rural and remote areas. Consumer dissatisfaction with complex policy structures and exclusions further impacts trust and market penetration.

Want to Assess the Impact of US-Imposed Trade Tariff on

Australia Health Insurance Market